Stop Trying To Understand Bitcoin

We often utilize complicated systems without understanding them, and this should be no different for Bitcoin.

One of the most common objections I still hear to holding any bitcoin is, “I just don’t understand what it is or how it works.” You, reading this right now, might even feel this way.

You’re likely reading this article on the screen of a phone or computer so think about this:

- Do you understand how the words on your screen were delivered to your device?

- Do you know how TCP/IP or HTML work? Do you know what those acronyms mean?

- Do you know how the computer you’re holding converts bits of information into the photons reaching your eyes?

I’m going to take a guess and say no, you are not sure how any of this works. You don’t understand it at all, yet if you look in Screen Time on your iPhone, you’ll see some staggering usage of a device and system you cannot begin to explain.

But you don’t need to know how these systems work because you find value in them. And that’s enough.

Let’s look at an even more abstract system: money and investments. You probably earn money every month and keep it in a bank account, pay for your life with a credit card and cash checks once in a while.

- Do you know how your bank clears and settles transactions?

- Do you know how Robinhood keeps the accounting for your stock portfolio and executes trades on your behalf?

- Do you know how the Federal Reserve “conducts the nation’s monetary policy”?

Even if you work in the financial system, I’ll take a guess that you do not have a full grasp on how these systems work. In many cases, the operators of these systems have no reason to help you understand — they often benefit from obscuring how they work to the outside world.

Even though you don’t understand how these systems work, you interact with them every day because you understand the value of each in your personal life.

Understanding Value

Understanding what something is or how it works is not a prerequisite to finding value in it. Bitcoin is no different. You can find value in it without feeling like you have a deep understanding of how it works or what it is. Plus, the earlier you get involved in Bitcoin and recognize that it could have value for you, the more you stand to gain as others come to realize the value Bitcoin can bring to their lives.

The moment Bitcoin “clicks” will be the moment you look at its properties in context of what you need. The simplest, one sentence description of Bitcoin is often enough to do this:

Bitcoin is an asset with a fixed, predictable supply that can be transported anywhere in the world in seconds and securely stored in your own brain.

I’m not going to explain how any of that works, because frankly, you don’t need to know. You only need reasonable assurances that all of this is true, just like you have reasonable assurances that your paycheck will come through or that the email you just sent to your boss will make it to their inbox. I’ll get into those assurances later.

So, what do you need that Bitcoin might be able to help you with? Maybe you want…

- To buy assets that produce income, so you can escape the nine-to-five rat race.

- To preserve savings against inflation until you retire.

- To escape tyranny by moving your savings out of a broken financial system or oppressive government’s reach.

Buying Assets

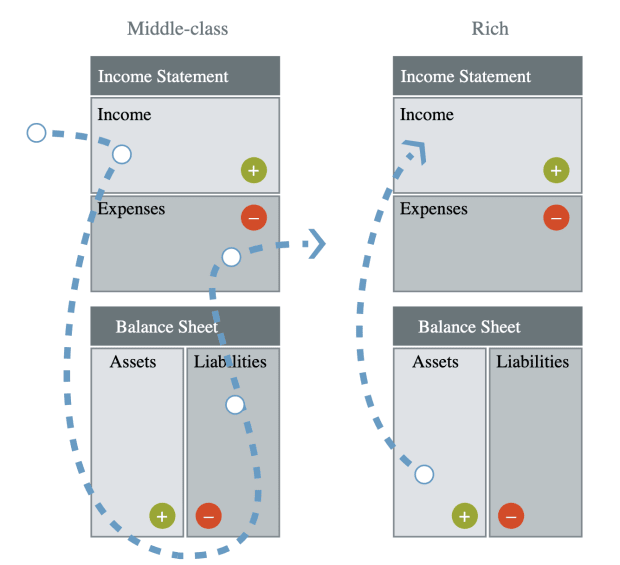

You want to buy a slice of a business that pays you each month, so you can eventually live off of that income instead of working nine-to-five (or longer). Why are businesses today insanely overvalued compared to their revenues? Why would investors continue to buy the stock of companies at such insane valuations?

We have to look at how central banks conduct their monetary policy, which lately means mashing one button: PRINT. The U.S. Federal Reserve increased the dollar’s supply by 24% last year alone. That makes cash a bad store of value and pushes investors into other assets.

Instead of sitting on cash, investors are buying stocks and investing in any business with even a flimsy pitch deck, making it hard for you and I, earning salaries or working odd jobs, to buy an asset that produces income for a reasonable price.

