The First Yearlong ICO for EOS Raised $4 Billion. The Second? Just $2.8 Million

The Takeaway:

- Block.One’s yearlong initial coin offering (ICO) for the EOS blockchain raised a record-breaking $4.1 billion in 2018.

- LiquidApps created a second-layer protocol for EOS to offload computing expenses for dapps, which became very expensive just a few months after EOS launched.

- In a similarly yearlong ICO, LiquidApps is currently selling DAPP tokens to be used on its new protocol.

- However, six months in, LiquidApps had sold only $2.8 million worth of DAPP. After the same amount of time for its sale, Block.One had sold $700 million worth of EOS.

New cryptocurrencies aren’t raising money like they once did, even during marathon sales.

In the first half of 2018, the average initial coin offering (ICO) raised $25.5 million, based on data reported by PwC. The biggest ICO of them all, the yearlong EOS offering, closed during that era and raised a whopping $4.1 billion.

But a second ICO that aimed to make EOS more usable and also opted for a yearlong approach hasn’t drawn as much investor interest.

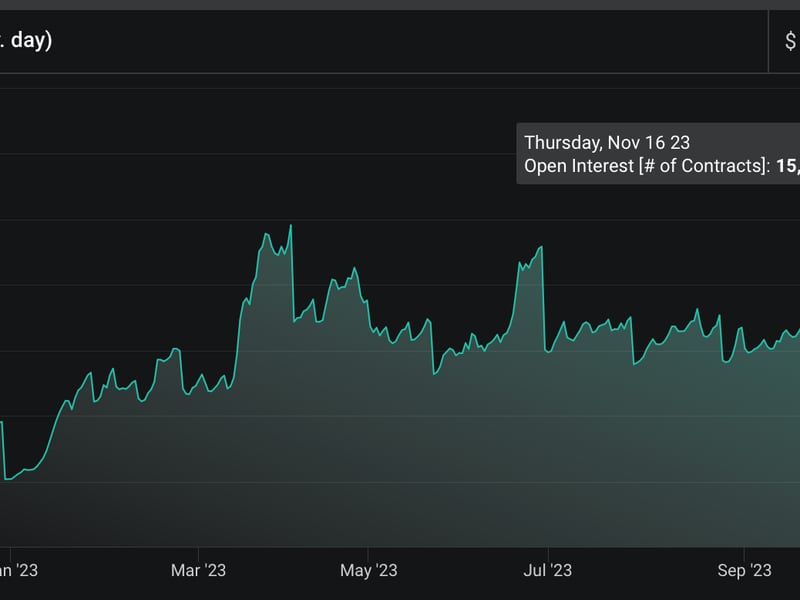

LiquidApps is building a second-layer solution for EOS that runs on the company’s DAPP token, which has been sold in daily auctions since February 2019. At the end of its 233rd auction cycle on Aug. 19, the DAPP sale had raised just $2.8 million worth of cryptocurrency.

A source with knowledge of the LiquidApps fundraise told CoinDesk:

“They’ve done an interesting job and [have been] innovative in learning from the Block.One sale and mechanics in crafting how a fundraise for a project should be done. Where they’ve struggled is, not just different market conditions, but finding the right investors and participants for their sale that fully understand the value proposition for the project.”

LiquidApps declined to provide comment on the results of its token sale so far, despite multiple attempts by CoinDesk for comment.

For 333 days and 444 sale cycles, 500 million of the 1 billion pre-mined DAPP tokens will be gradually sold off – that’s 1.12 million tokens every 18 hours. CoinDesk’s analysis is based on the reported price of these tokens in each sale, as shown on the LiquidApps auction site.

The LiquidApps solution is meant to take pressure off the EOS blockchain’s RAM system, which has gotten bogged down as computing resources have proven to be the scarce asset on the fourth-largest blockchain by market cap.

Still, the effort seems to be garnering comparably little fanfare. For comparison, six months into the EOS sale, the startup behind it, Block.One, had raised $700 million, according to a December 2017 report by the Wall Street Journal.

This is a different era in crypto, however, and LiquidApps has put out a much more real product than vastly larger ICOs that ended long ago.

