StarkNet Aims to Enhance Scalability, Privacy and Security on Ethereum

One of the problems with having custody of your own crypto is how difficult it is for everyday users to navigate the technology. A simple mistake can mean there is no way to recover your digital assets. For example, if you lose the “keys” (a series of alphanumeric characters) to your crypto account, you could lose access to your crypto forever. Traditional crypto wallets don’t have set mechanisms in place that could let you recover your account if you do lose access to it, unlike what happens with bank accounts in traditional banking.

Humans are bound to make mistakes, and blockchain developers recognize that simple mishaps are inevitable. In order to make crypto more user-friendly, crypto needs fail-safe mechanisms for owning crypto.

STARKNET

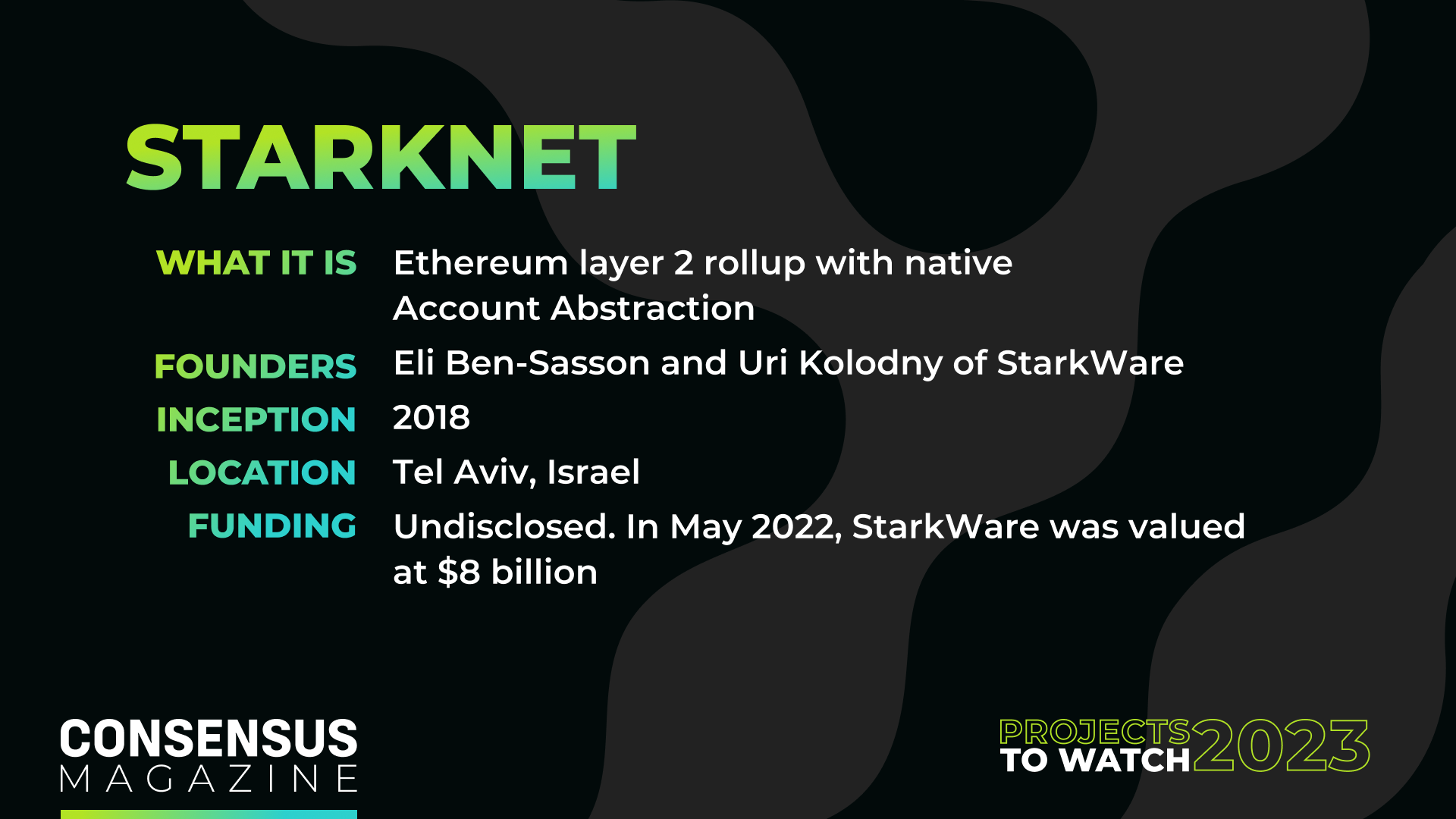

StarkWare, an Israel-based software company that wants to enhance scalability, privacy and security issues on the Ethereum blockchain, is one of the first projects to embrace account abstraction (AA).

Account abstraction aims to combine user accounts and smart contracts into a single type of account, allowing for security mechanisms such as social recovery and multisignatures. With AA, users won’t need to use their private keys to sign off on every transaction.

