The Fiat Mindset: Why Most Economists Don’t Get Bitcoin

Modern economists are often vehemently opposed to bitcoin and its application as money – why is this?

Josef Tětek is a SatoshiLabs and Trezor Brand Ambassador.

It’s a tulip mania, a Ponzi scheme, a bubble about to burst. You’ve heard it all before. And not just from your nocoiner friends: This narrative has been pushed for years by many famous economists with a Nobel on their shelf. Why do renowned economists fail to see the value in bitcoin? It’s not a failure of understanding; it’s a difference of worldview.

The influence of mainstream economics cannot be underestimated. As John Maynard Keynes said, “Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.” This fits current economic policy perfectly. So, let’s see how the madmen and scribblers view the current economy — and, therefore, society itself.

So What Is Mainstream Economics, Anyway?

Mainstream economics is mostly a mixture of two dominant schools of economic thought.

Keynesianism in its various forms (i.e., post-Keynesianism, new Keynesianism) is heavily focused on the economic aggregates: GDP, unemployment rate, consumer spending, inflation measured through consumer price index (CPI) and such. Market forces are viewed as chronically inadequate due to various alleged market failures. Society is in constant need of public goods supplied by the government. Public spending is a panacea in the eyes of Keynesian economists and should be done even at the cost of heavy budget deficits, if need be. Interestingly, Keynes himself prescribed public deficits only in the downturns; but the U.S. budget has been in a deficit in 46 out of the past 50 years, even in the times of strong economic growth.

Monetarism also focuses on the economic aggregates, but its prescriptions are, well, monetarist in nature: Instead of fiscal measures, the economy should be aided by the central bank’s actions. Inflating the money supply, manipulating short-term interest rates, stepping in as a lender of last resort, buying up mortgages, bonds or even equities — all these measures steer the economy from the inevitable crash, deflation and unemployment, in the eyes of the monetarist.

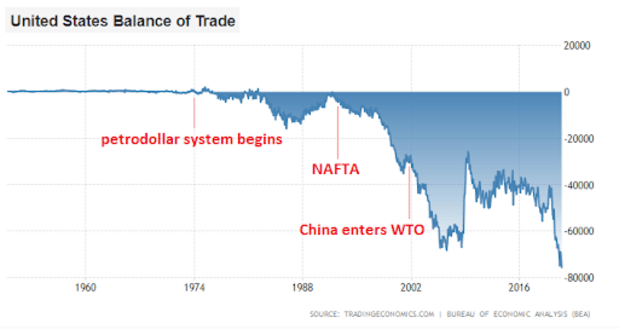

Today’s economic pundits, advisors and government officials usually hold these two views of the economy combined. Thus, the economic policy should be liberal with the taxpayers’ money and with their purchasing power as well. It’s important to point out that monetarism started to play a role in mainstream economics in the 1970s, after the U.S. dollar was decoupled from gold and the whole world found itself under a pure fiat money standard, without any link to gold whatsoever. In a sense, monetarism came to Keynesianism’s rescue: With ever-rising debt levels, an argument for ever-lower interest rates needed to be found. Chronic deficits drive the need to inflate the debt away through easy money policy. And easy money policy is, in turn, a strong incentive to go into more debt — for the government and the economy as a whole.

While an economic policy based on mainstream economics seemed to work over the past decades, it is doomed in the long run. Snowballing debt, fueled by easy money policy, simply isn’t sustainable and something has to give: Either the debt will be defaulted upon, or the purchasing power of fiat money will evaporate. As Dylan LeClair succinctly puts it: “There is mathematically no way out of the current economic environment.”

The Fiat Mindset

Instead of money created by the click of a mouse, we have money that must be mined — created through resource-intensive computations. … In other words, cryptocurrency enthusiasts are effectively celebrating the use of cutting-edge technology to set the monetary system back 300 years. Why would you want to do that? What problem does it solve? — Paul Krugman

Now, let’s tackle the initial question: Why do mainstream economists hate on bitcoin?

The above quote from the renowned Nobelist helps us answer the question. It’s noteworthy that what a sound money advocate views as the main advantage of bitcoin, the mainstream economist understands as its downside. For Paul Krugman (an epitome of mainstream economics today), bitcoin is a monetary setback, because you can’t create sats at the click of a button.

That’s a fiat mindset: The worldview that the state and its experts should be able to create and inject money at will, because they supposedly know better. We can call this by its true name: monetary socialism. The state defines what money is via legal tender laws and sets the monetary policy (i.e., rate of money creation), the state decides whom the new money will reach first, the state sets the interest rates, the state nudges people away from savings and toward debt. Though the state pays lip service to the market via tools like “open market operations.” there really isn’t much room for true market forces in the era of fiat money.

