The Anti-Bitcoiners Day: Nouriel Roubini and Peter Schiff Bashing Bitcoin’s Price Drop In-correlation With Global Markets Crash

The cryptocurrency market tumbled over the weekend, and it brought a wave of familiar negative voices. The two famous American economists, Nouriel Roubini and Peter Schiff, quickly took the opportunity to bash Bitcoin for not being a proper hedge during the current economic turmoil.

Dr. Doom Against Bitcoin

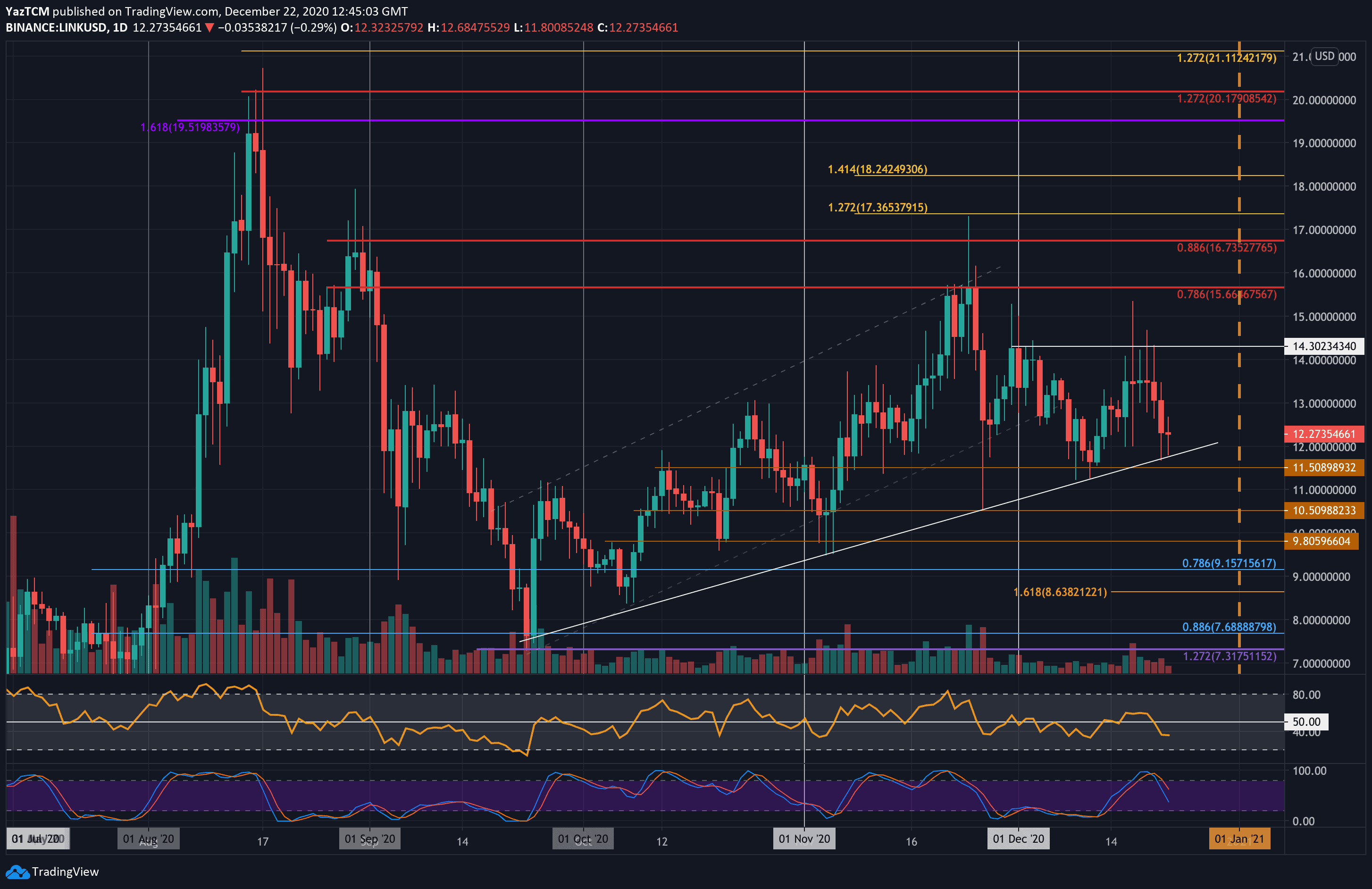

With the rising impact of the coronavirus and the recent Oil Price War, the financial markets plummeted. The cryptocurrency market also dropped severely. Bitcoin, the leading digital asset by market cap, plunged by over 15% in a matter of two days, which showed a positive correlation with the tumbling stock market.

Nouriel Roubini, also referred to as “Dr. Doom,” is a well-known Bitcoin non-believer. He took the current price drop as another opportunity to express his thoughts against Bitcoin’s recent shortcoming to serve as a hedge.

“In the meanwhile Bitcoin is down 8% in the last day, much more than global equities. Another proof that Bitcoin is NOT a good hedge vs. risky assets in risk-off episodes. It actually falls more than risky assets during risk-off. So BTC is a shitty shitcoin hedge in risk-off cases.” – he tweeted.

The largest digital asset has a compelling history when it comes down to its role as a potential safe-haven. Last year, during the peak of the U.S – China Trade War, it noted a negative correlation with the traditional financial markets. While stock markets were plunging, Bitcoin and Gold surged as safe-haven assets.

Something similar happened during the beginning of this new decade, following the tension between Iran and the US. Yet, when the coronavirus outbreak began affecting more and more people, Bitcoin and the stock market were correlating and severely decreased.

Peter Schiff Has A Go Too

Another famous nocoiner and Bitcoin basher, Peter Schiff, also expressed his opinions on the matter. He pointed out that the latest negative price developments in the cryptocurrency world are not surprising to him.

He believes that the decline is a result of Bitcoin’s inability to rally last week “on the most ideal financial circumstances.”

Interestingly enough, Schiff recently admitted that he never said that the price of Bitcoin wouldn’t ever increase. He even conceded that anyone who bought Bitcoin ten years ago and sells it now “will make a lot of money.” Ultimately, though, he reaffirmed his claim that “Bitcoin will never succeed as money.”

The post The Anti-Bitcoiners Day: Nouriel Roubini and Peter Schiff Bashing Bitcoin’s Price Drop In-correlation With Global Markets Crash appeared first on CryptoPotato.