Strategic Competition and Digital Currencies: Insights from Daniel Flatley, Sarah Kreps, Chris Meserole, and Matthew Pines

In the world of finance, Bitcoin has emerged as a game-changer. This novel virtual form of money has the potential to revolutionize the global economy and transform the way the world conducts transactions. However, as with any disruptive innovation, the intersection of strategic competition and digital currencies raises crucial questions and challenges. To shed light on this complex landscape, we turn to the insights of leading experts: Daniel Flatley, Sarah Kreps, Chris Meserole, and Matthew Pines.

Understanding the Intersection of Strategic Competition and Digital Currencies

The central question that arises when considering the relationship between strategic competition and Bitcoin is how these two forces intertwine. What role do digital currencies play in the global economy, and how does strategic competition impact their development?

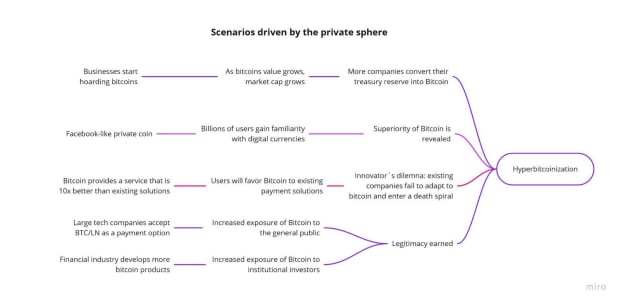

To fully grasp the implications of this intersection, it is crucial to delve into the role of Bitcoin in the global economy. As Daniel Flatley highlights, digital currencies have the potential to disrupt traditional financial systems. They offer a decentralized alternative to traditional banking, enabling individuals and businesses to transact directly without intermediaries. This newfound financial freedom has significant implications for economic stability, financial inclusion, and cross-border transactions.

Furthermore, Sarah Kreps emphasizes that Bitcoin also has the potential to enhance economic sovereignty. It provides an alternative to existing fiat currencies, reducing dependence on centralized monetary systems controlled by governments or financial institutions. This shift has profound implications for geopolitical power dynamics and financial autonomy for nations.

However, the impact of strategic competition on digital currencies cannot be overlooked. Strategic competition in the digital currency space can both fuel innovation and pose challenges. According to Chris Meserole, competition among countries and organizations to develop their own proprietary digital currencies drives technological advancements and pushes boundaries. This competition furthers the search for efficient and secure transaction systems, contributing to the evolution of financial systems.

On the other hand, Matthew Pines offers a cautionary perspective, warning that strategic competition can also lead to fragmentation and instability. The diverse range of digital currencies, each with its own characteristics and underlying technology, may lead to a lack of interoperability and compatibility. This fragmentation may hinder the widespread adoption of Bitcoin and other digital currencies while posing challenges to the legacy financial systems.

Considering the complex relationship between strategic competition and FinTech, it becomes evident that this intersection is a dynamic and evolving landscape. As governments, organizations, and individuals navigate this terrain, they must carefully weigh the potential benefits and risks associated with digital currencies. The future of the global economy and financial systems may very well be shaped by the outcome of this intersection.

Meserole’s Predictions for the Future of Digital Currencies

Looking ahead, Flatley anticipates the rise of central bank digital currencies (CBDCs) as a significant development. CBDCs are digital representations of traditional fiat currencies directly issued and regulated by central banks.

The introduction of CBDCs could reshape the financial landscape in profound ways. Monetary policy could be implemented more effectively, as central banks would have real-time data on transactions and economic activity. Cross-border transactions could become faster, cheaper, and more secure, eliminating the need for intermediaries and reducing foreign exchange risks. Additionally, CBDCs could enhance financial inclusion, providing individuals without access to traditional banking services with a secure and convenient means of storing and transferring value.

However, this is a particularly optimistic view on their implementation. Privacy concerns, cybersecurity risks, and the perpetuation of the existing financial system are among the factors that need to be carefully considered and addressed.

In conclusion, Chris Meserole’s insights offer a glimpse into the fascinating world of digital currencies. As technology continues to advance and societies become more digitally interconnected, the future of digital currencies holds immense potential for transforming the way we perceive and utilize money.

Sarah Kreps’ View on Strategic Competition in the Digital Currency Space

As an expert in international relations and strategic competition, Sarah Kreps provides a unique perspective on the dynamics at play.Kreps examines the current market trends and points out the strategic maneuvers undertaken by countries and corporations to establish themselves as leaders in this new field. This competition revolves around the development of blockchain technology, regulatory frameworks, and creating alliances with industry stakeholders. Kreps highlights the importance of understanding the geopolitical implications of digital currencies and the potential ramifications of a winner-takes-all scenario.

Kreps’ Suggestions for Navigating Strategic Competition

Based on her analysis, Kreps suggests that governments and organizations actively monitor developments and foster collaboration. Establishing regulatory frameworks that strike a balance between innovation and security is key. Additionally, promoting international cooperation could pave the way for harmonized standards and interoperability among digital currencies, ensuring stability in a competitive environment.

Matthew Pines’ Thoughts on the Intersection of Strategic Competition and Digital Currencies

Matthew Pines brings his expertise to the table, offering insights into the impact of strategic competition and his vision for the future.Pines emphasizes that strategic competition has accelerated the pace of digital currency development. Countries and companies vying for dominance have injected capital and resources into research and development, augmenting innovation. Pines highlights that this competition has led to significant advancements, pushing the boundaries of what is possible in the digital currency ecosystem.

Pines’ Vision for the Future of Digital Currencies

Looking forward, Pines envisions a more integrated and collaborative approach to digital currency development. He stresses the need for coordination, standardization, and interoperability to foster widespread adoption. Pines believes that striking a balance between competition and cooperation will be crucial in shaping a sustainable and inclusive digital currency ecosystem.

In conclusion, the intersection of strategic competition and digital currencies is a dynamic and multifaceted space with wide-ranging implications. The insights provided by Daniel Flatley, Sarah Kreps, Chris Meserole, and Matthew Pines offer valuable perspectives on the roles, challenges, and opportunities associated with digital currencies. As we navigate this evolving landscape, understanding the complex interplay between strategic competition and digital currencies will be essential for both individuals and policymakers alike.