Square, Twitter, And Substack Are Big First-Movers In Bitcoin Payment Solutions

Both social media giant Twitter and independent online publisher Substack have officially integrated Bitcoin tipping and payment services through third-party partnerships with Strike and OpenNode, respectively.

In the past month both social media giant Twitter and independent online publisher Substack have officially integrated Bitcoin tipping and payment services through third-party partnerships with Strike and OpenNode, respectively.

The platforms, serving a combined 350 million monthly active users, have both opted to offer Bitcoin and Lightning optimized API solutions.

Twitter and Substack’s Bitcoin integrations were announced and delivered just as El Salvador became the first country to make Bitcoin legal tender. Many merchants in that nation now accept payment for goods and services in Bitcoin. From a game theoretical perspective, that nation has a first-mover advantage.

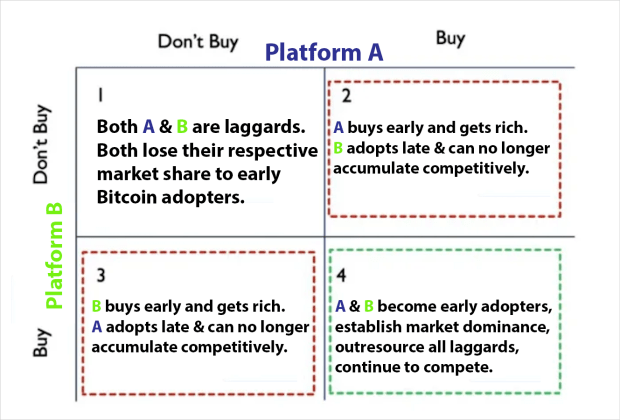

Importantly, after El Salvador made Bitcoin legal tender, the game-theoretic prisoner’s dilemma of national Bitcoin adoption was initiated in global geopolitics. Famous whistleblower Edward Snowden highlighted that Bitcoin favors those that adopt it early, thereby putting pressure on other nations, which will be penalized for being laggards.

The same model holds true at all scales. Substack and Twitter have chosen to remain competitive by adopting Bitcoin payment solutions. Although it is still unclear why they have not yet added Bitcoin to their balance sheets. The hold up is likely due to bureaucratic logistics, rather than an express preference to hold zero Bitcoin.

In any case, likely soon the first major social media platform will buy Bitcoin to hold in reserve. Square, Twitter, and Substack’s Bitcoin payment solutions give them a first-mover advantage in that space. They have indicated an understanding of Bitcoin and clearly value it as technology.

Over time, as these companies add Bitcoin to their balance sheets, yield enormous profits denominated in fiat terms, and carry out seamless, instantaneous, commission-less cross-border payment solutions with lightning integrations, it will elicit responses in the form of Bitcoin products and payment solutions from the world’s mega-companies, such as Apple, Microsoft, Google, Amazon, and Facebook. (It is worth noting that Bitcoin is fast encroaching on the market caps of all of these companies.)

Bitcoin’s terminal scarcity rewards early adopters, but punishes laggards. Companies, nations, and individuals at any level would do well to start accumulating Bitcoin on any scale possible, because if Bitcoin’s past price appreciation history holds true, it will only become more expensive as demand rises and supply deflates. The longer an entity waits to accumulate, the higher fiat price they get in at, the more Bitcoin they’ve missed out on accumulating that will remain in the hands of the diligent or those who chose to act first.

It is only a matter of time before companies realize that every Bitcoin MicroStrategy owns is one they probably never will. Late comers to the Bitcoin game will not be able to afford to play. They will be completely out-resourced and priced out of their respective market, losing their market share to the up-and-comers who embraced the soundest money, energy, and property in the world.