Study: Altcoins Comprise Only 10% of the Crypto Market, Not 30%

Bitcoin’s dominance refers to the share of the leading cryptocurrency, Bitcoin, in the overall crypto market. The indicator has ranged from a high of almost 96% in November 2013 to a low of 33.4% recorded in January 2018 during the craziest of the altcoin seasons.

Following Bitcoin’s 2019 bull run, its dominance rate has risen from 51% at the beginning of the year to nearly 70% as of now. However, a new study suggests that Bitcoin’s actual dominance is approximately 90%, a lot more than what most of us thought.

Market Dominance Calculated

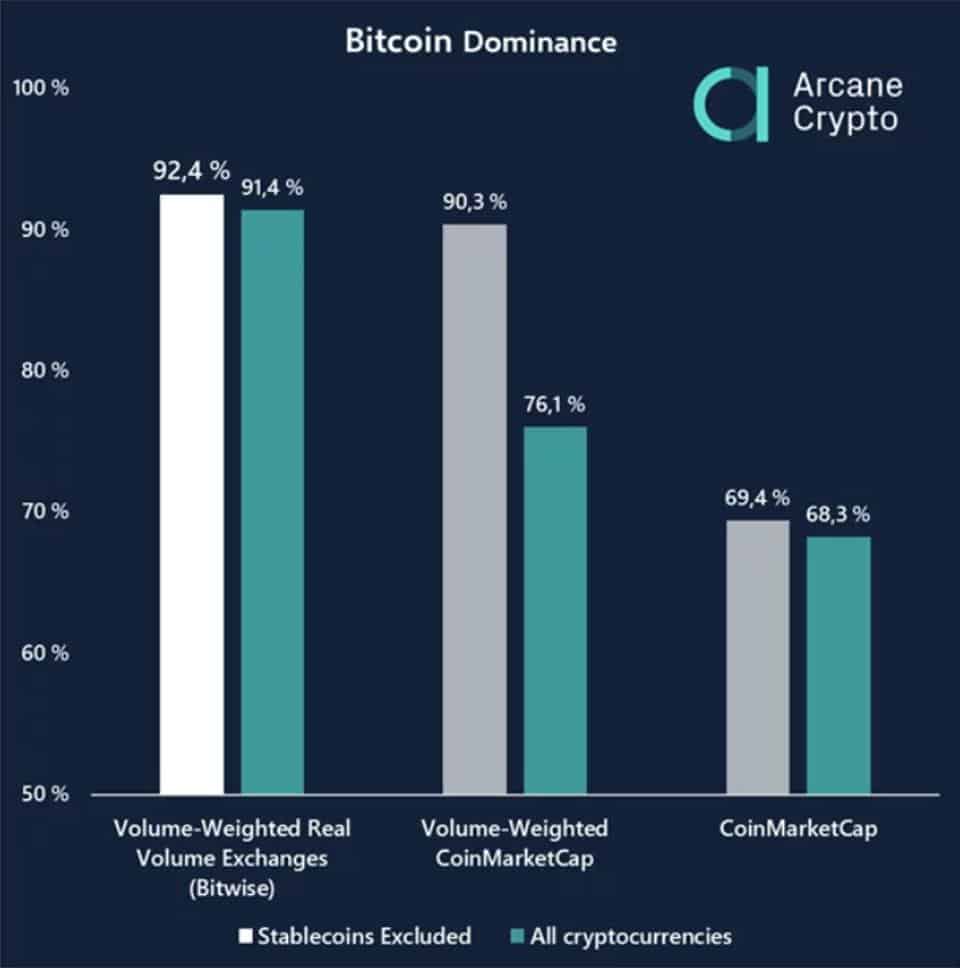

In order to obtain the relative share of each coin, its circulating supply must be multiplied by the coin’s price and then divided by the market capitalization of all cryptocurrencies. Doing this math shows that Bitcoin has always been the most dominant force in the cryptocurrency space. According to CoinGecko, Bitcoin’s dominance rate today is 68.13%, which is close to the year-to-date high of 69.73%. However, new research by Arcane shows that different numbers arise when adding trading liquidity to the mix.

Bitcoin Dominance at 90%

When liquidity is considered as well, Bitcoin appears even more dominant, with a market share of around 90%. Liquidity is the key to generating the most accurate market capitalization numbers, according to the person who conducted the research, Bendik Schei. Schei explains:

“The main reason is that one could easily create a cryptocurrency with 1 billion pre-mined coins, and do one trade at say three dollars each. This would lead to a total market capitalization of $3 billion, which would represent 1% market dominance with today’s valuations and inflate the total market capitalization. The problem is that the calculation does not take liquidity into account. One might be able to sell one token for three dollars, but what happens if you want to sell 1 million? Without accounting for liquidity, market capitalization becomes a meaningless measure.”

What’s Left for Altcoins?

When liquidity numbers are added into the mix, altcoins appear to be in an unenviable position. Even the three altcoins with the highest market caps – Litecoin, Ripple, and Ethereum – struggle to achieve 10% combined. Schei adds: “Every day Bitcoin stays ahead, it becomes less likely that any other cryptocurrency can compete as money.”

The post Study: Altcoins Comprise Only 10% of the Crypto Market, Not 30% appeared first on CryptoPotato.