One of the basic functions of money is (or should be) its role as a store of value. But there isn’t a place for that when establishment economists get to work. Since money can be created from thin air, there really isn’t a point to holding it over long term. Investments, you say? But why, we have credit with ever-lower interest rates for that! What about the safety net? Welfare programs! That’s why you’ll never see a mainstream economist conceding that bitcoin has the store of value quality going for it: It’s like asking a colorblind person to enjoy the rainbow. They just don’t have the capability to see it.

And it makes sense from the viewpoint of mainstream economics: The only way out of the Keynesian debt hole besides outright default is via inflation. The idea that money should act as a store of value is preposterous if you have the mainstream worldview. Money should serve as the medium of exchange. It’s enough if it doesn’t hyperinflate in the short term, but losing most of its value in the long run is desirable.

The Austrian Alternative

All rational action is in the first place individual action. Only the individual thinks. Only the individual reasons. Only the individual acts. — Ludwig von Mises

The key problem with the mainstream approach is its focus on the aggregate and little consideration is given for the individual actions and relative forces that play out in the economy. While it’s true the government or the central bank can stimulate the economy into a growth trajectory, the structure of the economy can end up being unstable as a result. Just consider the 2008 financial crisis: The U.S. economy has been seemingly growing strong for years, but this growth was later found to be pretty toxic and the whole financial system almost collapsed as a result. And the solution was more of the same, per the mainstream prescription: more deficit spending, lower interest rates, and unprecedented monetary policies such as quantitative easing.

The Austrian school of economics focuses precisely on what the mainstream ignores: relative price changes, capital heterogeneity, incentives in the private vs. public sector, the shifts in time preference via monetary policies. If you’re struggling to understand what that means, it can be simplified to one key idea: individual human action. Everything that happens in the economy stems from the fact that individuals act. The individual is motivated by subjective preferences and the incentives that people face. Economic policy can be viewed as an attempt to manipulate the incentive structure: Lower interest rates and people will be incentivized to go into debt and prefer consumption over investment.

Contrary to mainstream economics, the Austrian school isn’t technocratic in nature. The adherents of Austrian economics understand that the economy is fundamentally unmanageable. But the absence of conscious management doesn’t mean chaos ensues. As Hayek explains in one of the greatest economic articles of all time, individual actions are coordinated via the price mechanism. Economy is a complex system in constant flux and the relevant data points about supply, demand, resource scarcity and individual preferences (and never-ending changes of these factors) are dispersed among millions of minds. To communicate each data point in its full form is impossible — instead, the smallest viable information is communicated through price. Price is all the information that manufacturers, merchants, investors and consumers need to know to adjust their actions to better reflect reality.

But when money itself is subject to central planning, the price mechanism is polluted by a lot of noise. For the price mechanism to broadcast pure economic signals and the economy to work properly, money should be separated from the state.

It’s important to underscore what money is. Money, in the most fundamental sense, is a societal institution — a set of rules and habits that ease the cooperation among people. As Nick Szabo points out in Shelling Out, the institution of money emerges everywhere we look over the course of history, because it simply makes sense when the society reaches a sufficient division of labor. Money emerged from the need to store the value of one’s labor for later use and exchange the value with others. Both the store of value and means of exchange roles are crucial for money to fulfill its role in society. And it’s no coincidence that bitcoin emerged and took off at the peak of a worldwide financial crisis, when the store of value function in today’s money was sacrificed to keep the system together.

Conclusion

Everybody has a bias. The author of these lines is biased toward non-state solutions of society’s problems, and this bias is only partially based on value-free economic arguments. Political philosophy as well as self-interest is natural for humans and we shouldn’t be afraid to admit that. Fiat mindset is a bias held by those facing lifelong incentives to uphold the status quo.

The idea of stripping human discretion from monetary policy is completely opposite to the way money operates today. That’s a major problem for mainstream economics, which focuses on money as a short-term enabler, one which can’t be saved, only spent, inevitably in favor of those who print it.

That’s why mainstream economists will fight bitcoin until the bitter end of hyperbitcoinization. Bitcoin as an emergent money phenomenon is a slap in their face. It has the potential to completely shatter the illusion of technocratic management. When the state loses the ability to manage money, the formula that has worked in the past decades falls apart: no monetary inflation, no Cantillon effect, no chronic public deficits, no bailouts. The house of cards falls down. But don’t blame bitcoin for that; the fiat system would crumble even if bitcoin never emerged, because central planning always fails. Bitcoin can act as a lifeboat before the fiat collapse and as an instrument of recovery afterward.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.