The Fallacy Of Taper Talk

With its stated mandate goals, the Fed is implicitly telling the market that any taper talk is complete nonsense.

The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

“The monetary policy goals of the Federal Reserve are to foster economic conditions that achieve both stable prices and maximum sustainable employment.”

In the Federal Reserve’s mandate, there are two stated goals for their monetary policy:

- Stable prices

- Maximum employment

With these two stated goals, the Fed is implicitly telling the market that any taper talk is complete nonsense, and here is why:

The entire economic system is built upon credit, and to maintain full employment and stable prices (i.e., “2% inflation targeting”), credit cannot be allowed to contract.

Let’s dig into some recent trends in the real estate market for context:

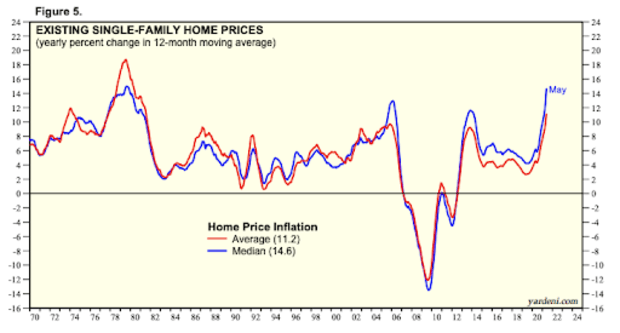

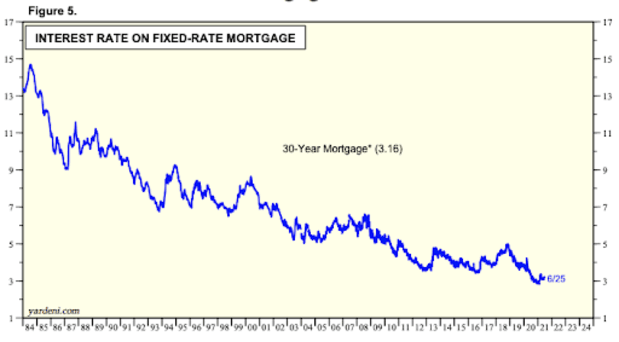

Median prices for single family homes have increased 14.6% year over year, fueled by record low mortgage rates over the last 18 months.

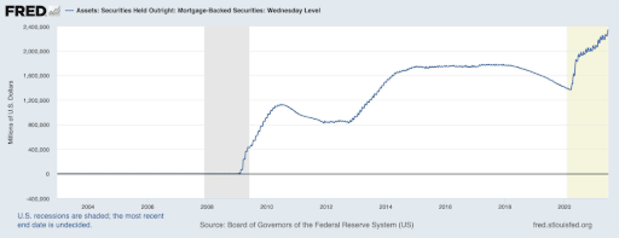

But what happens if the Fed tapers? What happens if the Fed stops buying mortgage backed securities at a clip of $40 billion per month?

The Fed taking the punchbowl away from markets would mean bad news for risk assets, real estate included. It is important to remember that real estate is among the most leveraged asset classes in the market, as it is commonplace to buy with only a 20% down payment (or even less).

If the Fed tapered and real estate prices declined, what would that mean for the broader economy?

![[promoted] Stackr: The Dawn Of A Digital Asset Savings Solution](https://www.lastcryptocurrency.com/wp-content/uploads/2018/10/5552/promoted-stackr-the-dawn-of-a-digital-asset-savings-solution.jpg)