Texas Bitcoin Mining Operation Shutdown By Host’s Armed Security

Last Monday, November 27, Whinstone Inc.’s private security entered the Rockdale, TX-based premises of Rhodium Enterprises in order to remove employees to cease operation of their 125MW Bitcoin mining facility.

The legal battle that culminated in this seizure started on May 2, 2023 when Whinstone US, Inc., a subsidiary of Riot Platforms, filed a lawsuit against certain Rhodium entities. The dispute centered around hosting and energy agreements between the two parties, with Whinstone seeking damages for alleged unpaid hosting fees and a declaratory judgment asserting its right to terminate these agreements.

Rhodium, not taking the accusations lightly, engaged outside counsel and countered with claims of its own. It sought damages for Whinstone’s alleged breaches of certain hosting agreements and filed a motion to compel arbitration. The court, siding with Rhodium, granted the motion, ordering the case to be resolved through arbitration. Within a document filed on June 12, 2023 titled “Rhodium Motion to Compel Arbitration and Counterclaims,” Rhodium made note of these power agreements signed in July 2020 — notably before inflation in energy prices seen the following two years after supply chain issues and lockdowns led to monetary stimulus, increasing the cost of power at the Rockdale site:

“In July 2020, Whinstone and Rhodium JV entered fourteen identical power agreements, each providing for Rhodium JV to receive 5MW of electricity from Whinstone (the “5MW Agreements”). The central purpose of each agreement was to provide electricity (70MW in total) at a fixed price for at least 10 years. Each of the fourteen 5MW Agreements states that it supersedes all prior or contemporaneous agreements between the parties relating to the “subject matter” thereof… Whinstone and Rhodium JV executed 20 total 5MW agreements, but Rhodium has only ever drawn power under 14 of them. Thus, only those 14 are relevant for present purposes.”

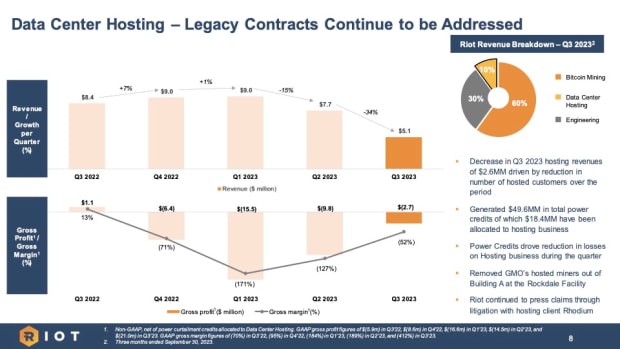

Riot Platforms, then known as Riot Blockchain, eventually purchased Whinstone Inc. on May 26, 2021, acquiring the rights to these power agreements signed in 2020. In Riot’s own Q3 2023 Quarterly Update, they referred to these contracts as “legacy contracts” on page 8, while also noting that “Power Credits drove reduction in losses on Hosting business during the quarter.”

“For the nine months ended September 30, 2023 and 2022, Data Center Hosting revenue was $21.8 million, and $27.9 million, respectively. The decrease of $6.1 million was primarily due to lower revenue share from customers due to the lower Bitcoin values in the 2023 period, as noted above, combined with hosting fewer customers during 2023 as we continue to address legacy contracts.”

This implies a net reduction of revenue from their data center hosting business, notably stating in the page’s title that these “legacy contracts continue to be addressed.”

Within the June 12, 2023 motion, Rhodium makes the claim that not only is Whinstone not owed money, they in fact owe money to Rhodium due to profits not shared from selling their energy back to the ERCOT market.

“Public records show that Whinstone has sold more than $100 million in electricity into the ERCOT market over the last several years. In 2022 alone, Whinstone’s sales approached $30 million… Based on the proportion of Whinstone’s total electricity allotted to Rhodium, Rhodium should have received approximately 25% to 30% of the profit from Whinstone’s sales into the ERCOT market… But Whinstone has not paid Rhodium a dollar of its energy sale profits. Indeed, Whinstone’s former CEO flatly told Rhodium personnel that Whinstone would not honor its obligation to share energy sale profits. Since August 2022, Rhodium has repeatedly sought payment of profits due from Whinstone’s energy sales… All told, Whinstone owes Rhodium at least $7 to $10 million in unpaid energy sale profits. In fact, the amount is likely tens of millions higher.”

