Synthetix Community Approves Plan to Nudge Positions Off Soon-to-Shut Version One of Its Perpetuals Market

Community members of Synthetix, a liquidity and derivatives trading protocol built on Ethereum, approved a plan intended to get customer money still on the soon-to-shut version one (v1) of its perpetuals market moved over to version two (v2).

Though v1 has been winding down for the past three months, roughly $150,000 worth of positions remain outstanding. The approved plan will gradually increase the margin requirements on existing positions to eventually liquidate all remaining positions on v1.

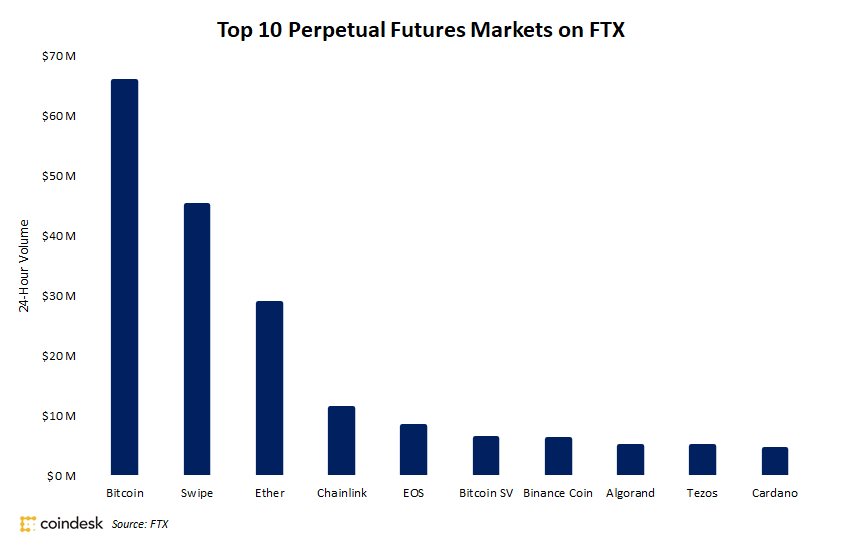

The change highlights Synthetix’s focus on its v2 perpetuals markets, which had $22 million in volume over the past day, data from a dashboard created by the Synthetix community shows. Synthetix’s v2 perpetuals markets, which launched in December, increases capital efficiency and improves risk management for market liquidity providers, representing a “significant upgrade” from v1, according to a blog post.

The motivation behind the recent governance proposal was to shut down Synthetix’s v1 perpetuals market “in the least intrusive manner,” allowing users to close their positions with enough time, as stated in a Synthetix’s governance discussion forum.

The price of SNX, the native token for Synthetix, has increased 1.7% in the past 24 hours to $2.36, per CoinGecko, while data from DefiLlama shows that the total value locked for Synthetix stands at $417.7 million, a 2% increase since May 1.

Edited by Danny Nelson and Nick Baker.