Spot Bitcoin ETF Inflows Equal March Record as BTC Price Heads for $69K

Spot Bitcoin ETFs had some hard times at the end of April and especially on May 1, but the trend has changed now with 10 consecutive days of positive flows.

This comes as BTC’s price went on a rollercoaster propelled by the news surrounding the Ethereum ETFs, but the asset now heads toward $69,000.

The cryptocurrency industry saw a massive milestone in January when the US Securities and Exchange Commission finally greenlighted nearly a dozen spot Bitcoin ETFs after a decade of rejecting or delaying every application.

The effects were immediate as these products started attracting billions of dollars in the first few months. Then came April, though, when the trend changed, and there were numerous days in the red.

May 1 was the most painful in terms of outflows, as the total amount withdrawn on that date was north of $560 million.

The tides turned once again in the following weeks, especially after the favorable data from the US CPI numbers for April. In fact, May 10 was the last date when the largest ETFs saw negative numbers.

The financial products have been on an impressive streak since then, equalling the 10 consecutive day record from March of inflows. May 15 and 21 saw inflows of more than $300 million, while May 24’s numbers exceeded $250 million.

BlackRock’s IBIT leads the pack once again in terms of inflows and has attracted over $16,350 billion. Grayscale is still the leader with $20 billion, according to SoSovalue, but the outflows there suggest that BlackRock will surpass it in the near future.

Overall, the total inflows in all ETFs are close to $13.7 billion. Meanwhile, Ethereum fans also saw some positive developments this week as the US SEC greenlighted eight spot ETH ETFs. However, it’s still uncertain when they will launch.

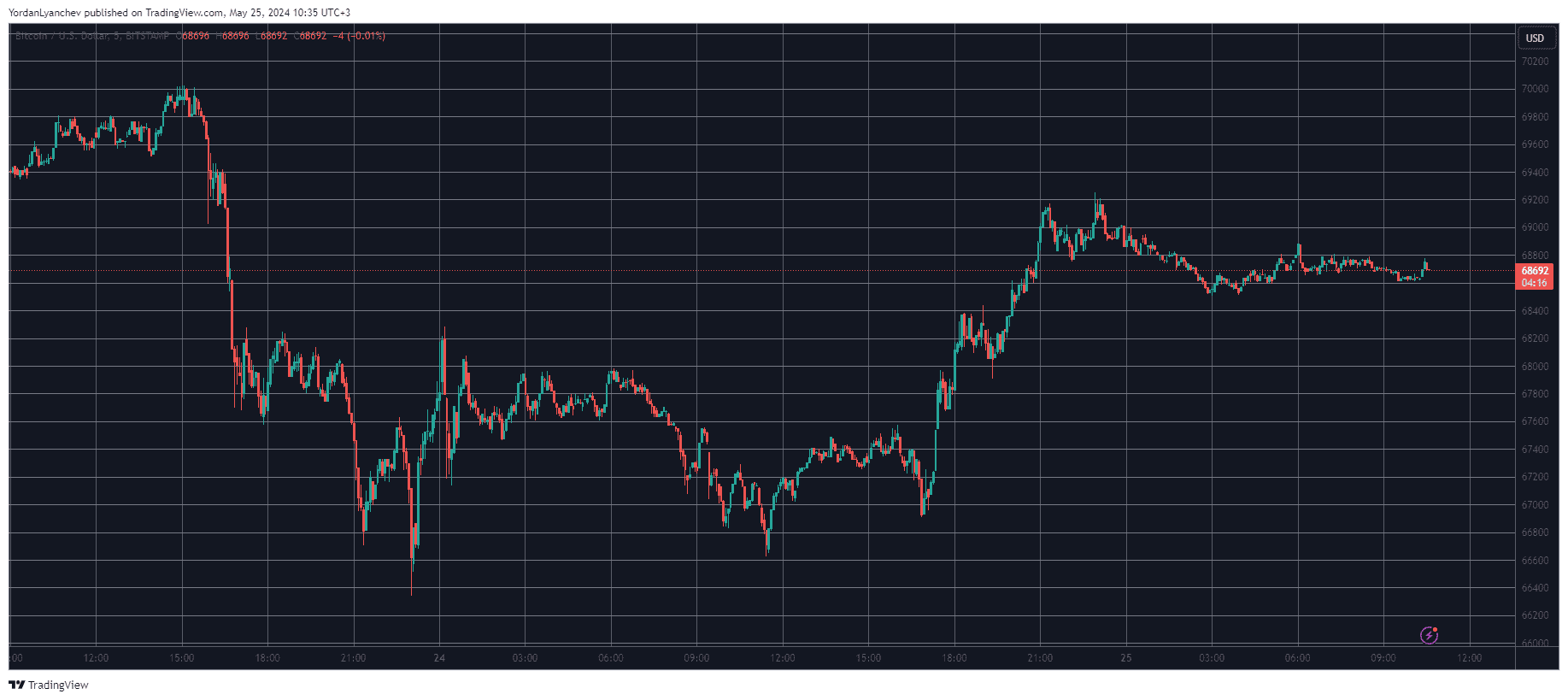

BTC responded with lots of volatility to the Ethereum news, skyrocketing from $67,000 to $72,000 before dumping to under $66,000 this week. The past 24 hours have been more positive, perhaps driven by the impressive inflows, and BTC now stands close to $69,000.

The post Spot Bitcoin ETF Inflows Equal March Record as BTC Price Heads for $69K appeared first on CryptoPotato.