Square’s Jack Dorsey Hits Out at FinCEN’s ‘Burdensome’ Proposed Crypto Wallet Rules

Square’s Jack Dorsey Hits Out at FinCEN’s ‘Burdensome’ Proposed Crypto Wallet Rules

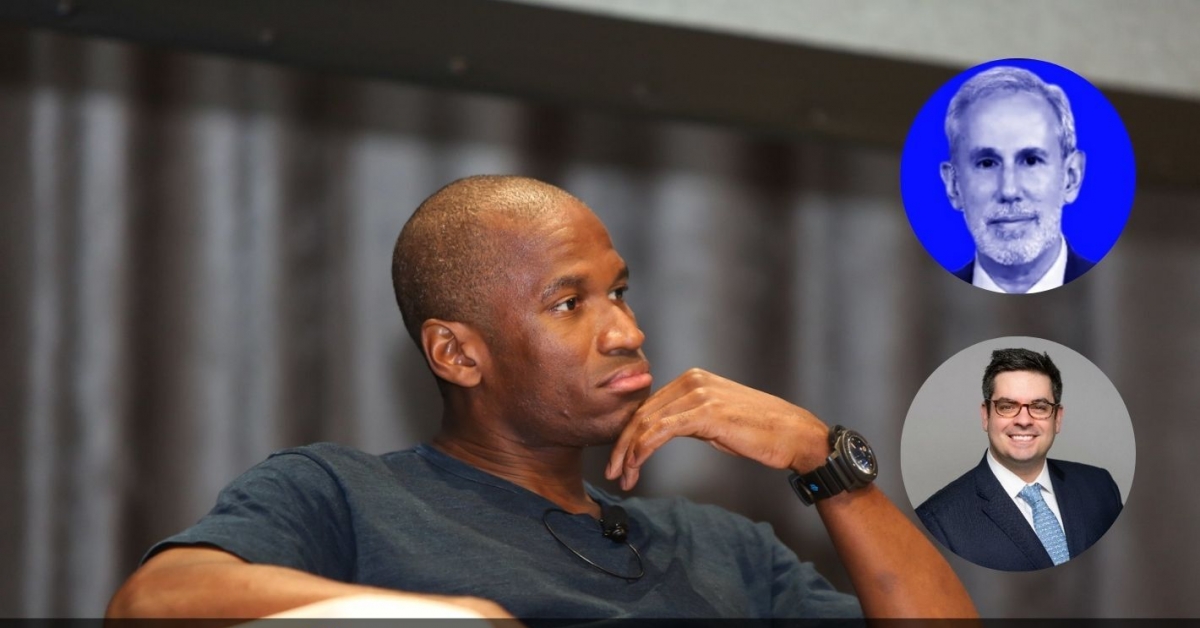

Jack Dorsey, CEO of payments company Square, has joined the ranks of those criticizing the Financial Crimes Enforcement Network’s (FinCEN) proposed regulations around collecting data on crypto wallet users.

In a Jan. 4 letter addressed to FinCEN, Dorsey said, if the rules are approved, cryptocurrency customers maybe pushed to use unregulated services outside of the U.S.

“This creates unnecessary friction and perverse incentives for cryptocurrency customers to avoid regulated entities for cryptocurrency transactions, driving them to use non-custodial wallets or services outside the U.S. to transfer their assets more easily,” he wrote.

This would ultimately mean that FinCEN would “actually have less visibility into the universe of cryptocurrency transactions than it has today,” Dorsey added, while innovation in the U.S. would be stifled.

“Technological limitations” may also make it difficult to identify and collect the counterparty information FinCEN would require, he said.

FinCEN proposed the regulations in December, potentially requiring users to comply with know-your-customer requirements if they want to send cryptocurrency from an exchange to a private wallet.

The agency would require personal information from the owner of the private wallet if the amount sent is greater than $10,000 in 24 hours. They would also have to keep records for transactions valued at over $3,000.

Blockchain analytics firm Elliptic has also offered comment on the proposal, recently saying the rules could “adversely impact” the effectiveness of existing anti-money laundering and countering the financing of terrorism regulations. Crypto exchange Coinbase said the 15-day comment period was insufficient to provide detailed feedback on the complex topic and suggested the rules were being rushed through by the outgoing administration.

Square has made notable investments in bitcoin and offers cryptocurrency services through its Cash App. “The burdensome information collection and reporting requirements deprive U.S. companies like Square of the chance to compete on a level playing field to enable cryptocurrency as a tool of economic empowerment,” according to the letter.

FinCEN’s period for public comment on its proposed crypto wallet rules closed Jan. 4.