Stablecoin Market Cap Jumps to $164B After Months of Stagnation

-

Expansion of the stablecoin market is bullish for the broader crypto ecosystem.

-

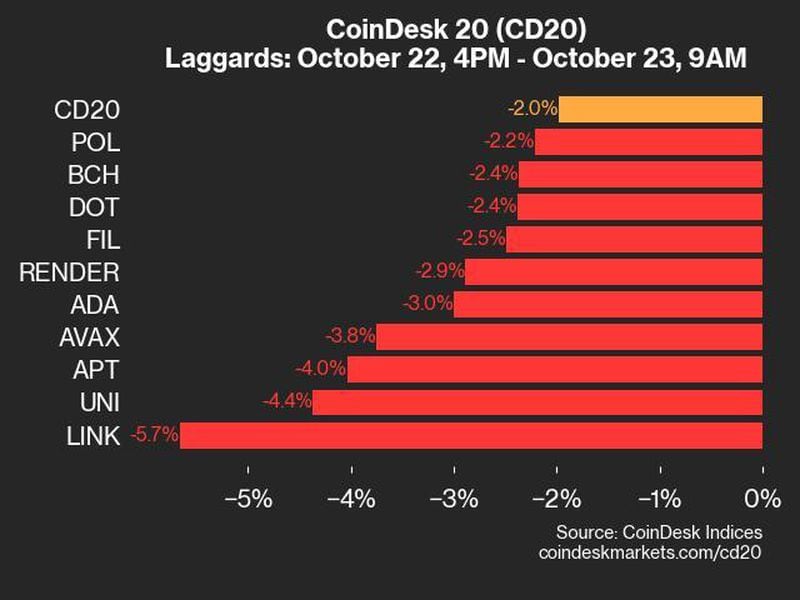

BTC and ETH slid amid broad-based risk aversion on Wall Street.

Stablecoins, which serve as a funding source for many crypto trading strategies, are experiencing growth after months of stagnation in a sign of renewed capital influx into the crypto market.

The aggregate market capitalization of the stablecoin sector, which includes hundreds of coins, jumped to over $164 billion for the first time since the collapse of Terra in May 2022, according to data source DefiLlama and trading firm Wintermute. It had been languishing around the $160 billion mark.

Stablecoins are digital currencies whose values are pegged to an external reference, such as the U.S. dollar. Tether’s USDT, the leading dollar-pegged stablecoin, alone boasts a market capitalization of $114.26 billion.

These coins help investors mitigate market volatility because they maintain a fixed value to the external reference. They are widely used to fund crypto purchases, derivatives trading and yield-generation strategies like lending through decentralized finance (DeFi). Stablecoins are also utilized for real-world payments and cross-border remittances.

The expansion “indicates growing investor optimism, underpinning a bullish outlook,” Wintermute said in a note shared with CoinDesk. “The increase in stablecoin supply indicates that money is being deposited into on-chain ecosystems to generate economic activity, either through direct on-chain purchases that can catalyze price appreciation or yield-generation strategies that could improve [market] liquidity. This activity ultimately fosters positive on-chain growth.”

Blockchain analytics firm Nansen voiced a similar opinion on X, calling the stablecoin expansion a bullish development.

Still, the two biggest cryptocurrencies – bitcoin (BTC) and ether (ETH) – have declined 5.5% and 10%, respectively, this week, CoinDesk data show.

The price swoon is likely due to a “sell the fact” reaction to Tuesday’s debut of the highly anticipated spot ether ETFs in the U.S. and the sharp slide in Wall Street’s tech-heavy Nasdaq 100 index. The index fell 3.7% on Wednesday, wiping out $1 trillion in market value.

The ongoing decline in the copper-to-gold ratio and the steepening of the U.S. Treasury yield curve favors risk-off sentiment.

Edited by Sheldon Reback.