State Street Launches Bitcoin Indicator To Quantify Media Sentiment

State Street has added a Bitcoin sentiment tool to its series, which will analyze and quantify Bitcoin media coverage for investors.

Investment services company State Street Corporation has announced the launch of its Bitcoin Thematic Indicator series, a tool that quantifies the prevalence and sentiment of media coverage around Bitcoin.

“Over the last few months, media coverage around Bitcoin has grown significantly relative to corporate, financial and economic media markets and continues to trend higher,” Rajeev Bhargava, head of the Investor Behavior Research Team at State Street Associates, said in the announcement. “Our newest Bitcoin series provides a quantitative and timely measure of the tone and intensity of media discussion and reveals additional transparency into this highly sentiment driven market, enabling our clients to make more informed investment decisions.”

State Street launched its MediaStats Thematic Indicators platform in November 2020. The platforms indicators comb through hundreds of thousands of digital information sources and generate daily sentiment indicators on a wide selection of assets to paint a more accurate picture of the markets for interested investors.

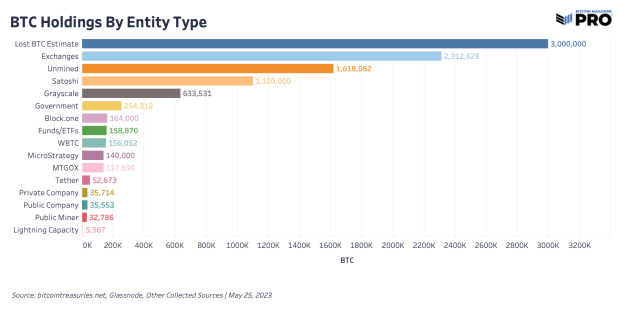

The Bitcoin indicator will focus on collecting and collating data about Bitcoin, its connections to traditional currencies and emerging trends. And with the recent surge in Bitcoin popularity and adoption, there is no shortage of investors who seek the information to be supplied by such an indicator.

The addition of this indicator by State Street reveals another financial firm that is interested in capitalizing on Bitcoin’s growing popularity and adoption, and one that wants to help its clients do so as well.