Spanish Bank Banco de Sabadell Crashing, 99% From ATH: Another Red Mark For The Global Economy?

Despite Bitcoin’s latest decline price , the world’s leading cryptocurrency is outperforming a broad range of different banking institutions. This makes the narrative “long Bitcoin, short the bankers” even more relevant. In fact, longing Bitcoin in 2019 while also shorting the stock of certain banks might as well have been one of the best trades.

Banks Are Having Hard Times

“Long Bitcoin, Short The Bankers” is perhaps one of the most popular catchphrases among the cryptocurrency community, commonly used by Anthony ‘Pomp’ Pompliano from Morgan Creek Capital.

Crunching the numbers, however, reveals that it might actually be something a lot more than just a catchphrase.

As noted by popular investment strategist and economic historian Raoul Pal, the share price of banks in Spain keep on plummeting.

My weekly public notice. Spanish banks keep plummeting… Banco Sabadell, new all time low at 80c and down 99% from peak. pic.twitter.com/QJDoqVOaD9

— Raoul Pal (@RaoulGMI) July 29, 2019

According to a recent report, the bank sold around $9 billion worth of bad loans to outside companies. The same source reveals that the number of bad loans in Europe is tumbling but also says that they will never be fully gone. Even though the news is seemingly good, Banko de Sabadell sees its stock price plummeting and is already a shadow of its former self, being 99 percent down from its ATH.

But it’s not just Spanish banks that are having hard times. The stocks of the international investment bank Deutsche Bank, which is based in Frankfurt, have also been on a steady decline.

Year-to-date, the value of DB’s stocks has decreased by about 5 percent. However, when we look at the bigger picture, we see that these numbers are a lot more alarming. In one year, Deutsche Bank has lost around 40 percent of its stock value. In the last 5 years, the bank has seen a 77 percent decrease. Since its all-time high price back in April 2007, DB is down upwards of 94 percent.

As you can see, it’s not just cryptocurrencies that go through various market cycles.

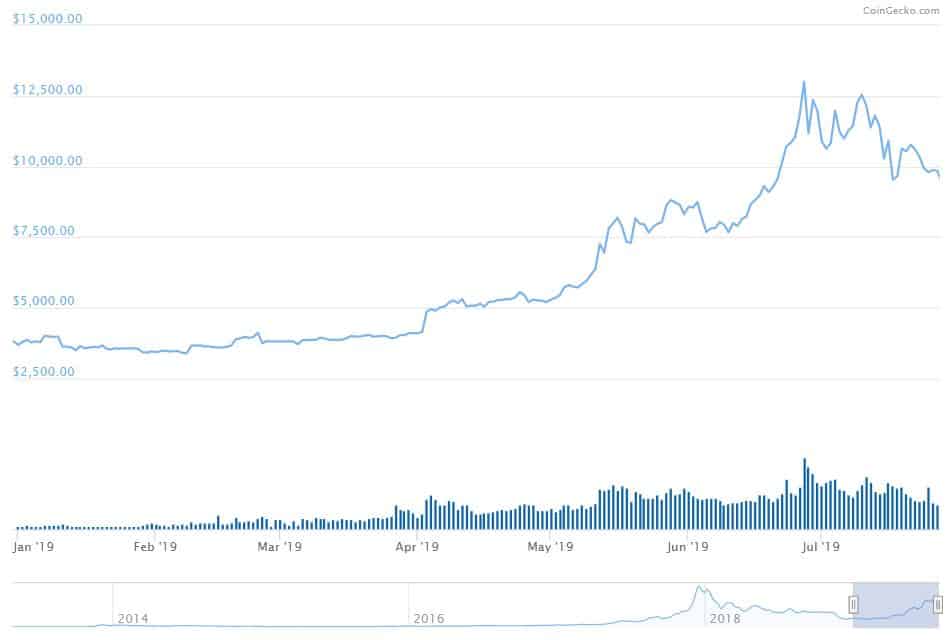

Bitcoin Prevails

While it’s still down about 52 percent from its all-time high value, Bitcoin marks a very profitable year in 2019. Since January 31st, the cryptocurrency is up around 190 percent despite having lost around $4,000 of its value in the last couple of weeks.

In other words, if one took the trade to long Bitcoin at the beginning of the year, while also shorting the stock price of the above banks and even more, for that matter, he would have made a solid profit.

The post Spanish Bank Banco de Sabadell Crashing, 99% From ATH: Another Red Mark For The Global Economy? appeared first on CryptoPotato.