Terra Classic (LUNC) Number of Holders Increased by Over 500% in a Month

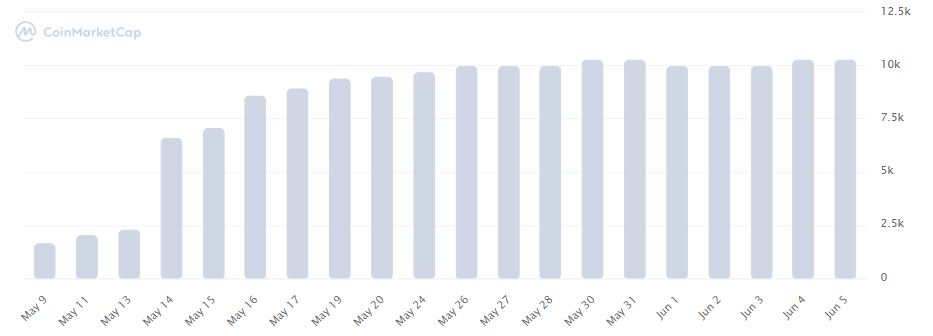

The Terra ecosystem went through a sheer catastrophe less than a month ago, but it appears that the number of unique addresses that hold assets in the new chain – Terra Classic – increased by more than 500%.

- As CryptoPotato reported previously – there are many lessons to be learned from the crash of the UST algorithmic stablecoin and the intertwined LUNA, the burning of which was supposed to help stabilize the peg.

- Unfortunately, many people lost a lot of money as tens of billions were wiped off the market in a matter of days in an event that was never before seen in recent history – two top cryptocurrencies by market cap were completely destroyed from existence in less than a week.

- This, however, apparently saw an influx of new holders to the now-old network – Terra Classic (LUNC).

- LUNC is the former LUNA token prior to the creation of the separate blockchain – Terra 2.0 – the original LUNA, as some refer to it.

- Data from CoinMarketCap reveals that the total number of unique addresses that hold assets in the Terra Classic chain increased by around 560% in the span of one month.

- One of the possible reasons for this is the plummeting price coupled with a lack of fundamental understanding of how the UST pegging algorithm worked.

- It’s entirely possible for unsuspecting investors to have bought LUNA for pennies in hopes of massive returns once the algorithm stabilized – which it ultimately wouldn’t.