StarkNet is a layer 2, or companion blockchain, to Ethereum created by StarkWare. It is one of the first projects to go full steam ahead with AA, and one of the first blockchains to natively integrate it.

Its founders, Eli Ben-Sasson and Uri Kolodny, more casually known as the Ernie and Bert of blockchain (it’s still up for debate who is who), have known each other since they were both 18 years old. Ben-Sasson, a computer science professor at Technion, has been involved longer in the blockchain space as co-founder of Zcash, the privacy crypto on the Bitcoin blockchain.

Ben-Sasson and Kolodny decided to tackle the challenges of scaling and privacy on the Ethereum blockchain together, founding StarkWare in 2018.

One of StarkWare’s projects is its blockchain, StarkNet, which is a validity rollup that scales Ethereum. Rollups execute transactions off-chain and then send the transaction data back on-chain to verify them.

StarkNet is unusual because AA is natively integrated into the protocol. Unlike Ethereum, where AA, also known as ERC-4337, is an additional layer on top of Ethereum, users of StarkNet can natively use AA without having to reprogram their wallets into smart contracts.

But in order to understand what AA does, it is important to understand the different types of accounts on Ethereum and how they solve problems.

There are two types of accounts on Ethereum: external owned accounts (EOA) and contract accounts (CA), and they differ in terms of how they perform transactions over Ethereum.

EOAs are the most popular type of account on Ethereum (like a MetaMask wallet), where users are given a pair of keys: a public and a private key. Users send funds to an EOA using their public keys. But only the account’s owner (the user that has the private key’s information) can actually initiate transactions from that account.

CAs, better known as “smart contracts,” are accounts that are controlled by code – not private keys. Therefore, they cannot initiate transactions themselves. An EOA needs to send a transaction (which acts like a coded instruction) to a CA in order for it to execute transactions.

If you lose a private key to an EOA account, you’re out of luck, because there is no way to regain access to your account (there’s no help desk or “password reset” button). Therefore, you lose access to your funds.

Account abstraction addresses the shortcomings of EOAs by merging the two types, therefore allowing users to have built-in fail-safe mechanisms and other special features for verifying transactions.

Under AA, user accounts can program social recovery systems into their wallets where several people – each with a key of their own – have the ability to access that account should the owner lose their private key. Then there’s also the option of creating “multisig wallets,” which requires multiple people to sign off on transactions as an extra layer of security.

So what’s the difference between account abstraction on Ethereum versus StarkNet? On StarkNet, AA is natively integrated in wallets and applications on the blockchain. On Ethereum, there’s still extra work that needs to be taken by providers and wallets in order for AA to be integrated with wallets.

“The legacy that exists on Ethereum is a very limiting factor in this regard, meaning even if you do introduce AA, anyone developing an application has to take into account a very significant installed base of EOA accounts,” said Kolodny. “On StarkNet, we start from a clean slate, all you have are these smart wallets. That’s the only sort of interaction that users have with the network.”

So what can be done with account abstraction on StarkNet?

Security checks for authorizing transactions that already exist in the Web2 sphere, such as facial ID or fingerprint login, are already available on StarkNet. “This is literally already working on applications on StarkNet,” said Ben-Sasson. “This immediacy of having the security and the [user experience] of whichever security means you’re using on a day-to-day basis, you get it at the core protocol level already today on StarkNet.”

Another use case that is natively available on StarkNet is what Ben-Sasson calls the “deadman switch.” Thanks to AAn on StarkNet, users can have features and coded logic built in that can transfer financial assets to others (that are pre-approved) in the event something happens. “If I just get run by a bus, then I can have the funds transferred automatically to some other address,” said Ben-Sasson. In a real world example, this would mimic that of a will and the transferring of traditional assets – which would be costly because lawyers and procedures are involved. This “switch” skips the middleman and transfers digital assets in the event that something major happens, which can be programmed through code.

Lastly, multisig features, where multiple users can sign off on transactions as an extra layer of security are already available on StarkNet.

The biggest hurdle with account abstraction is it’s not widespread yet. Ben-Sasson and Kolodny agreed there needs to be some education for users on how this feature works in order for it to take off and for crypto to become more mainstream. Until then, several projects have started to signal their interest in AA and using StarkNet for those use cases.

Kolodny shared that gaming applications have turned to StarkNet to build their apps with AA because other chains’ high gas costs have made it hard for any developer to build what they need on-chain. “People for the first time actually are able to build the games that they wanted to build,” Kolodny said.

Payment processor Visa told CoinDesk of a system in development using StarkNet, describing it in a thought-leadership proposal published in December. Visa detailed a “novel solution” for how StarkNet could be used to automate crypto transactions payments for bills. “With StarkNet’s account model, we were able to implement our delegable accounts solution thus enabling auto payments for self-custodial wallets,” the Visa researchers wrote.

But for now, getting developers to build on StarkNet and “warming them up to these concepts [such as account abstraction] and getting them to creatively think about what this can do, is going to take a bit of time and effort and education,” Kolodny said.

Edited by Jeanhee Kim.