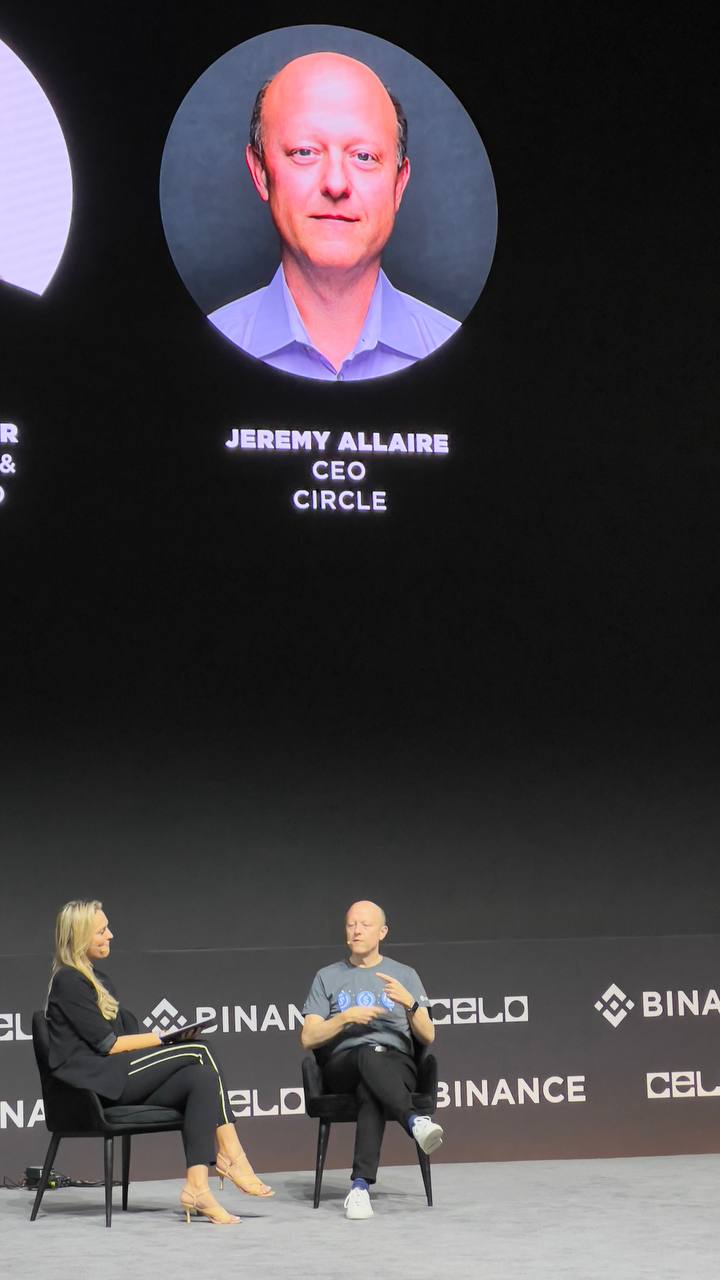

Stablecoins Will Thrive Over CBDCs: Circle CEO (Binance Blockchain Week)

Speaking at the current Binance Blockchain Week in Dubai, the CEO of Circle, the issuer of the second-largest stablecoin, expressed optimism regarding global regulation toward the sector.

He also asserted that people would prefer privately-issued stablecoins over government-launched CBDCs, which has been evident in China.

Allaire spoke a lot about the current regulatory environment in numerous countries and outlined the overall positive sentiment coming from most. In fact, he noted that even those who have been publicly against the sector or sitting on the sidelines, are actually watching carefully what others would do and are ready to follow suit with comprehensive regulations.

He believes the next 12 months will be crucial for the stablecoin space, which has already grown to roughly $170 billion, with Tether’s USDT and Circle’s USDC responsible for the lion’s share.

However, Allaire noted that this is still a fraction of the global financial space, which is hundreds or even thousands of times larger. This means that the stablecoin industry still has lots of room for growth.

On the question whether the majority of global population will prefer central bank digital currencies or stablecoins, Circle’s CEO was adamant that they will go for the latter.

This is because people prefer privately-issued products and the innovation coming from them, rather than government-backed alternatives.

He outlined China as a good example. The world’s most populated nation launched its own CBDC a few years ago, but is yet to see actual usage, according to Allaire. He said people only use it once the government provides free coupons.

The post Stablecoins Will Thrive Over CBDCs: Circle CEO (Binance Blockchain Week) appeared first on CryptoPotato.