Survey By Goldman Sachs: 34% Think Bitcoin Will Reach $100K Next Year

A crypto-oriented survey compiled by the US multinational investment giant, Goldman Sachs, revealed that the general sentiment on bitcoin and other digital assets is primarily bullish. Nearly half of respondents, representatives of corporations, hedge funds, and banks, own a form of crypto, and most expect their portfolio to expand in value in the following two years.

Bullish Perspective on Crypto: GS Survey Shows

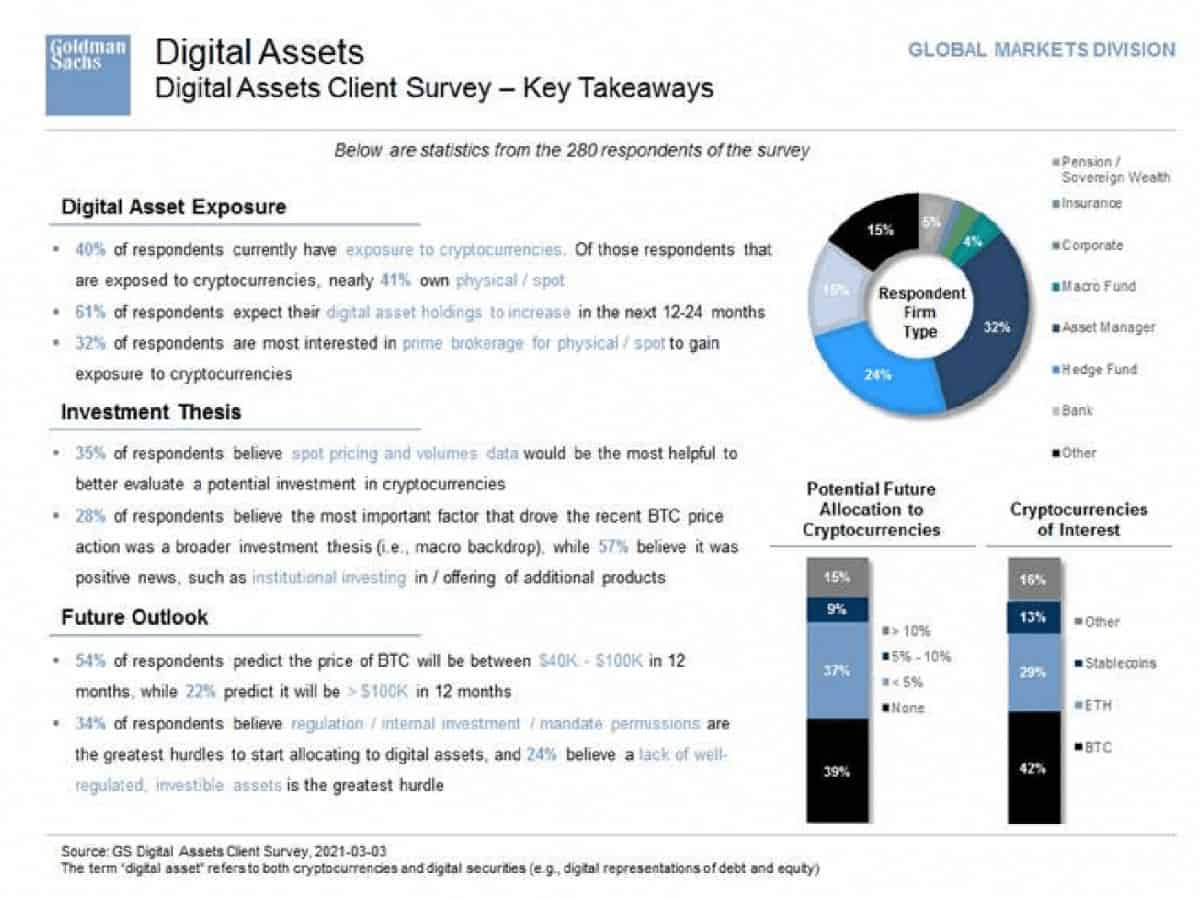

Goldman Sachs posted the key takeaways from its Digital Assets Client Survey that took cryptocurrency-related questions to 280 respondents from pension funds, insurance companies, corporations, macro funds, asset managers, hedge funds, and more.

Although the majority of the participants are from the traditional financial field, which is typically neglectful of the cryptocurrency space, 40% answered that they had allocated funds in digital assets.

61% of those investors believe that their crypto wealth will expand in the next 12 to 24 months. As far as precise future price marks go, nearly a quarter said that bitcoin will surge into the realm of a six-digit territory in the next year.

54% believe that the primary cryptocurrency will be between $40,000 and $100,000 in the same time frame.

About 35% of the respondents who have yet to put any funds in cryptocurrencies said that the lack of clear regulations is the most significant hurdle.

Somewhat expectedly, the first-ever and largest cryptocurrency was the most popular among the survey participants taking 42% of the interest, while Ethereum followed with 29%.

Goldman’s Somewhat Controversial History with Crypto

The large institution was among the first to show a positive approach towards the cryptocurrency industry in 2017 when news broke that it considered launching a cryptocurrency trading desk.

Citing technical difficulties and possible security breaches, the bank reversed the plans a year later. Since then, Goldman has bashed bitcoin and other digital assets, perhaps most notably during a conference call in 2020.

Arguably the most damaging narrative was in the first headline claiming that “cryptocurrencies including bitcoin are not an asset class.”

Additionally, Goldman’s report asserted that an asset “whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients.”

Nevertheless, more recent Reuters coverage displayed a change of heart from Goldman. Sources familiar with the matter said that the bank plans to reopen its crypto trading desk to offer BTC futures and non-deliverable forwards on behalf of its clients.

The organization is also reportedly considering developing and launching a Bitcoin Exchange-Traded Fund (ETF) in the US.