The Arrival Of BlackRock: Bitcoin’s First Spot ETF

The article below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The Arrival Of BlackRock

As most readers are likely aware, ripples were sent through the bitcoin investment space with the announcement of a spot bitcoin ETF application from BlackRock, the world’s largest asset manager. The move from the $10 trillion asset manager stoked plenty of excitement and concerns alike from bitcoin proponents, with many championing the potential for massive inflows from legacy institutional investors, while others pushed back, citing the risks that such a product structure could pose to the bitcoin market. The introduction of such a product could bolster bitcoin’s profile among traditional investors, but it’s vital to understand the potential implications.

This article delves into the BlackRock proposal, comparing it with existing bitcoin investment vehicles, assessing the potential risks and benefits and drawing parallels with the introduction of liquid investment vehicles into the gold market, which many analogize as bitcoin’s monetary predecessor. The goal is to evaluate the implications of such a product on the broader bitcoin market and institutional adoption, while keeping in mind the principles that underpin the potential of bitcoin to serve as a global neutral reserve asset and settlement layer.

BlackRock’s Bitcoin Trust Proposal: An In-Depth Examination

BlackRock’s submission of an S-1 with the SEC marks a significant development in the bitcoin investment landscape. Although not an ETF in name, BlackRock’s iShares Bitcoin Trust application bears striking resemblance to an ETF in function by allowing for daily subscriptions and redemptions, distinguishing it from existing bitcoin investment vehicles like Grayscale Bitcoin Trust (GBTC).

In contrast to the current leading bitcoin investment product, Grayscale’s GBTC, BlackRock’s trust proposes an in-kind redemption feature. This means investors aren’t tied to selling their shares and creating a taxable event; instead, they can opt for withdrawing bitcoin from the trust. This circumvents the tax implications that Grayscale investors face when selling their shares for fiat and then purchasing bitcoin.

However, it’s important to note that the proposed in-kind redemptions come with a big caveat: Only BlackRock’s authorized participants, essentially investment firms in good standing with BlackRock, can withdraw bitcoin from the product. This implies that the benefit of in-kind redemptions is essentially restricted to large-scale investors and institutions.

The trust is slated to adopt the grantor trust model, aligning its structure closer to the likes of gold investment trusts. This implies that owning shares of BlackRock’s trust would, for tax purposes, equate to owning the underlying asset, e.g., bitcoin.

Questions start to arise regarding potential risks with BlackRock’s proposed trust structure, particularly with the possibility of rehypothecation. A common practice among traditional asset ETFs, rehypothecation involves lending out assets to market participants. If extended to the Bitcoin Trust, it could lead to a situation where investors only have a claim to bitcoin that has been lent out, a situation that could lead to investors owning paper claims to bitcoin rather than the asset itself.

Furthermore, the proposal gives BlackRock considerable latitude in case of a Bitcoin fork, allowing them to determine which Bitcoin version to back. This opens up the possibility for potential manipulation and could present risks to investors who may not align with BlackRock’s decisions.

The Current Landscape Of Bitcoin Investment Products

Delving into the current landscape of bitcoin investment products, let’s focus on two leading vehicles: the ProShares Bitcoin Strategy ETF (BITO) and the Grayscale Bitcoin Trust (GBTC).

First, there’s the Grayscale Bitcoin Trust, which has long served as a primary avenue for legacy financial institutions to gain liquid exposure to bitcoin. Operating as a closed-end fund trading over the counter, GBTC saw billions of dollars flow into it over the years. The product carries a hefty 2% annual fee as a percent of net asset value and does not offer redemption back into bitcoin, thus creating a one-way street for supply. This structure was once very appealing to investors looking to exploit a seemingly automatic arbitrage trade, especially when the premium for GBTC shares reached as high as 40%, leading to a reflexive dynamic between inflows into the trust and demand for spot bitcoin.