Fred Kreuger, creator of the Lynx Wallet, which is built to work well with EOS, told CoinDesk that he was not surprised by more modest returns on the LiquidApps ICO.

Said Kreuger:

“Most end users and token buyers understand one thing – native tokens for blockchains.”

New era

The company made a conscious decision at the outset not to set a goal for its fundraiser.

“Our goal with the Token Generation is to bring as many stakeholders into the ecosystem to best establish it for success,” LiquidApps CEO Beni Hakak told CoinDesk in a February email, shortly before the sale opened. “As true believers in the free market, we don’t involve ourselves with price speculations – there is no technical possibility to combine an auction, like we’re doing, with a capped amount.”

There may be less pressure on LiquidApps to raise a substantial amount due to its close relationship to another well funded ICO, Bancor.

Hakak was the director of operations at Bancor until January of this year, according to his LinkedIn page, which also lists him as the CEO of LiquidEOS, an EOS block producer that CoinDesk previously reported as a project of Bancor itself.

In February, the LiquidApps white paper listed eight people on its founding team, including all three co-authors of the original Bancor white paper: siblings Guy and Galia Benartzi and Eyal Hertzog. Still, according to a Bancor spokesperson, LiquidApps is a distinct and separate company, though one made up of Bancor alums.

That relationship yielded a great deal of skepticism from the broader crypto community. At the outset of the LiquidApps sale, Cornell professor Emin Gün Sirer saw the whole effort as ill-advised.

“This is an idea that, in the old days, would attract no more than $225K in seed funding from angels and a few VCs, and those VCs would be considered mavericks for taking this on,” he told CoinDesk in an email before the sale opened, adding:

“If $4 billion was not enough to yield an EOS network that is functioning smoothly, the thing to do is not to seek additional funds for more work in the same vein, but to question what went wrong with the original design of the RAM market in EOS.”

Why buy DAPP?

RAM is the ready, easy-to-access memory that applications need to work through a given function. Early on, speculators bought up the RAM supply in anticipation that increased popularity of EOS would make it valuable. In fact, it became so pricy that acquiring RAM resources on EOS became prohibitive.

The first product from LiquidApps was vRAM, a way for EOS dapps to offload most of their RAM needs to a second, less expensive layer. To its credit, vRAM was live at the start of the token sale and has been running ever since.

Investing With a Difference (IWAD) runs a node on the LiquidApps network, and one of the companies it worked with to use its services found dramatic savings. Moonlighting, a freelance job site that runs on EOS, would pay $2,000 per day to run all of its transactions on EOS, according to Raman Bindlish of IWAD. Their costs after moving most transactions onto IWAD’s deployment of LiquidApps dropped to about $10 per day.

“We are doing 10,000–20,000 transactions per day, and CPU/NET cost on EOS blockchain is almost minimal,” Bindlish told CoinDesk. “So, using LiquidApps framework for RAM, we brought down the cost of each transaction to less than $0.0005 on average.”

Since releasing vRAM, LiquidApps has put out many more useful tools for developers, such as a way to make accounts for free (an EOS account costs a bit of EOS), an oracle system and a time tool, among other things. LiquidApps published a detailed account of progress so far early this year. To access its different services, users pay in DAPP tokens.

Despite doubts about the necessity of its product, launching the solution has led to a network of service providers running its vRAM system and other products. This has created a new income stream for technically proficient teams no longer able to earn enough contributing to consensus on EOS, either as a block producer or standby block producer.

LiquidApps began in an era of expensive RAM. In September of 2018, it was running at roughly $0.80 per kilobyte. For context, at that time, it would cost a developer a few dollars in RAM to add one new user.

Since then, the price of RAM has dropped considerably. As of this writing, a kilobyte of RAM cost about $0.34 in EOS, according to EOS New York.

And EOS, for its part, had a strong first quarter in terms of transaction volume, largely driven by gambling dapps.

Hakak told CoinDesk in February:

“We believe The DAPP Network should be a separate, complementary ecosystem (economy) to EOS. While EOS Mainnet is where the consensus is established, the DAPP Network is a secondary trustless layer; and having a unique token, the DAPP token, will allow this ecosystem to flourish.”

EOS token image via Shutterstock