The Case for Regulating, Not Banning, Crypto

One bitcoin costs roughly $17,700, not $0, to mine, and there isn’t an unlimited supply, but instead a hard cap of 21 million tokens. Unlike with shares, no single company can increase the total number of bitcoin. Ethereum has a negative supply schedule, and so its native token, ether, decreases in supply. USDC is backed by dollars, one to one, held in regulated banks. All of these assets, which account for most of the volume in the crypto ecosystem, aren’t created at no cost and without limit, and so Allen’s “root” argument doesn’t apply to 70% of the market.

Related Posts

Bitcoin Miners May Shift Focus to AI After Halving, CoinShares Says

Bitcoin miners may shift towards AI due to the potential for higher revenue, CoinShares said.The average bitcoin production cost post-halving is about $53,000.Some miners are actively managing financial liabilities and are using excess cash to pay down debt, the report said.14:59Why Bitcoin May Fall to $52K14:59Why Bitcoin May Fall to $52K00:39What's the Biggest Misconception People

Crypto Infrastructure Firm Ramp Network Secures Ireland Registration

The Ramp Network has secured a virtual asset services providers (VASP) registration in Ireland.It plans to make Ireland its European headquarters and secure a license as a Crypto Asset Service Provider.14:50Rep. French Hill 'Rejects' Gensler's Argument Ahead of FIT21 Vote01:04Donald Trump-Themed Meme Coins Are Breeding Crypto Millionaires01:40SEC's Gensler Pushes Back Against House Bill; Crypto Exchanges

