The Currency Cold War: Four Scenarios

The Currency Cold War: Four Scenarios

The year is 2030, and you need to buy some new sunglasses. You browse through your options online. You use augmented reality to try on a few pairs, you find one you like, and now it’s time to pay.

This piece is part of CoinDesk’s “Internet 2030” series about the future of the crypto economy.

You have 17 options for payment, including: the digital U.S. dollar (but you’d rather not support the U.S. government and President Ivanka Trump, so you decide against the USD), Facebook Libra (but you have reservations about the new Facebook Brain Implant, so no thanks), Bitcoin (yet you’d rather not part with your digital gold, as the price of BTC just hit $500k), Sunglass Coin (the native currency of this sunglass website, which gives you a 10% discount), Parity Coin (a project that seeks to promote gender wage parity), Green Coin (a project that works to combat climate change), and on and on.

This sounds complicated but it isn’t, as your smart wallet instantly computes all of the exchange rates, and it’s seamlessly connected to the sunglass vendor’s website.

Or maybe none of this happens. Maybe the currency of 2030 looks a lot like 2020. Or maybe you’re paying in digital Chinese Renminbi.

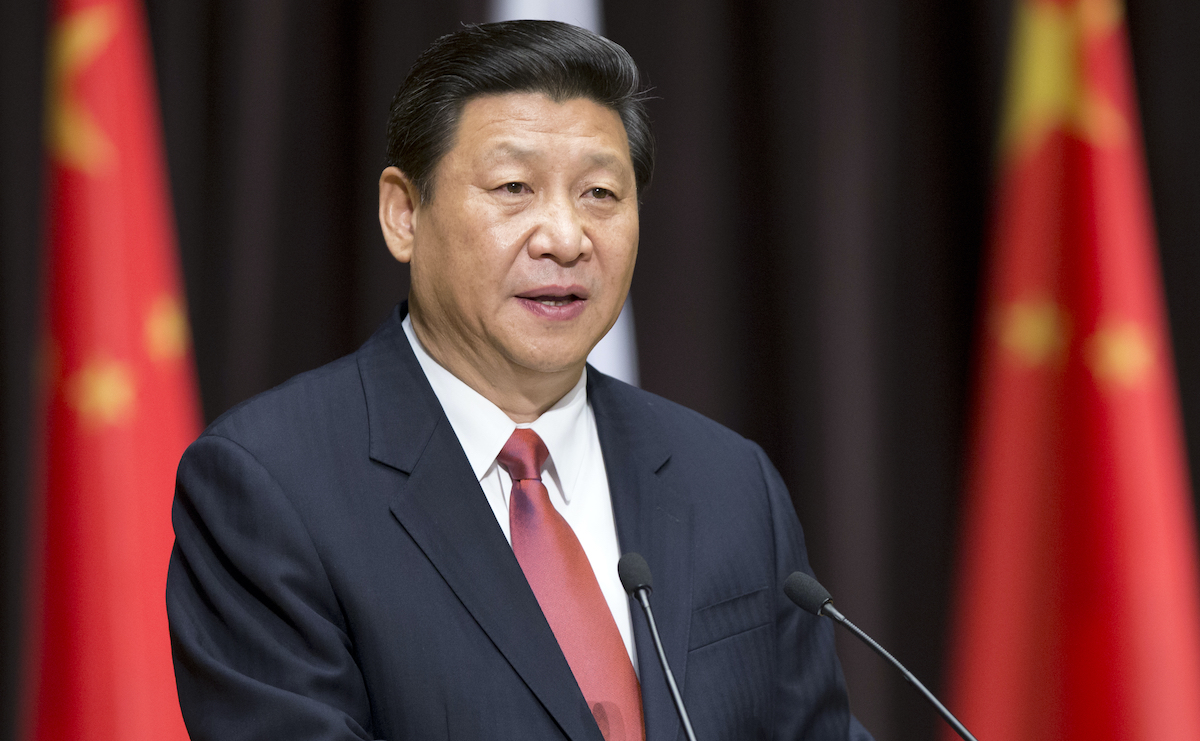

The only thing we know for certain about the future of global currencies: There’s a ton of uncertainty, and many scenarios are in play. As fintech guru David Birch has framed it, the global powers are engaged in a “Currency Cold War,” with China and the United States vying for supremacy. China bolted to a head start with the government-backed DCEP project (Digital Currency/Electric Payment), but we now know the Federal Reserve is experimenting with a digital dollar. And then of course we have the wildcards of Bitcoin, the potential juggernaut of Facebook’s Libra, and thousands of other current and future cryptocurrencies, all governed in novel ways and sometimes acting autonomously.

Which one will win?

And what would the outcome mean for the internet in 2030? We asked a handful of futurists to share some thoughts on a few scenarios, mostly in the name of a fun thought-experiment. The real world consequences are serious, though. “This is not just fun, it’s critically important,” says futurist Ross Dawson. “The world of money could change fundamentally in the next 10 years, and the implications could be massive. This is something we really need to be actively thinking about.”

