The Bitcoin Price And Macroeconomic Correlations

A look at how macroeconomic volatility spikes are impacting the bitcoin price.

The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

This Daily Dive will touch on some of the recent macro trends and correlations in the BTC market. If you haven’t read this recent thread on the bitcoin market, check it out.

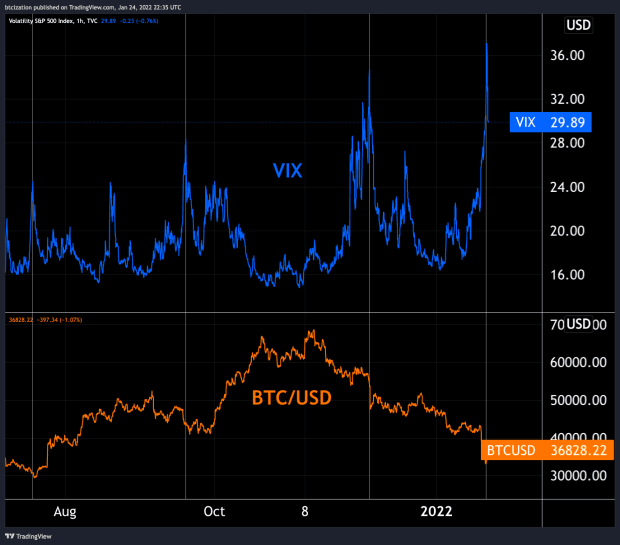

In Friday’s Daily Dive, with bitcoin below $40,000, we noted to keep an eye on the VIX, as risk assets continued to sell off in unison over the following month.

“If things continue to get ugly in equity markets, keep an eye on the VIX, which is a volatility index for the S&P 500. If stocks continue to drop, it will likely lead to continued weakness in bitcoin. The real question is what is the threshold where bitcoin derivatives markets face cascading liquidations, which is what worsened the sell-off in March of 2020.”

Just a mere three days later, U.S. markets opened down big and bitcoin was trading near $33,000 as volatility exploded, with the VIX touching as high as 38 before a massive reversal occurred:

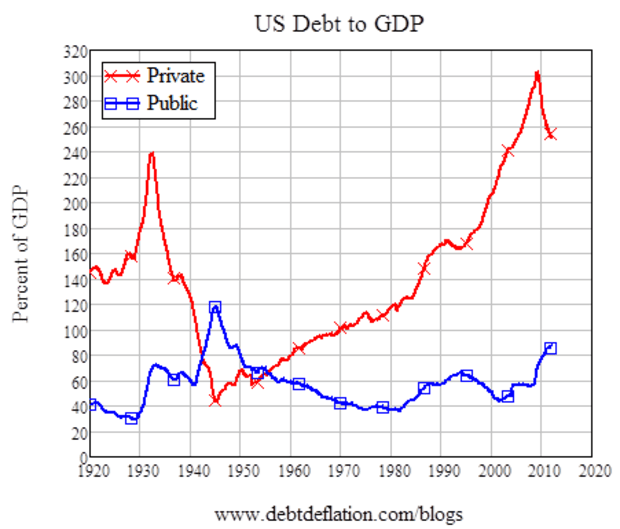

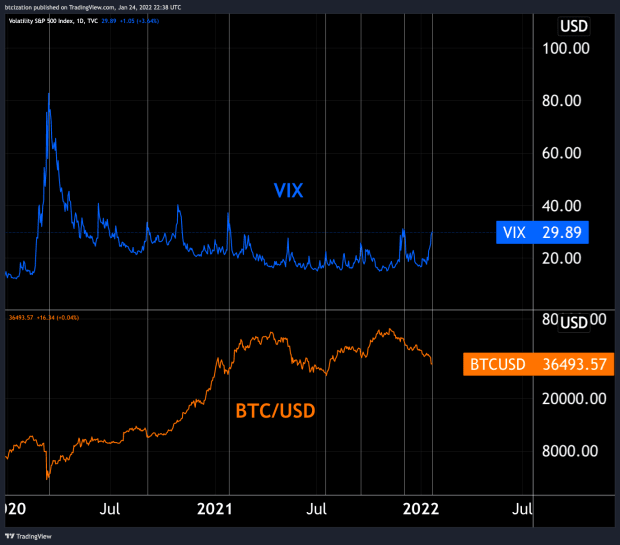

As bitcoin matured as a global macroeconomic asset, it increased its correlation to equities and sold off during moves higher in the VIX (risk off moments). Here are some highlighted moments over the last two years where this has occurred:

We also have monitored the market’s expectations for the Federal Reserve Board through the Eurodollar futures market, a futures market on the expected Fed funds rate. Expectations fell today as equity markets tanked, which was an implicit nod to the infamous “Fed put.”