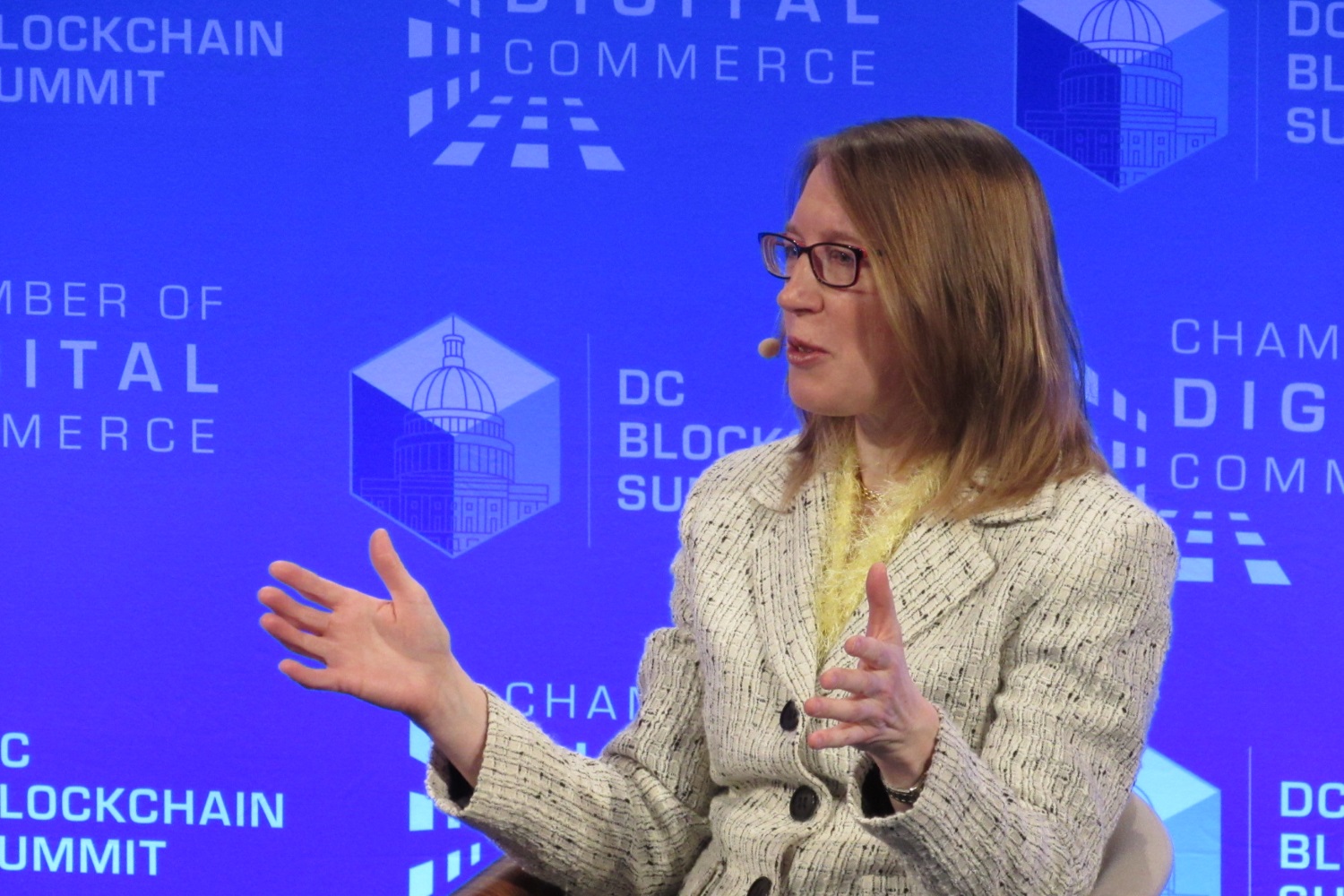

SEC ‘Crypto Mom’ Hester Peirce Tapped for Second Term at US Regulator

Jun 3, 2020 at 21:49 UTCUpdated Jun 3, 2020 at 22:24 UTCSEC Commissioner Hester Peirce (Credit: CoinDesk archives)SEC ‘Crypto Mom’ Hester Peirce Tapped for Second Term at US RegulatorHester Peirce, one of five commissioners with the U.S. Securities and Exchange Commission (SEC), has been tapped for a second term at the regulatory agency. Peirce, who…

‘Ruff’ Month? Dogecoin’s Price Slid 36 Percent in October

Market data shows that the meme-themed dogecoin was the worst-performing coin out of the world's largest 25 cryptocurrencies by capitalization. The cryptocurrency – derided as a joke by some, beloved by others – first hit the market in 2014 and has since been through a series of boom-and-bust cycles ever since in terms of overall market…

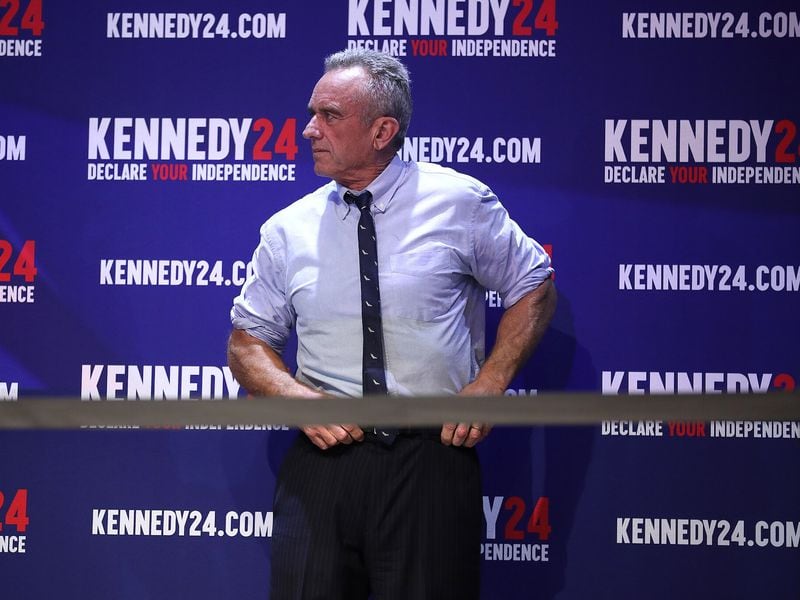

Will RFK Jr. Debate Trump or Biden? Probably Not, Prediction Market Says

This week in prediction markets…Will there be a Biden-Trump-Kennedy debate?When will OpenAI's Sora launch?It's gone to the catsSolana vs. Ethereum: Which chain will earn more in fees?A presidential debate that includes independent candidate Robert F. Kennedy Jr. alongside President Biden or Republican frontrunner Donald Trump is unlikely to happen, bettors on crypto-based predictions platform Polymarket

Qatar’s Sovereign Fund Might Be Buying Bitcoin, But Surely Not $500B Worth

Bitcoin maximalists like Max Keiser have spread rumors of a $500 billion BTC purchase by Qatar, which would be larger than the sovereign fund's current holdings. The Qatar Investment Authority has denied investing. But, with BTC increasingly accepted on Wall Street, sovereign funds may add digital assets to their portfolios soon. In recent days, rumors

Ether Leaves Bitcoin Behind With 2020 Gain of Over 100%

Jul 24, 2020 at 12:55 UTCUpdated Jul 24, 2020 at 12:56 UTCEther, the second-largest cryptocurrency by market value, has more than doubled in value this year, leaving bitcoin, the crypto market leader, far behind. Ether is trading near $275 at press time, representing a nearly 114% gain on a year-to-date (YTD) basis, according to CoinDesk’s…

LedgerX Claims ‘Record’ July for Bitcoin Options Trading

Bitcoin derivatives trading provider LedgerX says it saw a "record" amount of trading volume over the last two months.