This same page 8 of Riot’s Q3 2023 Quarterly Update makes note of an important precedent: The 2022 removal of “GMO’s hosted miners out of Building A at the Rockdale Facility.” In a filing by Japan’s GMO on July 12, 2022, Whinstone is accused of making similar seizures of power and mining equipment:

“On or about March 29, 2022, Whinstone improperly removed certain of GMO’s mining machines in breach of its obligations under Section 3.1.3 of the Texas Agreement (allowing for relocation of equipment only with prior written consent of GMO, which Whinstone neither requested not obtained) and Section 14 of the Texas Agreement (which allows Whinstone to suspend services only under certain circumstances, none of which are applicable). Due to Whinstone/Riot’s removal of GMO’s machines, GMO suffered a decrease of an estimated 20 petahashes in mining capacity, which amounts to at least $16,000 a day in profits. While GMO demanded that the equipment be returned/replaced and send a formal notice related to such on April 12, 2022, it did not receive any response. And upon visiting the Rockdale data center on May 7, 2022, GMO personnel discovered that its machines had not been placed back in service but had instead been replaced by Whinstone machines operating for Whinstone’s own benefit. Despite multiple demands that the GMO machines be put back in position, Whinstone refused.”

This action upon GMO by Whinstone is implied to have been done to counter energy cost increases at the Rockdale site, with further references in their complaint noting:

“Whinstone also recently invoiced GMO for an increase in power price from $0.0285/kWh to $0.03/kWh (resulting in an increased cost of approximately $50,000.00 per month), ostensibly because the power price to be paid by Whinstone to its provider, TXU Energy, is set to increase. However, the 2019 Texas Agreement provides that the power price of $0.0285 USD/kWh “shall not be increased for 10 years” and that “the Parties shall consult with each other in good faith on the price” thereafter. Whinstone’s right to pass on increases is strictly limited to changes in regulation and similarly-imposed costs. Despite GMO formally disputing the charges and seeking explanation, no explanation or evidence has been submitted by Whinstone that this power price increase meets that standard. The recent charges therefore constitute a further breach of the 2019 Texas Agreement.”

On page 20 of Riot’s 10-Q, GMO’s fourth amended complaint against Whinstone is noted, bringing the total damages sought just shy of $650 million dollars.

“On June 13, 2022, GMO Gamecenter USA, Inc. and its parent, GMO Internet, Inc., (collectively “GMO”) filed a complaint in the United States District Court for the Southern District of New York (Case No. 1:22-cv-05974-JPC) against Whinstone alleging breach of contract under the colocation services agreement between GMO and Whinstone, seeking damages in excess of $150 million. Whinstone has responded to GMO’s claims and raised counterclaims of its own, alleging GMO itself breached the colocation services agreement, seeking a declaratory judgment and damages in excess of $25 million.”

On October 19, 2023, GMO filed its fourth amended complaint claiming an additional $496 million in damages, for loss of profit and profit sharing, based on Whinstone’s alleged wrongful termination of the colocation services agreement as of June 29, 2023. At this preliminary stage, the Company [Riot Platforms] believes that GMO’s claims lack merit; however, because this litigation is still at this early stage, the Company cannot reasonably estimate the likelihood of an unfavorable outcome or the magnitude of such an outcome, if any.”

While the suit from GMO against Whinstone is still under litigation, the legal tussle between Rhodium and Whinstone continues on. Whinstone and Riot, dissatisfied with the arbitration decision, filed a motion for reconsideration, which was ultimately unsuccessful. Unwilling to concede, they then sought relief from the appellate court, only to have their request denied on November 22.

This led to the shocking move, at 10 PM on Monday, November 27, of Whinstone sending a notice to Rhodium purporting to immediately terminate certain hosting agreements. This action escalated quickly, as Whinstone proceeded to shut off power to Rhodium’s facilities in Rockdale, removed its personnel using private security – notably without altercation — and revoked its access.

Responding swiftly to what appeared to be a unilateral and drastic measure, Rhodium, in collaboration with outside counsel, filed a motion for a temporary restraining order the very next day, November 28. The motion sought to restore full access to and use of the Rhodium facilities.

The judge presiding over the case granted Rhodium’s motion for a temporary restraining order on the morning of Wednesday, November 29. According to an email sent to Rhodium investors that same day, “A further hearing on this matter has been scheduled to take place on Tuesday, December 5,” ultimately deciding the fate of this temporary restraining order.

As of time of publishing, neither Rhodium or Riot Platforms has made comment on the ongoing litigation.