There are an infinite amount of currency scenarios, but for everyone’s sanity, we’ll consider just four, loosely inspired by the cheeky “Red vs. Blue” framework Birch lays out in his book The Currency Cold War, with “Red” being a state-sponsored digital currency like China, and “Blue” being a cryptocurrency like Facebook’s Libra (ie a private coin.

The scenarios:

Scenario 1: The U.S. dollar wanes, but no one dominant currency emerges in its place. We have countless currencies to use for every transaction. (Birch calls this the “Rainbow Scenario.”)

Scenario 2: China’s digital currency gains dominance – the Red Scenario.

Scenario 3: “USA! USA!” The U.S. retains dominance with a digital dollar – The Green scenario.

Scenario 4: A non-government-backed cryptocurrency (such as Bitcoin) gains dominance – the Blue Scenario.

A few obligatory disclaimers: The experts clarify that these are not hard predictions, but rather some possible scenarios that could unfold. (So don’t angrily @ them in 2030 if you can’t buy your beer with Guinness Coin.) Also, each futurist speaks only for him or herself, so the speculation of one should not be construed as the consensus of all.

So how will money impact the Internet 20300, and how did we get there?

The rainbow scenario

The U.S. dollar wanes, but no one dominant currency emerges in its place. We have countless currencies to use for every transaction.

Futurist Brett King, author of the book Bank 4.0, sees the conditions today that could give rise to a system of jumbled currencies. It starts with the protests and the polarization.

“We’ve had about a 1,000 percent increase in protests from 2000 to 2020,” King says. “You have the highest levels of inequality recorded in US history, and that’s very similar for economies like the U.K. and Australia.” He also notes a “clear disconnect between the stock market and the economy.”

How could people protest the inequality? How could people express their values, desire for change, and demands for social justice? Potentially through other currencies besides the U.S. dollar.

“You might find people choosing cryptocurrencies — or mini-economies within the global economy – where people say, I’m going to make an ethical choice with this kind of currency, or this kind of platform,” says King. Other questions King suggests people might ask of their currencies:

- Is this currency a net carbon neutral platform?

- Does this currency fit within an ecosystem that is environmentally sustainable?

- Is this currency committed to equality, and growth of the middle class?

Birch offers a darker twist. He conjures up a scenario where the many different currencies are splintered, yes, but also the “virtual world” has even greater prominence than today, and that people “withdraw into the virtual world, and begin to lose interest in the physical world.” (Again, he’s not predicting this scenario, and he considers himself an optimist, but he suggests this as one possible outcome).

Birch says that in this world, we’d see a “rise of gated communities in cyberspace, which work much better than gated communities in the real world.” (In gated communities in the real world, Birch dryly notes, you “need shotguns to keep people out,” but online you just need cryptography).

The dominant currencies on the planet? “The currencies of the communities where I live,” says Birch. “I don’t care about the U.S. dollars anymore, because [in this scenario] I don’t pay taxes. I care about the Reddit Dollar. Or I care about the IBM dollar.” In this world, says Birch, “the nation state begins to crumble a little bit, and we find ourselves in a constant state of cyber war, where our loyalties are no longer national.”

The red scenario

China’s digital currency gains dominance

China is making moves. The nation’s global yuan payment network (Cross-Border Interbank Payment System) already has nearly 1,000 financial institutions, according to the Nikkei Asian Review’s Koji Okuda, and is making inroads in Africa, “due to China’s economic clout in the region, especially with its Belt and Road infrastructure-building initiative.” And as Ledger Insights reports, “Africa’s payments using China’s currency increased by 123% over three years” during June 2019.

That said, even as China continues to aggressively make inroads with both currency strength and the DCEP, most of the futurists agreed that it’s unlikely that China would gain true hegemony in the next decade, even if the nation continues to gain influence.

They broadly agreed with CoinDesk’s Michael Casey, who wrote in Money Reimagined newsletter, “To be clear, I see very little prospect of a digital renminbi becoming a dollar-like international store of value for central banks. Rather, the DCEP’s programmable qualities could render redundant the very need for a reserve currency intermediary in international transactions, allowing cross-border users to bypass the U.S. banking system.”

And even if China achieves hegemony, it’s entirely possible that the impact would be, on balance, a positive one. “I actually have a positive notion of what China would become,” says Professor Michael Sung, co-director of the Fintech Research Center at the Fanhai International School of Finance at Fudan University. He acknowledges the historical baggage of the Communist Party, but notes, “If you look at China, they went from real communists to a free market in the space of a decade. It went from the #1 polluter in the world to leading the Paris accord.”

Sung, a U.S. citizen, has hope that because China engages in constant experimentation and “micro-adjustments,” the nation does “care about the local population, because it legitimizes their ability to rule.” China is not there yet, but i“going to evolve into something like a Scandinavian, enlightened social democracy.” (Sung elaborates on his bullish thoughts on China’s blockchain projects in an op-ed for CoinDesk.)

