Spot Ethereum ETFs Approved, Massive BTC, ETH Volatility, Major CEO Steps Down: This Week’s Crypto Recap

It was another eventful week in the cryptocurrency markets, with Ethereum going under the spotlight this time. Let’s unpack.

Last weekend went very quietly, with little to no real action in terms of news and price movements. However, everything changed on Monday evening when Bloomberg’s ETF experts raised their prediction rate for the SEC approving spot Ethereum ETFs this week to 75% from 25%.

This caused immediate shock in the markets, as ETH exploded by over 20% from $3,100 to a multi-week peak of $3,800. The rally kept going in the following days for the second-largest cryptocurrency, which exceeded $3,930 at one point as speculations arose about whether it would be able to break the $4,000 barrier.

Bitcoin also followed suit on the way up and skyrocketed from $67,000 to a six-week high of its own at almost $72,000 on Monday evening. However, both assets failed to maintain their run at the end of the week, even though the big news from yesterday was that the Securities and Exchange Commission had indeed approved eight spot Ethereum ETFs to go live for trading in the US at some point.

Both BTC and ETH dropped by more than 4% just hours before the ETFs were greenlighted, faced tons of volatility after that, and failed to recover most losses. In fact, ETH has performed worse than BTC on a 24-hour scale and sits at $3,700 now, while bitcoin is above $68,000.

Still, ETH is among the top performers in the past week, having surged by 18%. Other big gainers from this week include BONK (43% up) and PEPE, which charted a few consecutive all-time highs.

Market Data

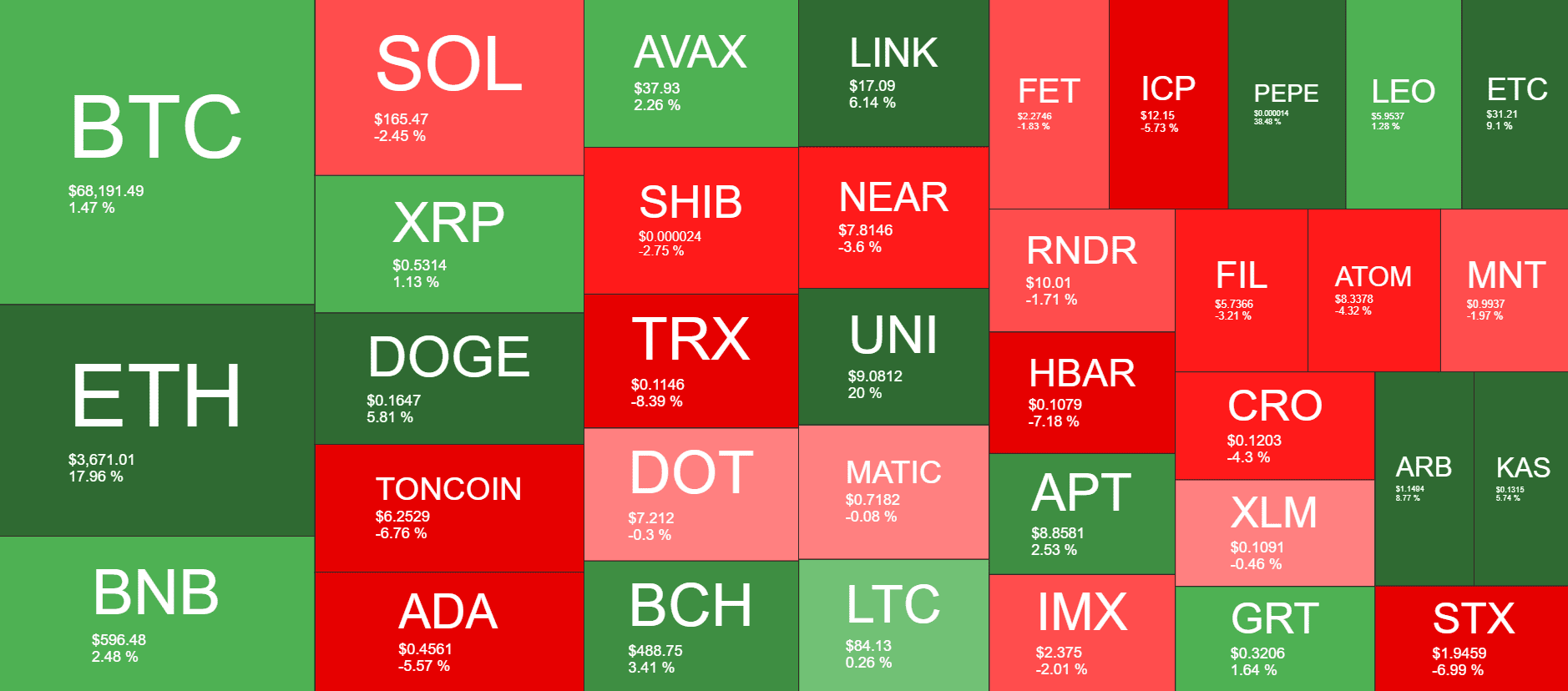

Market Cap: $2.676T | 24H Vol: $133B | BTC Dominance: 50.2%

BTC: $68,191 (+1.47%) | ETH: $3,671 (+18%) | BNB: $596 (+2.5%)

This Week’s Crypto Headlines You Can’t Miss

SEC Approves Spot Ethereum ETFs for Public Trading. As mentioned above, the biggest news this week in the entire industry came from the US securities regulator. Despite previous dabbling with whether ETH is a security or not, the SEC greenlighted eight spot Ethereum ETFs, perhaps due to political pressure.

8-Day Winning Streak: Spot Bitcoin ETFs See Strong Inflows. The ETF front has been quite strong in the past several days as the spot BTC products recorded an impressive streak that now stretches to nine consecutive days of positive inflows.

Bitcoin Pizza Day: A Delicious Slice of Crypto History Turns 14. May 22 will forever remain in the Bitcoin history books as the Pizza Day. On this day, 14 years ago, Laszlo Hanyecz made one of the first transactions involving paying with BTC and purchasing two Papa John’s pizzas for 10,000 BTC, and we celebrated this massive achievement earlier this week.

Solana ETFs to See More Demand Than Other Altcoin Funds: Bloomberg Analyst. Following the launch of spot Bitcoin ETFs and the approval of Ethereum-based products, experts have now started to speculate which will be the next crypto asset in line. According to Bloomberg’s James Seyffart, Solana ETFs could follow suit, but there’s a lot of controversy on that front.

Grayscale CEO Michael Sonnenshein Steps Down. Another big piece of news from this week came from the company behind the world’s largest Bitcoin ETF – Grayscale. Michael Sonnenshein, who spent 10 years at the asset manager, decided to step down from his last job as CEO. The person who will be replacing him comes from Goldman Sachs.

Bitcoin Network Sees Lowest New Addresses Created Since 2018. Despite all the positive news around Bitcoin, not everything is going its way. The new addresses count has declined substantially in the past few weeks and recorded their lowest levels since the bear market in 2018.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Shiba Inu, and Polkadot – click here for the complete price analysis.

The post Spot Ethereum ETFs Approved, Massive BTC, ETH Volatility, Major CEO Steps Down: This Week’s Crypto Recap appeared first on CryptoPotato.