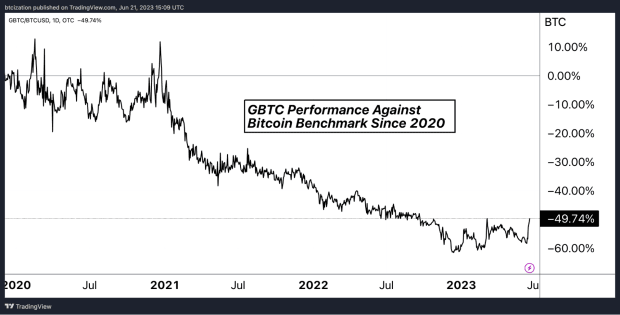

However, this feedback loop reversed as demand for GBTC shares wavered when institutions began to attempt to unwind the arbitrage trades they had put on — meaning selling GBTC to realize the gain — which caused the premium to turn into a discount, with shares trading less than the net asset value of the bitcoin within the trust. The dislocation of GBTC from its net asset value alongside its inferior liquidity profile relative to spot bitcoin itself resulted in a market that liquidated all overleveraged participants who were using GBTC as collateral.

GBTC’s relatively high 2% annual fee has also come under scrutiny, especially as cheaper investment vehicles have emerged. As a result, GBTC shares came under immense pressure during the later months of 2021 and throughout 2022, with the discount to net asset value plummeting to almost negative 50%.

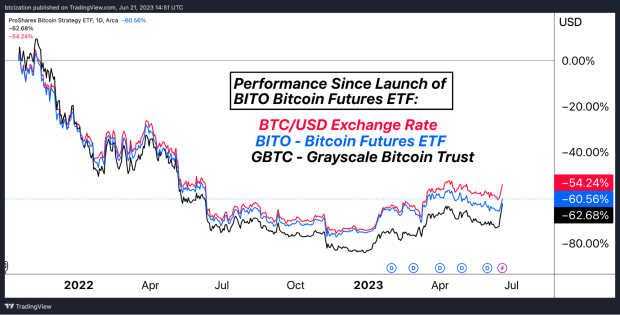

Besides GBTC, there is also BITO, which marked a significant milestone in the history of bitcoin investment products. As the first bitcoin-linked ETF available on a U.S. exchange, BITO opened the doors for investors to gain simple, indirect access to bitcoin exposure through a securitized ETF that has exposure to bitcoin futures contracts. However, as a futures ETF, BITO doesn’t hold bitcoin directly. Due to the nature of futures contracts, the fund exposes investors to rollover risk, particularly when the futures curve is in contango — meaning futures prices are higher than current spot market prices — which causes their holdings to decay relative to the price of bitcoin over long periods of time.

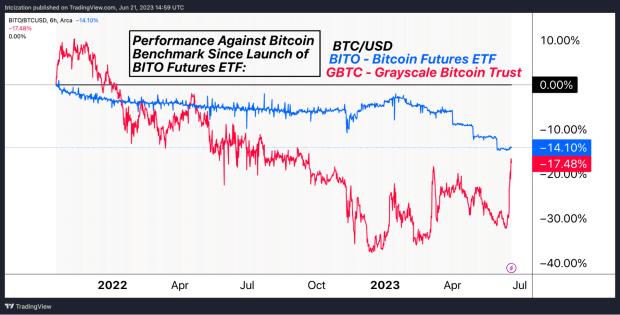

Displayed below is the relative returns of GBTC and BITO shares against bitcoin since the launch of BITO, and since the start of 2020.

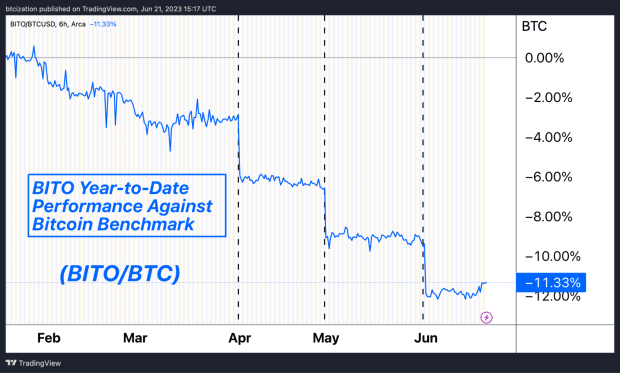

The rollover effect of the BITO bitcoin futures ETF is particularly noticeable in 2023. The dotted lines show periods when the monthly calendar bitcoin futures contract expires and the subsequent front month roll over takes place.