Investors are not even buying companies for the income they produce anymore; they are just buying them hoping they can sell them later for a higher price. Investors are ultimately scrambling to buy scarce assets. Investable companies are slightly more scarce and difficult to create than fiat currencies operated by governments — especially when those governments show you their willingness to print infinite currency.

Some investors are starting to realize that a far more scarce asset now exists and they are piling into it in waves. It is unique among assets in that it has a fixed, predictable supply. That asset is called bitcoin.

Preserving Savings

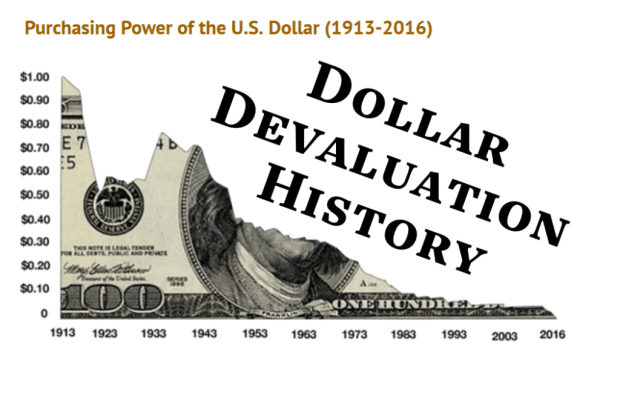

You want to grow your savings so you can retire comfortably, but inflation is always creeping up and eating away your nest egg and the value of your wage or salary. Why do we see steadily rising prices over the past century? It has nothing to do with economic growth and everything to do with the fact that our currencies do not have a fixed, predictable supply. The currencies we use today are constantly manufactured — you could call it counterfeited — by central banks. This debases the value of all units of that currency in circulation.

If you want to protect your savings against the rising price of goods and services in your home country’s currency, you need money that cannot be debased. You need money that doesn’t carry a negative real interest rate, like almost all fiat currencies today. You need bitcoin.

Escaping Tyranny

You may have it even worse: you aren’t just trying to escape the rat race or save up, but you are threatened by a hostile or corrupt financial system or government that could snap up your savings overnight. Cash in a bank account is easy to freeze or seize. A nice piece of property can be taxed or taken by force. A bag of jewelry can be seized at the border. What you need is an asset that’s highly portable and easy to secure: bitcoin.

An East German border guard jumping to West Berlin — the “Leap of Freedom” — with only the clothes on his back. Source: Time

What if you just want to rent everything and work until you drop dead?

If this is you, maybe you don’t need bitcoin. The World Economic Forum predicts that by 2030 “You’ll own nothing” — and rent everything. You don’t need to worry about asset prices outpacing income growth because you’re happy to be sitting in your cubicle at 70, making sure you can pay rent on your shoebox this month and continue to lease your clothes.

If you would prefer a bit more independence and self-determination in your life, maybe bitcoin is something you’d benefit from.

How can you trust this simple definition of bitcoin?

I mentioned needing reasonable assurances that the properties of bitcoin which make it such a powerful tool for saving money and gaining independence hold true.

How does bitcoin provide reasonable assurances that it truly is a fixed supply, highly portable, secure asset and unit of account?

Reasonable Assurances

Instead of reading every line of Bitcoin’s code and reasoning about how it all works in practice, we need to take a step back and look at history. We rely on this type of reasonable assurance just to get through our daily lives.

You do not read the entire operation manual of your car before you trust it with your life at 70 miles per hour on the highway. You are reasonably confident you’ll be fine, given the brand of the car and the fact that most of your friends didn’t have to read the manual to use their cars safely.

You do not chemical test every meal because you’re pretty sure the greens at your local grocery store aren’t going to poison you (though sometimes, they do).

We use history and the experience of others to gauge everything in our lives. Let’s apply that to Bitcoin.

To get a sense for whether Bitcoin fulfills its promises of being fixed in supply, instantly portable and secure to store, we need to ask ourselves:

- Has Bitcoin operated in a predictable manner over its history?

- Can we use it to transfer value globally, and quickly?

- Is it secure to store and use?

Predictable Supply And Operation

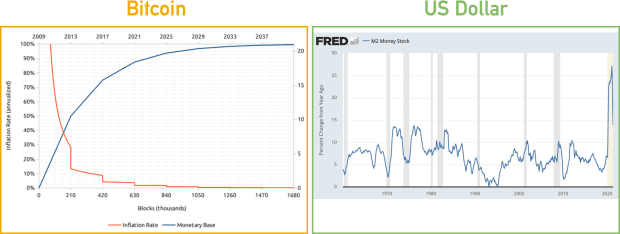

Bitcoin is far more predictable in its supply (“inflation rate”) than fiat currencies, which are subject to the whims of a few powerful people.

