Swiss Startup Amun Wins Regulatory Approval to Sell Crypto-ETPs to EU Retail Investors

Swiss Startup Amun Wins Regulatory Approval to Sell Crypto-ETPs to EU Retailers

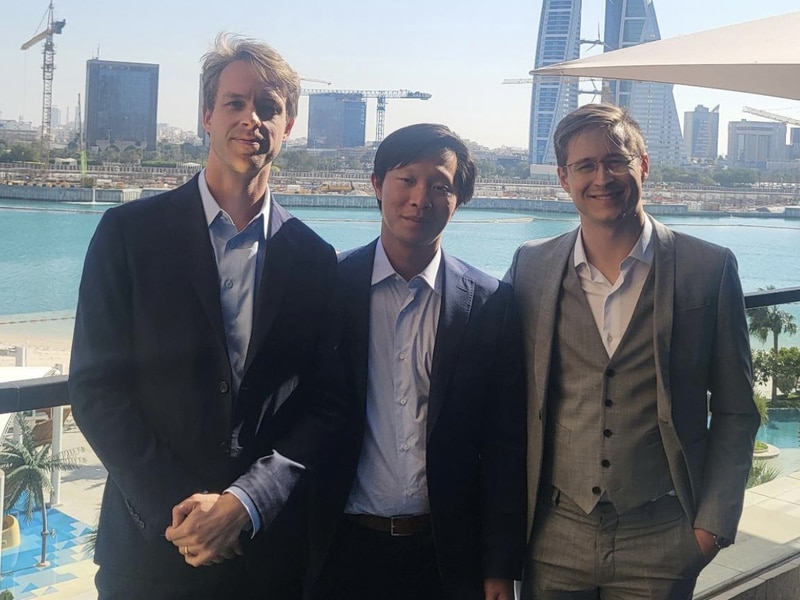

Swiss financial startup Amun has won an approval from the Swedish Financial Supervisory Authority (SFSA) to widen its offering of crypto-based financial products to retail investors in the European Union.

The company said in an announcement on Tuesday that the EU member state regulator has cleared a base prospectus filed by the firm. With that, EU retailers who have access to the Swiss SIX and Germany’s Boerse Stuttgart exchanges can now trade various crypto-based exchange-traded products (ETP) offered by Amun.

Under the EU securities law, each member state has the ability to review and issue licenses applicable across the EU under the “single passport” rule. Sweden’s financial regulatory stamp opens Amun to a greater European retail market.

“[The approval] gives us wide access to sell directly and market directly to basically all retail in Europe,” Amun CEO Hany Rashwan said to CoinDesk.

The SFSA’s approval also green-lights the firm’s further plans to apply to list its crypto ETPs on other regulated exchanges in the EU in its bid to expand the market access.

Listing on other regulated exchanges is expected to be approved by the EU in 2020, Rashwan said. However, product listings must be approved by individual exchanges. Still, Rashwan said the firm is eyeing three of Europe’s largest exchanges for next year.

Amun currently lists seven products on the Boerse Stuttgart and ten on the Swiss SIX, all of the products being crypto-based ETPs totaling some $55 million assets under management.

It most recently launched an ETP with digital asset bank Sygnum listed under the “MOON” ticker along with a Tezos (XTZ) backed ETP on the Swiss SIX in November.

“Our mission is clear and that is to help investors more safely, cost effectively and easily invest in crypto asset classes through our crypto ETPs,” said Amun’s President Ophelia Snyder in a statement. “We are very fortunate to have finished this process within 4 months of its consultancy period.”

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.