SushiSwap to Create Legal Entities in Panama And Cayman Islands

With regulators displaying greater interest in cryptocurrency, SushiSwap and other DAOs are gearing up to improve their legal structures to avoid unnecessary penalties or lawsuits.

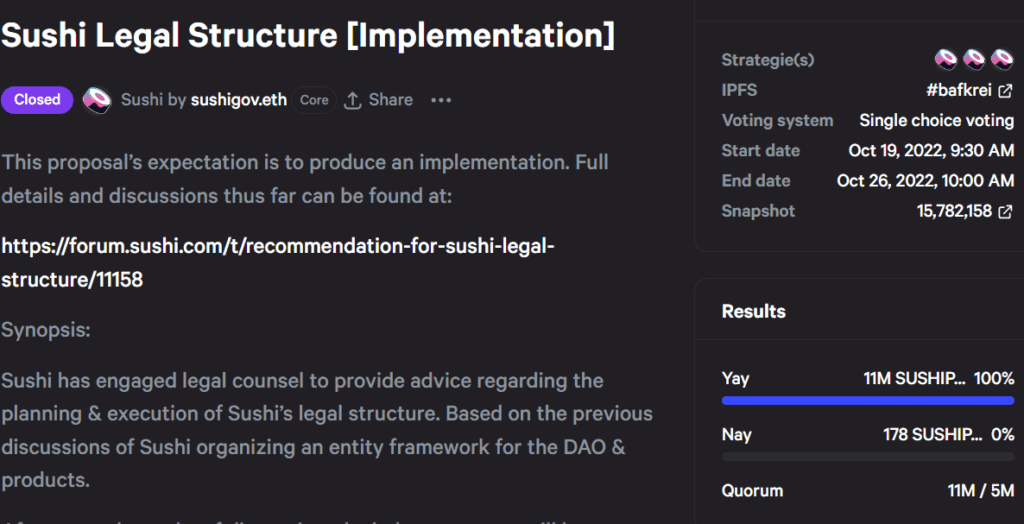

On October 26, Sushiswap, a decentralized exchange (DEX) with yield farming capabilities, decided to adopt a legal structure through three entities based in the Cayman Islands and Panama.

According to Sushiswap’s statement, they have already hired legal counsel to advise the planning and execution of SushiDAO’s legal structure and organize the legal framework for the entity and its products.

How Will Each Foundation Operate?

The Cayman Islands Foundation (DAO Foundation) will manage SushiDAO IRL through a governance board that will have the “flexibility to manage the governance process on the Sushi blockchain” in order to facilitate off-chain activities.

In addition, the new Foundation will be in charge of other essential tasks such as managing the treasury, grants, the on-chain governance process, and facilitating proposals and voting activities.

The “Panama Foundation” administers the existing protocol, including AMM/order book, Kashi, and staking-related contracts, as well as providing assistance to service providers.

Finally, a new corporation called “Panamanian Corporation” will be in charge of the protocol’s operations related to the GUI layer (Front-end).

This corporation will function as a wholly-owned subsidiary of the Panamanian Foundation, helping service providers to develop and maintain the GUI layer of the protocol.”

The SushiSwap Community Reacts

Although the proposal has already been approved and the team behind SushiSwap is working towards its implementation, the magnitude of the changes has sparked much controversy among Sushiswap enthusiasts, with some users questioning if the protocol is making the right decision in establishing its domicile between the Cayman Islands and Panama, as when regulatory issues arise they must be prepared to comply with its regulatory framework. As an example, Hamletmachine said:

“IMO any Head Chef must embody this core ethos, and let that lead any legal discussions/outcomes. It is not acceptable for us to restrict these open source tools from any human who wishes to use them, period. Otherwise just go build on Amazon AWS, apply for a money transmitter license & call it a day.”

Nickjrishwain, for his part, indicated that because of its nature, the proposal. However, even though having a legal structure seems to be a solid recommendation, it could affect the protocol’s operation in the long term.

Another user under the nick of Neiltbe, who is apparently part of the team that created the proposal, responded to the community’s concerns by stating that they had proposed using a foundation and corporation in Panama for the following reasons:

“(1) The nature of the protocol/GUI layer, (2) Panamanian foundations are non-commercial in nature and do not have beneficial owners and, as such, are ideally suited for deploying the protocol, (3) Sushi is taking in account FATF VASP guidance and the structure has been designed to avoid engaging in VASP activity where applicable, (4) the corporate formation process results in two entities that can separately house the protocol and GUI layers, which reduces the need to form additional entities and (5) there is no corporate level tax on these entities.”

The post SushiSwap to Create Legal Entities in Panama And Cayman Islands appeared first on CryptoPotato.