Futurist Heather Vescent paints a darker picture. Vescent studies cyber-security and espionage, and is the co-author of Cyber Attack Survival Manual. She points to a likely outcome in a world of Chinese currency hegemony: massively increased surveillance. “In Western countries, we have a split between government and the private sector. Not so in China, which is why Chinese espionage supports their private sector businesses.”

“Imagine if Apple was a Chinese company being run globally, with the Chinese views,” she says. “China’s not going to change their world-view when they have products in the United States.” So how does this change the Internet 2030? “Well, you want to be afraid of surveillance?” A scenario of China hegemony would mean surveillance on steroids.

“It’s not just about the digital currency,” Vescent says. “It’s not just the power of the transaction. It’s the value behind that currency. A world in which the Chinese currency eclipses the US currency is a world in which Chinese values eclipse US values.” A world of Chinese currency hegemony, she explains, would be the result of other dramatic shifts in power. (Again, the futurists do not consider this likely.)

Oh, and here’s one final cheery possibility about the Dominant China scenario: Vescent says that if China has digital currency hegemony, that implies it has made massive strides in quantum tech, the next generation of computing. “We will figure out quantum computing, and that will break the blockchain,” says Vescent. “The only question is when it will happen, and by whom. So in this scenario – the Red scenario – assume that China breaks quantum first, and blockchains are no longer secure.”

Green scenario

“USA! USA!” The U.S. retains dominance with a digital dollar.

At first this sounds obvious: This scenario is like today. Done.

Not so fast. Brett King thinks that given all of the competition and headwinds the U.S. could face from the other scenarios (such as China competition), then if it retains its dominance in the next decade, then it must have done SOMETHING pretty impressive. “How do you keep the U.S. relevant from a currency perspective?” King asks, musing a bit.” He then imagines a scenario where the U.S. shows renewed dominance with growth in global infrastructure.

First he considers some basic possibilities: maybe the U.S. creates advances in autonomous shipping, drone delivery, or supply chain tech.

Then he floats what he calls “a really out there scenario”: Climate change leadership. “In the process of all of this [coronavirus pandemic aftermath], climate change starts hitting, and you’ve got trillions and trillions of debt all around the world. Right? So the U.S. goes to the United Nations and says, ‘We believe that all national debt should be forgiven, but that national debt must be committed to climate mitigation over the next 50 years.’ And it will be monitored by the global community.”

King continues, on a roll. “Suddenly, now you’ve got trillions of dollars of capital that can go towards greening the planet, energy efficiency, and all these sorts of things. So the U.S. is heavily incentivized to go into the Sahara, and build massive solar farms that can supply all of Europe. As an example. But something like that would make the U.S. increasingly relevant in the system.”

Blue scenario

A non-government-backed cryptocurrency (such as Bitcoin) gains dominance

What would the internet look like if a private (non-government regulated) currency emerged as dominant? “If you could pay anybody anywhere in the world, instantly and for free, we wouldn’t be so dependent on the advertising model of internet content,” says Birch. Micropayments (such as Brave) might finally emerge from niche to widespread.

“If I can pay 25 cents to read the thing I want to read on The New York Times – I don’t have to subscribe to it and use credit cards – they don’t have to show me disgusting adverts for ear wax, so that’s kind of a win-win,” says Birch. Then again, he acknowledges that this is class-based, as “the rich can buy themselves out of this cesspit.”

Birch also highlights the optimist possibilities, as “If you could do business with anyone in the world, hopefully, new products and services would spring up, to facilitate that trade and interaction.”

International uncertainty may drive cryptocurrency usage. “If we have a stable geopolitical structure, where most people and most nations feel secure, then that will not encourage a large rise of non-government digital currencies,” reasons futurist Ross Dawson.

“Whereas if we have a deep social division and disruption – and civil wars in developed countries in the next decade, that’s very plausible, depending on how you define ‘civil war’ – this will fracture societies and trust in government, and could lead to wholesale shifts to cryptocurrencies.”

With apologies to the crypto super-bulls, this is not necessarily the Lambo Scenario or Moon Scenario. Dawson imagines a potential world of “dueling economies” – even within the United States – if a cryptocurrency emerges dominant. One will be the official legal economy that’s regulated by the U.S. government (like today), and the other an unregulated “shadow economy” that’s dominated by the cryptocurrency.

“There will always be national currencies,” says Dawson. “We’re never going to have a time when the government says, “Okay, we give up, we’re not going to do this anymore.” (He later clarifies that maybe “never” is too strong of a word, but certainly not in the next decade.)

So the question is what’s the balance between the shadow economy and the regulated economy? He points to Italy’s shadow economy as an example, which by some estimates is more than 12% of the nation’s GDP – largely the result of tax evasion.

At least in this scenario, Bitcoin (or some other cryptocurrency) is finally not just a Store of Value or a speculative investment. It could be widely used to buy a cup of coffee, pay your rent, or, yes, to buy your pair of sunglasses.