A Closer Look At BlackRock’s Bitcoin Trust: Potential Implications & Risks

Given the intricate design of BlackRock’s Bitcoin Trust, its implications and potential risks raise serious concerns. There is an excellent post written by Allen Farrington, aptly named Trust Me, Bro, which details some of the fine print and seemingly opaque risk models that an otherwise “bullish” ETF application from BlackRock contains. Below is a summary of some of his points in this section, but Farrington’s piece is well worth a read.

From a broader perspective, BlackRock’s trust could amass a considerable amount of Bitcoin, which isn’t necessarily a problem in and of itself, but bitcoin investors should pay close attention and remain vigilant of the possible second-order effects. BlackRock could in theory “sell bitcoin” to many financial institutions in the form of its iShares ETF, which is subject to rehypothecation and opaque ownership, unlike bitcoin UTXOs which exist on a transparent and immutable ledger.

Second, in terms of monopolistic pricing, it is likely that the existence of an ETF will place significant pressure on bitcoin exchanges, where the trading costs of an ETF are a mere few basis points compared to the rates of 50 bps to 100 bps charged by many exchanges for spot purchases. This could lead to consolidation of liquidity and put price-setting into the hands of BlackRock (or another entity with the dominant ETF).

In addition to accumulating a significant share of the circulating bitcoin and having a heavy hand in setting the price, BlackRock could create a narrative around any specific bitcoin that has yet to enter or has left the perceived safety net of the trust. This may look like spreading stories of dirty coins that could have been used by criminals, terrorists, drug dealers, etc., and would have a negative impact on fungibility of the asset because it would essentially create two tiers of bitcoin.

If BlackRock paints the picture of clean bitcoin within their trust versus the dirty bitcoin outside of it, they can then turn to banks to encourage opting into the trust’s version of Bitcoin since it will be viewed as “safe” from a regulatory perspective, further consolidating the ownership of bitcoin and allowing banks to offer their clients access to “bitcoin” which will actually be paper claims to the underlying asset as mentioned earlier.

Also within the trust filing is a section that provides BlackRock an option to choose the “appropriate network” should there be a time when Bitcoin faces an adversarial change in consensus and undergoes a hard fork. The filing specifies that BlackRock’s choice may not necessarily be in line with the most valuable fork. While this is likely a simple form of due diligence, by amassing a significantly large share of bitcoin that has the backing of equally large banking institutions and is held by a large portion of retail investors looking for simple exposure to bitcoin, it’s possible that BlackRock could instigate a hard fork or side with a consensus proposal that changes the fundamental aspects of Bitcoin which make it unique and valuable in the first place.

As mentioned above, there are also redemption concerns with the way this trust is structured. Only authorized participants, meaning investment firms, can withdraw bitcoin from the trust. Average, everyday investors will not be the ones able to redeem bitcoin from the trust in the first place, and since the authorized participants have to be in good standing with the firm, it’s possible that BlackRock could refuse redemptions — even to institutional investors.

All those concerns notwithstanding, there are historical examples of the creation of ETFs, namely gold, and their impact on the market.

The Impact of Exchange-Traded Products: The GLD Analogy

There’s many comparisons and contrasts between gold and bitcoin as investment vehicles. This article doesn’t dig into those but rather highlights the analogy and market impacts of a gold ETF in the past. By far, the biggest question of a bitcoin BlackRock ETF is: What does it mean for the price, market cap, liquidity, adoption, demand, etc.? This is not a new bitcoin-centric startup launching an investment vehicle, but rather the largest financial institution in the world that carries weight for market adoption in the age of passive investment vehicles.

