South Korea’s Upbit Becomes Latest Exchange to Delist Privacy Cryptocurrencies

Another cryptocurrency exchange has delisted a slew of privacy coins following recent regulatory requirements from the international body the Financial Action Task Force (FATF).

According to a notice from Korea exchange Upbit, transaction support for monero (XMR), dash (DASH), zcash (ZEC), haven (XHV), bittube (TUBE), and PIVX (PIVX) will end Monday, September 30.

At the beginning of September UpBit posted a notice of investigation by the exchange over the same coins. The exchange was determining if the privacy coins met the requirements listed by the FATF guidance issued last June.

Privacy coins, to various degrees, allow coins to be transferred on a public ledger without exposing individual’s addresses or identities. Other exchanges have begun delisting the coins as well, such as Coinbase’s delisting of zcash in the UK this summer or other Korean exchange OKEX dropping 5 privacy coins.

Writing on a company blog, Upbit said money laundering and the possibility of inflows of privacy coins to the exchange were the leading reasons for delisting.

“There are also crypto-assets that can selectively utilize anonymity features among projects that are subject to end of transaction support. For these crypto-asset, Upbit has only supported transparent withdrawal/deposit support.

Nevertheless, the decision to end trading support for the crypto-asset was also made to block the possibility of money laundering and inflow from external networks. Upbit will continue to consider crypto-asset that represent anonymity functions as candidates for designation of investment warning crypto-asset.”

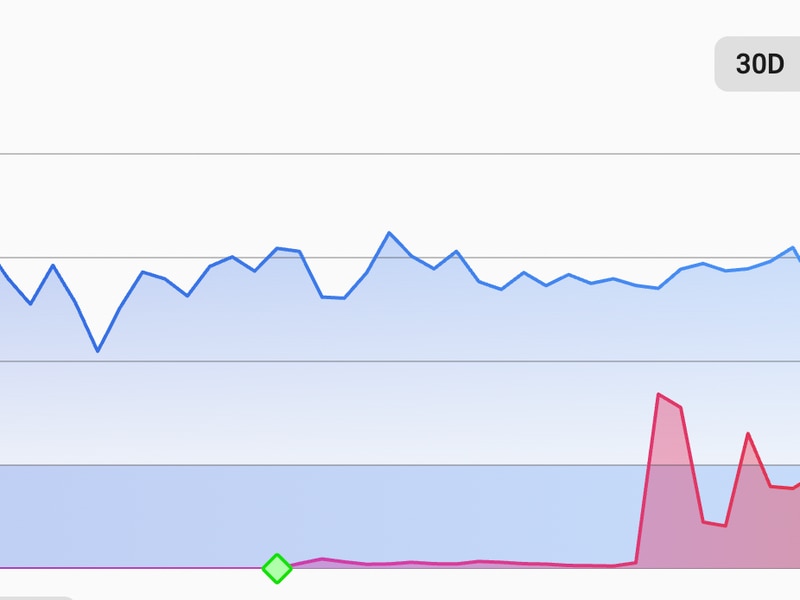

A drop in exchange listings has been blamed for a flailing privacy coin prices. According to Messari, zcash’s price has dropped over 50 percent since July 1 joined by monero, down near 20 percent over the same period.

Still, exchange delistings and price drops haven’t necessarily slowed privacy coin tech development. This past month, zcash’s Electric Coin Company released Halo, a new zk-SNARK which can verify an entire blockchain in one proof.