South Korean Pension Fund Buys $34 Million in MicroStrategy Shares

South Korea’s National Pension Service (NPS) has purchased $34 million worth of shares in MicroStrategy, the business intelligence firm that has accumulated billions in Bitcoin.

JUST IN: 🇰🇷 South Korean pension fund reports buying $34 million in MicroStrategy shares. pic.twitter.com/Sg5cRAkjzZ

— Bitcoin Magazine (@BitcoinMagazine) August 16, 2024

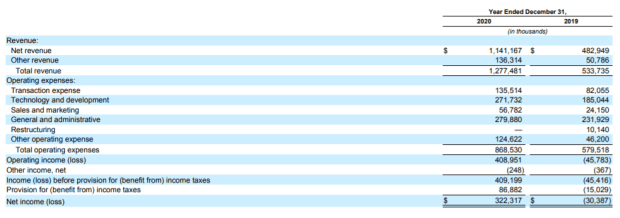

According to a recent SEC filing, the NPS bought 24,500 MicroStrategy shares in the second quarter at an average price of $1,377. This translates to roughly 245,000 shares after MicroStrategy’s 10-for-1 stock split this month.

As South Korea’s public pension fund, the NPS is the country’s largest institutional investor, with over $777 billion in assets. The $34 million MicroStrategy investment can be seen as an indirect bet on Bitcoin.

MicroStrategy holds the most Bitcoin of any publicly traded company, with over 226,500 BTC worth around $13.2 billion. The firm took on debt to accumulate most of its Bitcoin, making the stock a leveraged play on Bitcoin.

The NPS joins a growing list of pension and sovereign wealth funds, gaining exposure to Bitcoin through MicroStrategy. Norway’s central bank and the Swiss National Bank also disclosed MicroStrategy holdings earlier.

MicroStrategy’s stock price has nearly doubled this year as more institutional players bet on the company’s Bitcoin strategy. Defiance ETFs even launched a leveraged ETF that targets 175% of MicroStrategy’s daily moves.

Major pension funds’ global embrace of MicroStrategy shares validates Bitcoin’s emergence as the best treasury for public companies.