Bitcoin also sports lower downtime than other payment networks — even everyday ones like Visa or settlement systems like FedWire.

Given that the asset has never seen a supply shock and has flawlessly stuck to its pre-ordained inflation rate over 12-plus years while experiencing rapid growth and securing hundreds of billions of dollars in value, we can be pretty sure it will be predictable going forward.

Surely more predictable than the dollar and not devalued systematically!

Fast, Global Value Transfer

Try sending money to someone in another country, and let me know if you’re able to do so in less than a few days without paying a hefty fee. That’s our existing banking system: clunky and costly.

Bitcoin does not care what piece of land you happened to be born on or the size of the transaction you’re trying to make. As long as you have an internet connection and the bitcoin address of your recipient, you can broadcast a transaction and have it settled in minutes.

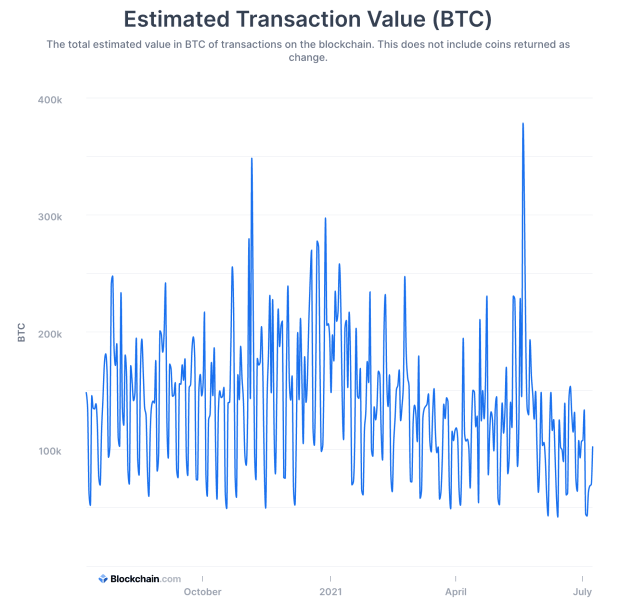

People do this every day with Bitcoin, moving billions of dollars, experiencing zero issues. For the last 12 months, somewhere around 150,000 bitcoin have moved on the Bitcoin blockchain each day. You can be reasonably sure your transactions will go through as well.

Secure Storage

No other asset matches the security and portability of bitcoin. Put some on a hardware wallet or on an app on your phone and see for yourself. If you save your seed phrase and any passphrase you set up, you can smash your wallet to bits and still get your bitcoin back with just the seed words you wrote down. Memorize them and you can take them anywhere. Try walking out of a hostile country with gold bars in your brain.

More and more people trust the Bitcoin network with their savings each day since its inception. You don’t have to look far to see the value locked in bitcoin and the number of addresses and wallets growing.

The protocol itself has never been hacked — nobody has lost a single satoshi (one-hundred-millionth of a bitcoin) to a protocol error. That’s beyond a reasonable assurance of safety.

But… It’s Volatile!

Importantly, it is a mistake to look at the bitcoin price as evidence of the properties of bitcoin because a market price consists of not one asset but two: a base and a quote asset. When we look at the price of bitcoin, we are looking at its price in U.S. dollars, or in Euros or in some other fiat currency which does not have a fixed, predictable supply.

The supply of fiat currencies — and perceptions about how that supply might change due to central bank policies — has a massive effect on asset prices. Just look at the S&P 500 dips around Fed policy changes and announcements. Bitcoin, when priced in dollars or another fiat currency, is subject to this volatility. The volatility is further accentuated by the vagaries of demand for a very new and misunderstood asset, plus the doggedly predictable supply of bitcoin. If you’re willing to wait three or four years, your purchase of bitcoin usually goes up in fiat terms despite volatility in the interim.

Regardless of price swings, the Bitcoin network continues to operate. Its basic properties remain true.

What Is Bitcoin To You?

This is the question you must ask yourself to “understand” Bitcoin: not what it is but what it does for you, for your loved ones, for our societies.

To me, it’s a better form of money and the best way to save. Money is a technological system just like the internet or your car, but with a far longer history and more importance to society’s peaceful functioning and development. Getting money “right” can mean peace or war, life or death for societies and people.

Instead of trying to understand Bitcoin, you may want to start by trying to understand what Bitcoin is replacing: our existing global monetary system. Here’s one place to start.

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.