The Biggest Winners from April’s Early Crypto Market Rebound

Bitcoin and the rest of the cryptocurrency market have started Q2 off with an emphatic bang, having at one point increased the market’s total capitalization by nearly $40 billion since the beginning of April.

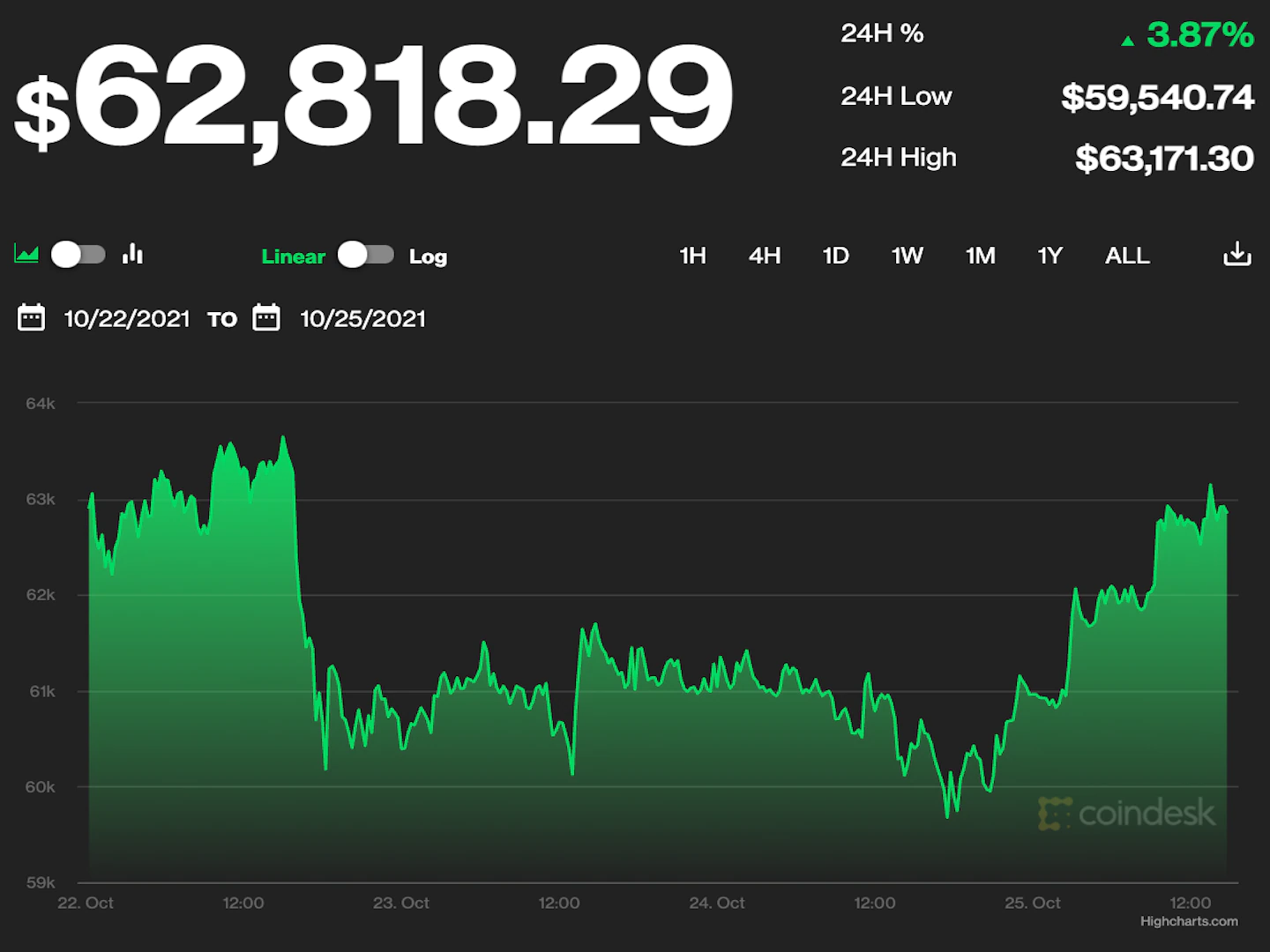

Indeed, bitcoin led the market-wide charge on April 2, surging over 20 percent in a single hour – a move that had since extended to a 136 day of $5,304 yesterday, according to data from CoinDesk’s price data.

A common byproduct of a rallying bitcoin, however, is diminished returns of the BTC denominated trading pairs of most other cryptocurrencies, as opportunistic investors tend to shift funds into the market leader when it picks up a bid.

Such was proven Tuesday when almost all of the top 50 cryptocurrencies ranked by market cap were posting impressive 24-hour gains in US-dollar value, yet only Nano (NANO) was found to be reporting BTC denominated gains, Messari data revealed.

On Wednesday, though, it seemed investors were rotating funds back into the many other cryptocurrencies besides bitcoin, boosting both USD and BTC denominated values significantly.

Highlighted above were the top performing cryptocurrencies so far this month as of yesterday’s trading session, according to Messari data.

As can be seen bitcoin, the largest cryptocurrency by market cap, once again is being outperformed by others, granted the prices of smaller cryptocurrencies are easier to move since they have smaller market caps and are more thinly traded.

Bitcoin Cash (BCH), a fork of the bitcoin blockchain, is the standout best performer so far this month, at one point flashing 94 percent price growth against the USD, roughly 50 percent of which was recorded on Wednesday alone as its BTC pair surged nearly 40 percent.

Litecoin (LTC) has also aggressively extended its impressive Q1 gains into the second quarter of the year. The cryptocurrency’s trade price is now up 43 percent month-to-date, albeit the figure was above 54 percent yesterday, after rising 31 percent in USD value and coming just shy of a $100 price tag on most exchanges.

The price of the “worst” performer in this group on Wednesday was Aion (AION), which aims to act as a bridge connecting different blockchains, still reflected a strong USD denominated increase of 25 percent and a notable 16 percent jump in BTC value.

With the reasons for the recent market surge pointing to technical catalysts, the perhaps unparalleled volatility is creating a day trader’s paradise, although such volatility being back for the long haul is not quite yet a certainty.

Disclosure: The author holds BTC, LTC, ETH, ZEC, ZIL, AST, REQ, OMG, 1st and AMP at the time of writing.

Cryptocurrencies via Shutterstock