The Federal Reserve, Reverse Repo And Bitcoin

In this episode of “Fed Watch,” the hosts discussed the latest in the bitcoin market and macroeconomics.

Watch This Episode On YouTube

Listen To This Episode:

- Apple

- Spotify

- Libsyn

- Overcast

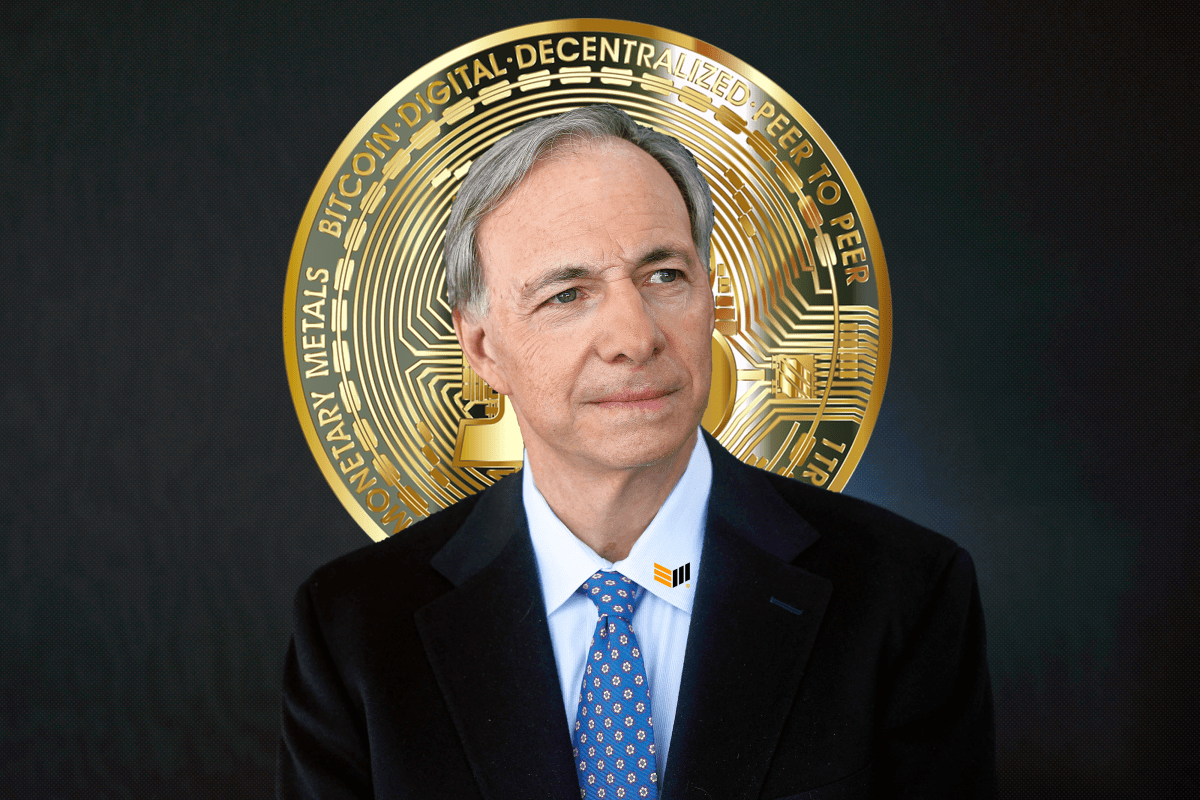

In this episode of Bitcoin Magazine’s “Fed Watch” podcast, we, your hosts Christian Keroles and Ansel Lindner, are back from a well-deserved break. We started out the show by reminiscing about the Bitcoin 2021 conference from a couple of weeks ago. It was the first time we met in person. Perhaps next time, we will record a podcast together live from the conference.

We also talked about current price action for bitcoin and the incredible last couple of weeks for bitcoin that is not yet represented in price. Of course, El Salvador and Taproot are very bullish for bitcoin, but we also gave a bullish spin to the crackdown on mining in China.

Our main topic for this episode is debriefing the reverse repo situation and the latest Federal Open Market Committee (FOMC) meeting. In the statement from last week by Chairman Powell, the Federal Reserve left its headline monetary policy stable. However, there were several changes, one minor and two major.

