‘The Dow’ for Crypto Markets? New CoinDesk 20 Index Underpins Futures Contracts at Bullish

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

CoinDesk Indices introduced the CoinDesk 20, intended as a broad cryptocurrency market benchmark that can underpin tradeable products – akin to the S&P 500 or Dow Jones Industrial Average, which play a big role in the stock market.

-

Bullish, the crypto exchange that owns CoinDesk, is offering perpetual futures contracts based on the CoinDesk 20.

Cryptocurrencies just got a new benchmark that, similar to the stock market’s Dow Jones Industrial Average, explains how the market is broadly doing.

And the index has an investable product based on it, potentially giving the measure a shot at broader adoption – something previous marketwide benchmarks have failed to win.

CoinDesk Indices on Wednesday introduced the benchmark, called the CoinDesk 20 Index, that tracks the world’s largest and most-liquid cryptocurrencies. The behemoths, bitcoin (BTC) and Ethereum’s ether (ETH), are among its 20 members, but it goes well beyond them to give traders a diversified summary of the market’s performance.

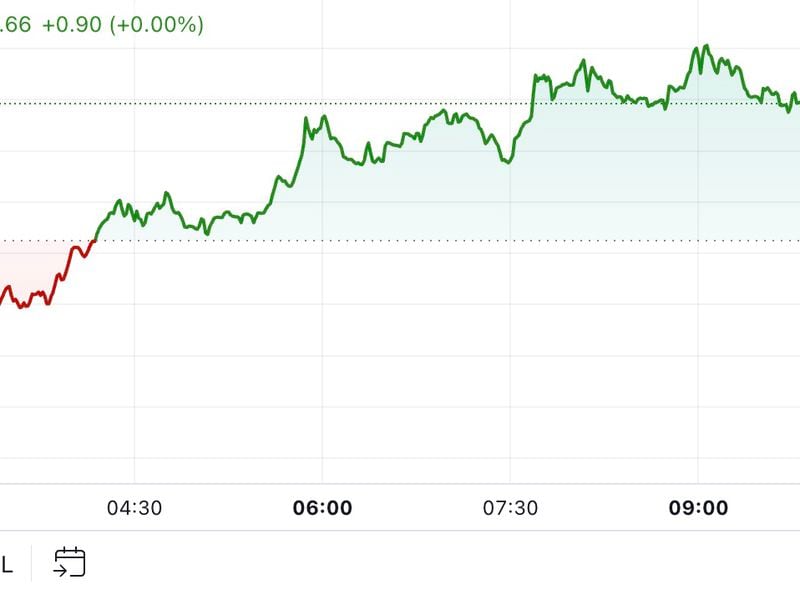

Bullish, the cryptocurrency exchange that owns CoinDesk, is offering perpetual futures contracts tied to the CoinDesk 20. Trading volume for these products, which can be used to hedge crypto portfolios or speculate on the broader market, exceeded $1 million within a few hours of their introduction on Tuesday.

“We are delighted the CoinDesk 20 is already generating liquidity at the institutional level,” Alan Campbell, the president of CoinDesk Indices, said in a statement.

The Dow or S&P 500 for Crypto?

Indexes are a key part of financial markets. The Dow has for more than a century given a sense of how the whole stock market is doing (though it only has 30 stocks out of the thousands that trade in the U.S.). Its younger cousin, the Standard & Poor’s 500 Index, steers the value of futures contracts and exchange-traded funds that are some of the most popular products in finance.

The CoinDesk 20 is aimed at a similar objective. At present, there’s no widely followed index that serves as the flagship barometer for crypto and provides the foundation for tradeable products. In other words, crypto has no Dow or S&P 500 that is cited by basically everybody.

“As the digital asset marketplace develops as an asset class, it needs an accessible, tradeable and trusted reference, and I believe the CoinDesk 20 is that reference,” Tom Farley, CEO of Bullish, said in a statement.

A different index with the same name was discontinued by CoinDesk Indices in 2022. The company also still offers the CoinDesk Market Index, but it includes almost 200 cryptocurrencies, many of them fairly illiquid, so it is a less-suitable launch pad for futures and ETFs.

Immediate availability of futures at the Bullish exchange could give the CoinDesk 20 a boost that prior efforts lacked.

Bitcoin and ether, the world’s largest cryptocurrencies by market capitalization, have the biggest weightings at 31% and 22%, respectively. But the CoinDesk 20 goes pretty far down the size rankings, too. Tokens from Aptos (APT) and Filecoin (FIL) tie for the smallest weighting of 0.7%; they’re the 30th and 33rd biggest cryptos by market cap, respectively, according to coinmarketcap.com.

Meme coins such as dogecoin (DOGE) and shiba inu (SHIB) are included in the group. Stablecoins like Tether’s USDT and Circle’s USDC are excluded.

There is a 30% limit on the weighting for the largest cryptocurrency in the CoinDesk 20 – at present, bitcoin – and no other member can exceed 20%, an attempt to ensure the index is diverse. Excluding stablecoins, the CoinDesk 20 includes more than 90% of the total market cap of the entire crypto industry.

|

Cryptocurrency (ticker) |

Weight in CoinDesk 20 |

|---|---|

|

Bitcoin (BTC) |

30.9% |

|

Ether (ETH) |

22.4% |

|

Solana (SOL) |

10.2% |

|

XRP (XRP) |

7.9% |

|

Cardano (ADA) |

4.7% |

|

Avalanche (AVAX) |

3.3% |

|

Dogecoin (DOGE) |

2.9% |

|

Polkadot (DOT) |

2.4% |

|

Chainlink (LINK) |

2.2% |

|

Polygon (MATIC) |

2.0% |

|

Internet computer (ICP) |

1.5% |

|

Shiba inu (SHIB) |

1.4% |

|

Litecoin (LTC) |

1.3% |

|

Uniswap (UNI) |

1.3% |

|

Bitcoin cash (BCH) |

1.2% |

|

Cosmos (ATOM) |

1.0% |

|

Ethereum classic (ETC) |

1.0% |

|

Stellar (XLM) |

0.8% |

|

Aptos (APT) |

0.7% |

|

Filecoin (FIL) |

0.7% |

Edited by Marc Hochstein.