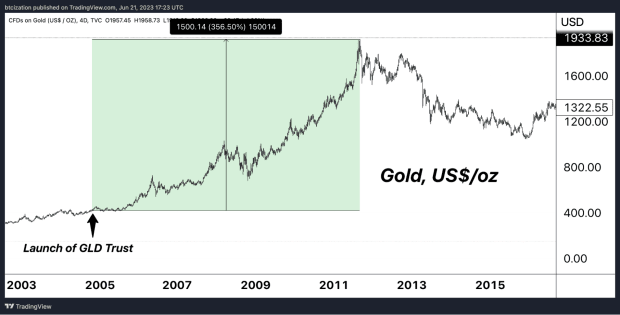

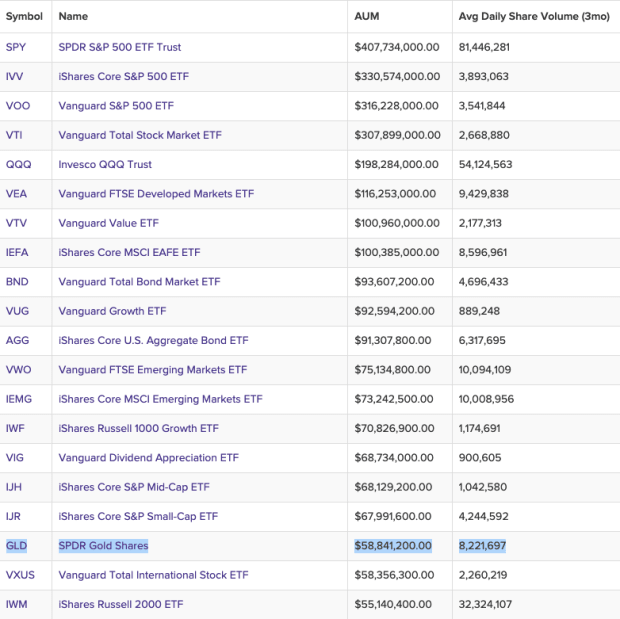

For comparison, let’s look at the SPDR Gold Shares (GLD), the largest gold ETF by assets under management (AUM) that started in 2004. It’s still one of the largest ETFs in the market today with $58 billion AUM. In November 2004, the ETF had over $1 billion in total asset value in the first few days and then hit $50 billion by 2010.

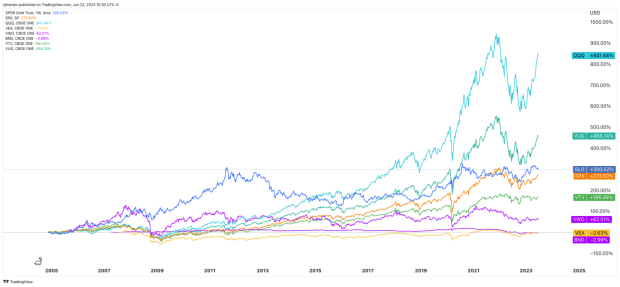

Compared to many of the top ETFs in the market, GLD has been one of the best performing ETFs since its inception, only behind QQQ and Vanguard’s Growth ETF. This only accounts for looking at ETF performance since GLD’s start date as opposed to comparing similar start dates of other ETFs.

GLD is just one of a few large gold ETFs on the market. Total gold ETF products are estimated to have $220 billion in AUM as of last month. In 2022, gold in tonnes held by ETFs accounted for 1.66% of estimated above ground gold supply. A much larger share of gold supply, around 15%, resides in central bank reserves heavily dominated by the United States, Germany, Italy, France, Russia, China and Switzerland.

Obviously, it’s not easy to separate the impact of a widely adopted gold ETF on gold’s price over the last two decades, but it’s clear that the ETFs, even accounting for only a small amount of gold supply, have had a significant impact on the market. The GLD ETF was a major shift in how investors could purchase gold and essentially opened up gold buying to the masses while increasing gold market volumes and overall liquidity. In a limited way, there’s already been some of that impact via the GBTC trust with all its limitations. Compared to bitcoin today, GBTC’s 3.2% of circulating supply was a primary driver of bull market mania despite locking up only a small share of bitcoin supply.

Coupled with new narratives and a bit of gold mania into 2011, the GLD ETF was a key spark for a 350% rise over 6 years. Bitcoin is on a path to go through a similar shift where a more comprehensive ETF with more regulatory clarity will offer it to the masses, both institutional money and 401K or IRA style accounts. It’s not the self-custody bitcoin this publication advocates for, but it is a significant development in the market that many will likely opt for as it’s a market need for those wanting financial exposure to bitcoin on a larger scale, without the responsibility of holding their own keys.