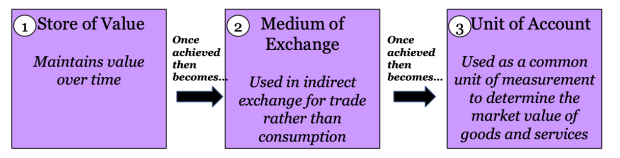

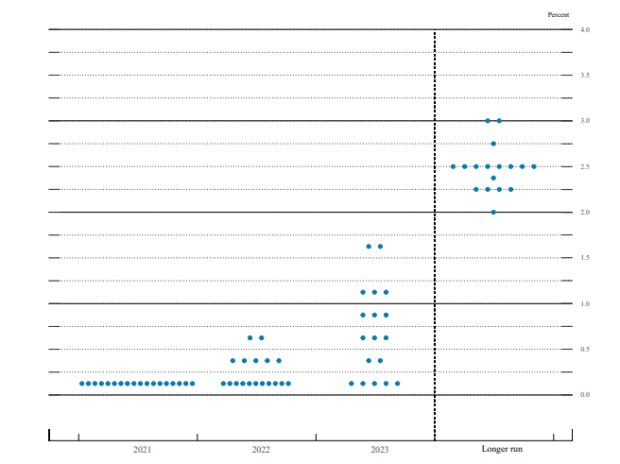

The minor change was the dot plots. At each meeting of the Fed’s FOMC, members place dots on a chart where they expect the Federal Funds Rate to be in the future. From that dot plot, seen below, market participants form their expectations about future Federal Reserve policy and also draw conclusions about current market conditions.

That is the basic stuff, and we cover that quickly in this episode, but then we get into the more meaty changes. First was a 5 basis point (BPS) (0.05%) increase in the interest on excess reserves (IOER). The move was likely to keep participating in quantitative easing (QE) attractive for primary dealers. When banks participate in QE, they sell treasuries to the Fed and receive reserves. These are inert reserves, as we’ve stated many times in the past.

They don’t do much of anything except sit at the Fed and collect IOER. These reserves, however, are counted against the banks’ balance sheets as an investment according to the international Basel III rules. Since the market is experiencing a collateral shortage which we’ll talk about next, QE doesn’t make sense for the banks. The banks need that collateral. Why would they sell it to the Fed? Well, because IOER. They raised it to make sure the banks have an incentive to continue participating in QE.

The next major announcement was the 5 BPS rise in reverse repo rates. We took our time and really covered this topic in depth, from explaining what repos are and why money market funds would want to participate in them. It was our intention to show how the money market funds, banks and the market in general has gotten into this mess. It’s too complex and lengthy to cover in this short write up, you must listen to get the full conversation.

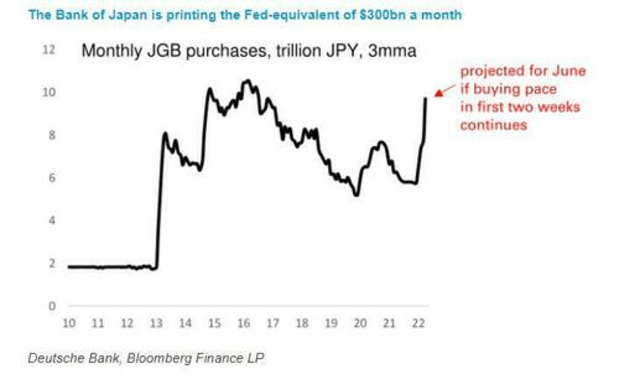

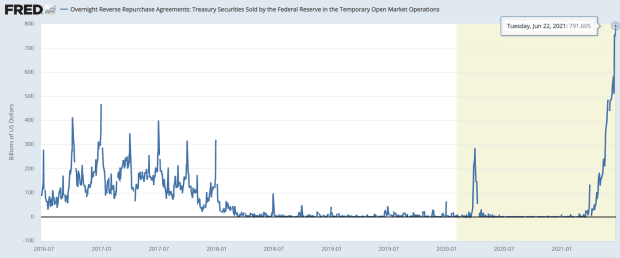

Currently, the total amount of reverse repo from the Fed is a staggering all-time record of $791 billion. Without knowing anything about this market, you can tell something is wrong here. Market participants in this market include money market funds and banks, among other large entities. What they are doing is parking dollars at the Fed in exchange for collateral.

There are three main forces behind this dramatic rise: One, the market has been flooded by money through government stimulus, two, the U.S. Treasury itself has been spending down its $1.2 trillion account balance also flooding the market with dollars while not issuing as many T-bills as normal, and three, QE is draining collateral from the system. These things combine to create a tight collateral shortage.

The 5 BPS rise in the reverse repo rate is very significant because it leapfrogs the open market rates on T-bills (one- to three-month bills). Why would anyone who could buy a three-month T-bill to receive 4 BPS when they can repo with the Fed and receive 5 BPS? All of these T-bill rates should have risen to 5 BPS as a floor. But they did not. Even today, a week later, three-month and shorter bills are at 4 BPS and reverse repo volume is continuing to climb.

The Fed is trapped. It will be fascinating to see what is next. Stay tuned to “Fed Watch: Bitcoin And Macro” and we will keep you up to date on all the developments.