Thailand’s SEC Greenlights Investment From Institutional and Wealthy Individuals in Crypto ETFs

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

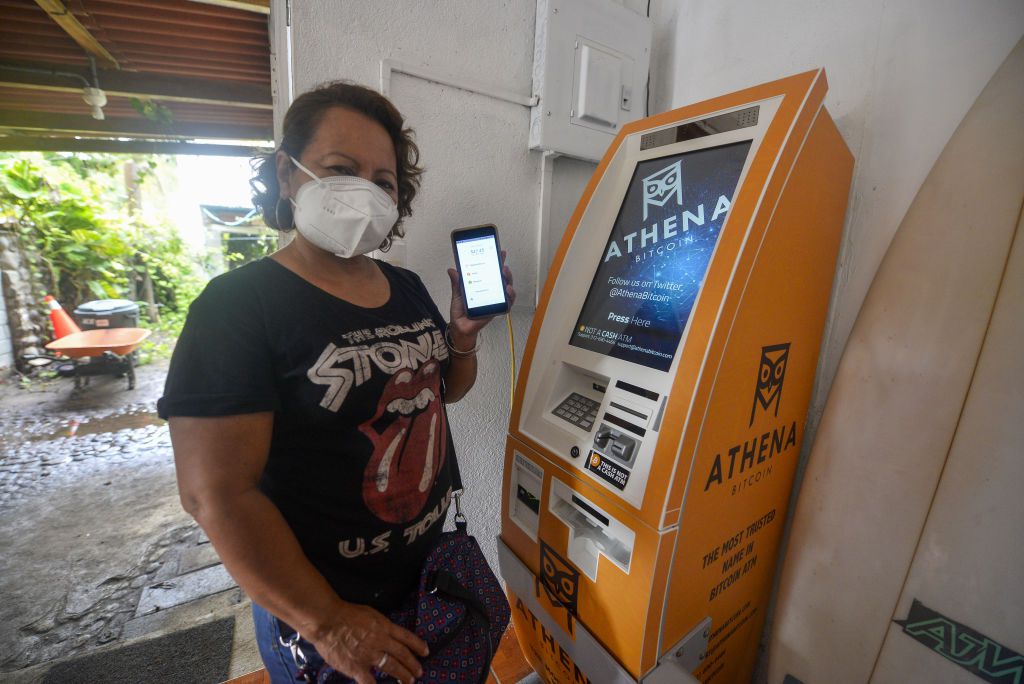

Thailand’s Securities and Exchange Commission (SEC) has made an exception, allowing institutional investors and very high-net-worth individuals to invest in crypto exchange-traded funds (ETFs).

The SEC will now allow asset managers to invest in spot bitcoin (BTC) ETFs on U.S. exchanges, said Pornanong Budsaratragoon, the SEC’s Secretary-General, on Monday.

Spot bitcoin ETFs are classified as securities rather than digital assets under the SEC Act. This reclassification allows Thai securities firms to also partake in these investments. The SEC is contemplating extending this investment opportunity to individual investors in the future.

“Asset management firms asked the SEC for them to have exposure in digital assets, especially bitcoin and spot bitcoin ETFs, but we need to consider carefully whether to allow asset management firms to invest in digital assets directly due to the high risk,” said Pornanong.

In January 2024, the Thai SEC stated that they did not plan to allow asset management firms to launch spot bitcoin ETFs. Until now, the regulator has required individuals to invest in digital assets only through registered local exchanges.

Edited by Parikshit Mishra.