But what about price suppression schemes, similar to the ones that big banks have historically used to tamper the price of gold? Bitcoin’s design characteristics largely shield it from the type of price manipulation that traditional assets like gold have historically experienced. Unlike gold, whose physical nature makes it hard to verify, assay, secure and transport — leading to dependency on futures contracts that can be manipulated — bitcoin exists on a transparent and immutable ledger.

Furthermore, Bitcoin’s digital nature and decentralized structure enable virtually cost-free and near instant settlement of transactions, which allows for manipulation and price dislocations in the futures market to be settled with ease compared to gold, which is much more costly to store and transport. Hence, the type of price suppression seen in the gold market is fundamentally challenging to replicate in the bitcoin market.

Conclusion: The Future Of Bitcoin ETFs And The Path Forward

After all of the Bitcoin ETF conflict and regulatory debate over the years, it’s becoming clear that BlackRock is likely a leading candidate to advance some sort of new bitcoin investment vehicle in the United States. The SEC’s delay in clarity and regulation over the years, all but seems part of a broader plan to get the market’s dominant bitcoin ETF investment option into the hands of one of America’s largest traditional finance institutions. Although other ETFs may get approved, it’s likely a winner-takes-all market or an oligopoly in terms of initial flows, competition and size of AUM.

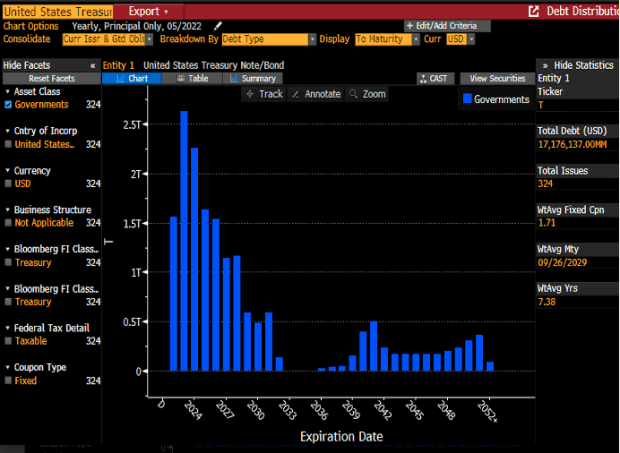

Based on the standard procedural timelines, the best guess is that an ETF approval is on the horizon for sometime in early 2024. It’s a timely move as it will coincide in the same year as Bitcoin’s next halving. Ideally, this is the perfect time for institutional investors to get exposure to bitcoin while also playing into a gold-like-mania narrative, to drive increased market interest right before Bitcoin’s planned supply issuance schedule gets cut in half.

Although helpful for price and boosting institutional demand and access, be wary of the second- and third-order effects of this ETF. Wide adoption of BlackRock’s ETF, complete with bitcoin IOUs, will offer more paper bitcoin variants to emerge. This could lead to a small cohort of institutions having a significant impact on overall price and market liquidity because of the large size of their financial flows. Other effects may include rehypothecation, determining “clean” versus “dirty” bitcoin and influence of new institutions on future hard-fork scenarios.

In summary, this type of investment vehicle is an inevitable path for an asset that is gaining institutional adoption at the same time as the market expands with many others demanding bitcoin exposure. BlackRock is free to purchase bitcoin like anyone else. Ultimately, it’s up to the market to decide and create better bitcoin custody solutions over time that can outcompete pseudo-bitcoin ETFs and IOU-like products.

That concludes the excerpt from a recent edition of Bitcoin Magazine PRO. Subscribe now to receive PRO articles directly in your inbox.

Relevant Past Articles:

- Earlier Than You Think: An Objective Look At Bitcoin Adoption

- Grayscale’s SEC Hearing Gives New Hope For GBTC Investors

- The State Of GBTC: Discount Shrinks For The First Time In Over A Year