The Biggest BONK Whale Just Invested in ‘Ycombinator for Solana’

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

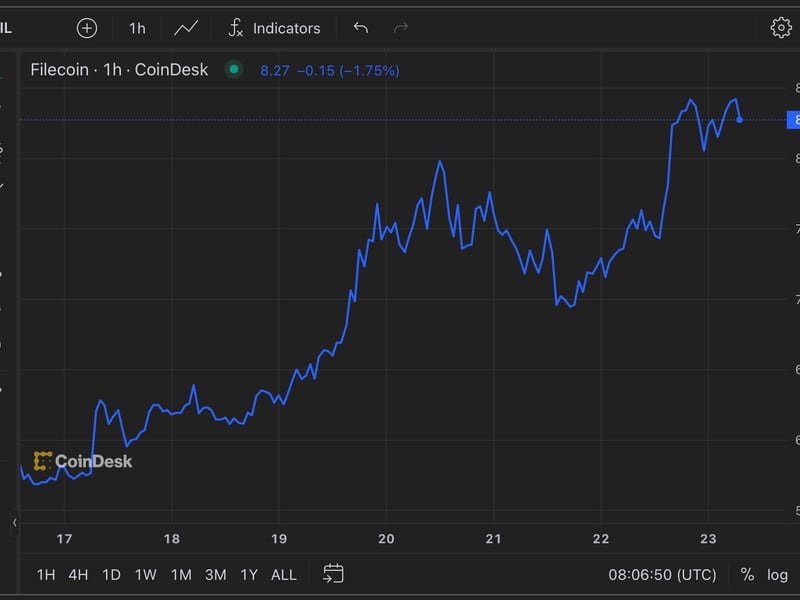

The BONK meme coin started as a jokey way to spread some wealth across Solana when FTX’s late-2022 implosion left that crypto ecosystem down bad. One year later both are up big, making BONK into an unlikely something else: an investor in a venture fund.

Bonk DAO – a 12-person council of Solana power brokers who manage $124 million worth of BONK token – plans to invest $500,000 of its treasury in an early-stage startup fund that will back projects building on Solana, according to a recently concluded governance vote.

The fund is being organized by Colosseum, the recently launched startup accelerator that plans to organize hackathons that spawn new projects for the Solana ecosystem. Last week, the Solana Foundation passed this responsibility over to Colosseum, which is being run by its former head of growth Matty Taylor.

“We were fairly surprised to be honest, because we had not heard of a DAO making this type of investment in a venture fund before,” Taylor said.

He declined to discuss Colosseum’s ongoing fundraising due to securities laws.

BONK DAO was born at BONK token’s inception in 2022 when the meme coin’s creators allocated over 15% of all BONK to the group for it to manage and spend on community projects, according to BONK’s website.

The Cayman-based entity remains the single-largest holder of BONK tokens, with over 12% of the meme coin’s total supply.

Since then, the group has voted to send BONK into hackathon sponsorships, liquidity pools and DeFi partners across Solana. The investment is its first foray into writing a venture check, according to its governance page.

The vote to send money to Colosseum recently passed with eight in favor and none against the proposal to invest in “Ycombinator for SOL.”

“Helping to support builders in the ecosystem and diversify the DAO treasury across early stage builders and founders via equity,” the proposal read.

A separate, ongoing vote proposes turning the BONK into USDC through a monthslong trading partnership with the market-maker STS Digital.

Edited by Aoyon Ashraf.