Surge to $18K or a Crash to $15K: What’s More Likely For BTC? (Bitcoin Price Analysis)

Bitcoin’s price continues to consolidate in a tight range, as it failed to break a significant resistance level to the upside a few days ago. However, from a technical analysis standpoint, the time for a decisive breakout is near.

Technical Analysis

By: Edris

The Daily Chart

On the daily chart, the price is still consolidating in a large falling wedge pattern. These are commonly known as potential bullish reversal patterns in a bear market, provided they get broken to the upside.

However, last week’s rejection from the $18K resistance level and the 50-day moving average has halted the rally toward the higher boundary of the pattern. As a result, it likely initiated a drop down to the $15K support level and the lower trendline of the wedge.

Considering today’s bullish daily candle, a retest of the 50-day moving average currently located around the $17K mark seems likely. The short-term future of BTC’s price would be determined by the outcome of this attempt.

The 4-Hour Chart

Viewing the 4-hour timeframe, it is evident that the price is recovering but is experiencing major issues returning above the $16,800 level following last week’s plunge.

In the event of a break above the $16,800 level, a retest of the broken bullish trendline would be expected. On the other hand, the price’s failure to break above $16,800 would likely initiate a bearish continuation toward the key $15K area.

A recent short-term bullish move was signaled by the RSI indicator, as a clear divergence was formed between the last two price lows.

However, the oscillator is currently showing values around 50%, hinting at a neutral state in momentum and offering little clue on the probable direction of the trend in the short term as the market continues to witness a fragile equilibrium between buyers and sellers.

Onchain Analysis

By Shayan

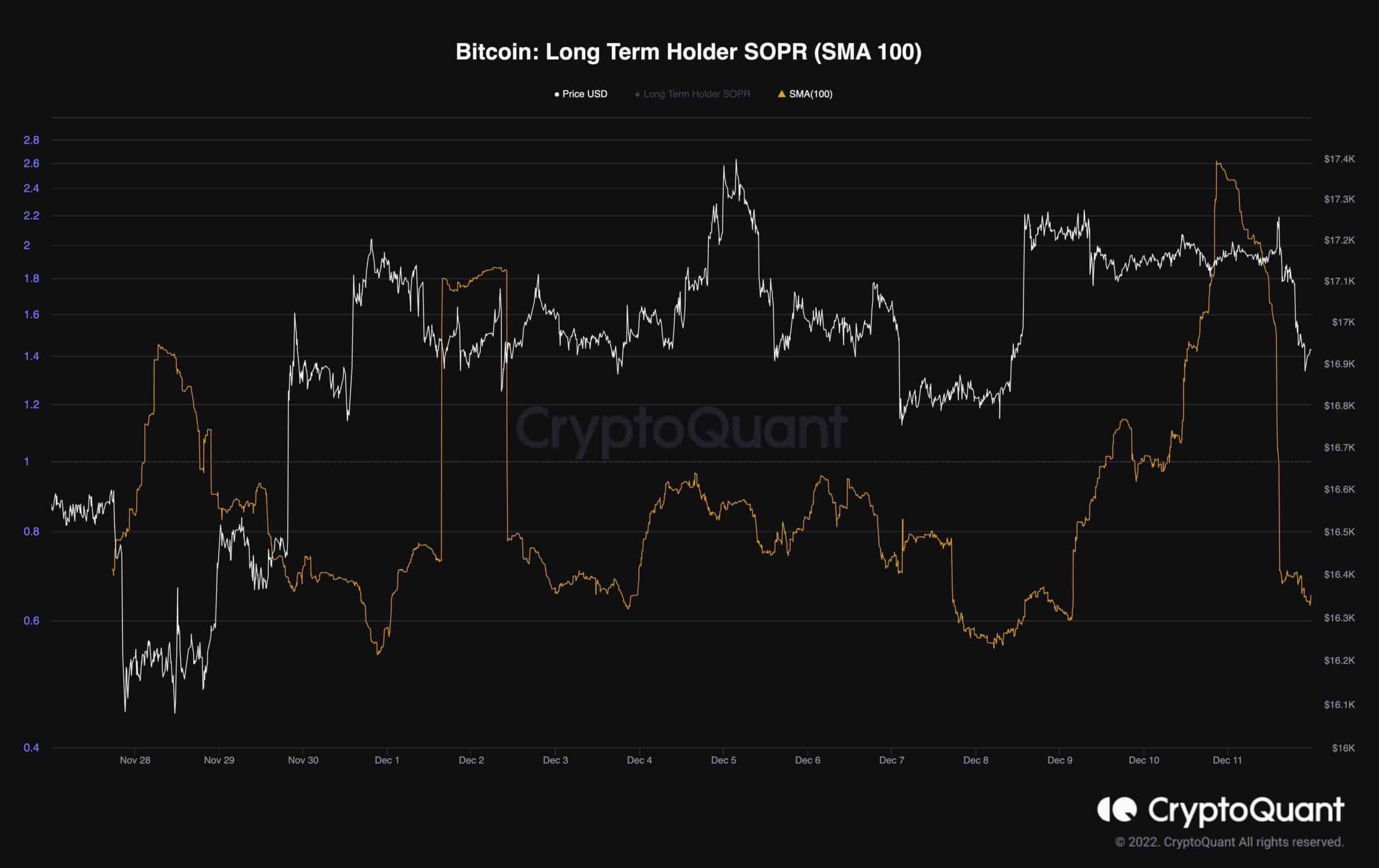

The following chart includes the Long Term Holder SOPR(Block resolution) and Bitcoin’s price.

Long-Term Spent Output Profit Ratio is a ratio of spent outputs (more than 155 days) in profit at the time of the window. Values over ‘1’ indicate more long-term investors are selling at a profit, while values below ‘1’ mean more long-term investors are selling at a loss.

The metric spiked three times during the price recovery from $16K to roughly $18.4K. Also, it has printed a significant jump after Bitcoin surged and reached the crucial resistance level of $18K.

This proves that long-term holders consider each price surge an opportunity to offload their assets and realize profits.

This is typical behavior during the late bear market stages; however, the next bull run won’t be initiated unless this cohort stops distributing their assets and start accumulating BTC with higher rates.

The post Surge to $18K or a Crash to $15K: What’s More Likely For BTC? (Bitcoin Price Analysis) appeared first on CryptoPotato.