Stablecoin Tether’s Market Capitalization Nears Record High of $83B

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

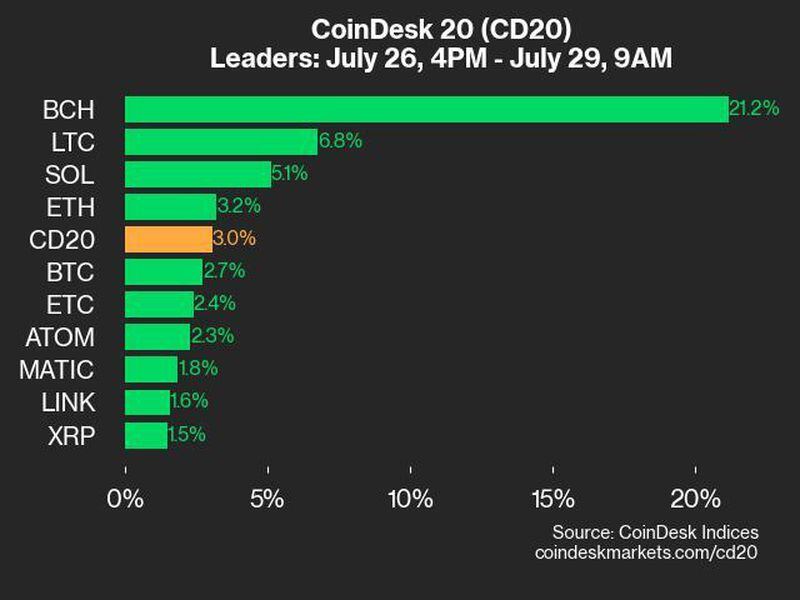

Tether (USDT), the world’s largest dollar-pegged stablecoin, is thriving, having survived the Terra-induced turmoil of mid-2022. The market value of the stablecoin continues to rise and is now within a whisker of its record high.

Coingecko data show tether’s market capitalization has increased by over 20% to $80 this year – with the valuation surging by 12% in the past four weeks alone.

The rise means tether’s market cap is now just $3 billion short of the record high of $83 billion reached in May last year.

Markus Thielen, head of research and strategy at crypto services provider Matrixport, said tether’s valuation had been driven higher by “aggressive minting and issuance” on Tron Network, which has a greater presence in mainland China compared to Ethereum and a greater focus on the movement on money.

Per data tracked by Matrixport, tether issued on Tron accounts for more than half of the stablecoin’s current market value.

While tether’s market capitalization has surged alongside bitcoin’s price rally, the market capitalization of Circle’s USDC stablecoin, the world’s second-largest dollar-pegged coin, has dropped by 27% to $32.5 billion. Investors began fleeing USDC last month after Circle revealed holding $3.3 billion dollars with failed Silicon Valley Bank (SVB).

The market value of Paxos’ centralized, dollar-pegged stablecoin BUSD has also declined by 58% to $7 billion this year. In February, The New York Department of Financial Services ordered Paxos Trust Company to cease minting BUSD. Paxos, in response, stopped minting new tokens while promising to process redemptions till February 2024.

According to Matrixport, some USDC holders likely diversified into tether and bitcoin.

“When news about unlimited support for bank deposits made the rounds, bitcoin prices exploded from $20,000 to $28,000 within a matter of days,” said Thielen in a note to clients on Thursday. “But it would appear that holders of USDC either converted their Circle stablecoin into Tether’s USDT or that they simply sold $10 billion of USDC and bought bitcoin instead.”

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.