Staking provider P2P.org said it has gone live with its Staking-as-a-Business (SaaB) model for institutions. The offering aims to help platforms like exchanges, wallet providers and custodians add staking and decentralized finance (DeFi) services to their businesses to diversify avenues of growth.

The company said it currently has more than 1 million staked ether (ETH) and recently surpassed $7.4 billion in total value locked, or TVL.

10:14

Staking Is ‘Definitely a Positive’ for the Spot Ether ETF Narrative, Analyst Says

06:50

Tax Expert Breaks Down the Crypto Tax Basics for Beginners

13:53

German Finance Heavyweights Develop Fully-Insured Crypto Staking Offering

01:58

Seen at Consensus 2023: An Alpaca Steals the Spotlight

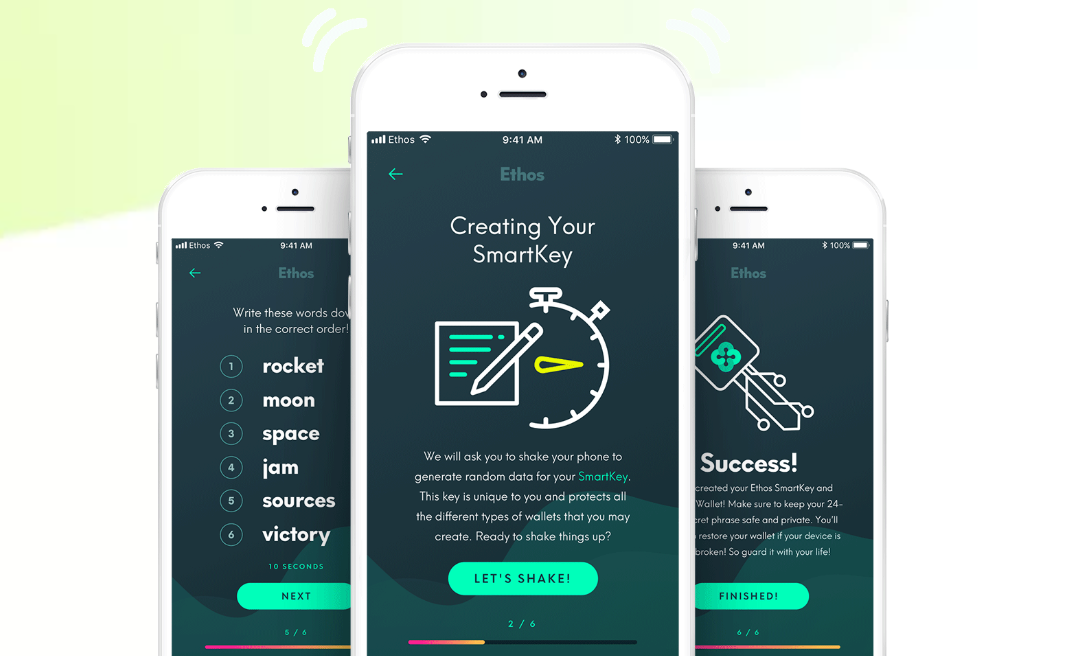

Staking allows cryptocurrency investors to put their holdings to work by earning passive income without needing to sell them. Institutional staking operates in the same manner but en masse. There are non-custodial and custodial staking providers.

As well as staking infrastructure, the SaaB model will offer support services such as marketing, legal and sales support, a press release said.

“This holistic support ensures a smooth transition for businesses venturing into staking & Defi services, guaranteeing a successful and profitable implementation,” said Artemiy Parshakov, head of product at P2P.org.

P2P.org raised $23 million in funding last April from a trio of crypto industry heavyweights including Jump Crypto. Various other institutional-focused staking startups have come to fruition in the last year, such as Northstake, which raised $3 million from PreSeed Ventures.

P2P.org is a validator for Ethereum and 30 other blockchains, according to the press release.

Edited by Nick Baker.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)