South Korean Central Bank Accelerates Digital Currency Pilot to Keep Up With Other Nations

The Bank of Korea (BOK) has launched a new pilot program for a central bank digital currency (CBDC) amid concerns the institution risks lagging behind other nations if it sits on the sidelines.

The South Korean central bank said Monday that it had reevaluated the CBDC proposal after observing that other developed nations, including neighboring Japan and its close ally the U.S., were moving forward with their own digital currency plans faster than anticipated.

Abandoning their wait-and-see approach, BOK officials have now pushed the central bank into a 22-month pilot program – which started this month – to assess the technical and legal ramifications of replacing physical cash with a digital equivalent.

“The U.S. and Japan had had no plans to issue a CBDC in the near future, but they changed their stance recently to enhance research in the emerging area,” said an official, speaking to The Korea Times. “The BOK also decided to remain proactive in the rapid shift in payment environments here and abroad, so we are going to set up the CBDC pilot system and check technical and legal issues surrounding its introduction here.”

CBDCs have become an extension of existing international rivalries, with some seeing digital currencies at the center of currency struggle to replace the dollar-denominated global economy. That China, the emerging global powerhouse, has made its digital yuan a top priority has forced lawmakers in other countries to press their own governments to begin work on CBDC initiatives.

Back in February, a group of senior Japanese politicians petitioned their government – which has already joined a CBDC working group – to share and collaborate on as much digital currency research as possible with close allies, including the U.S., against China’s bid for complete “currency supremacy.”

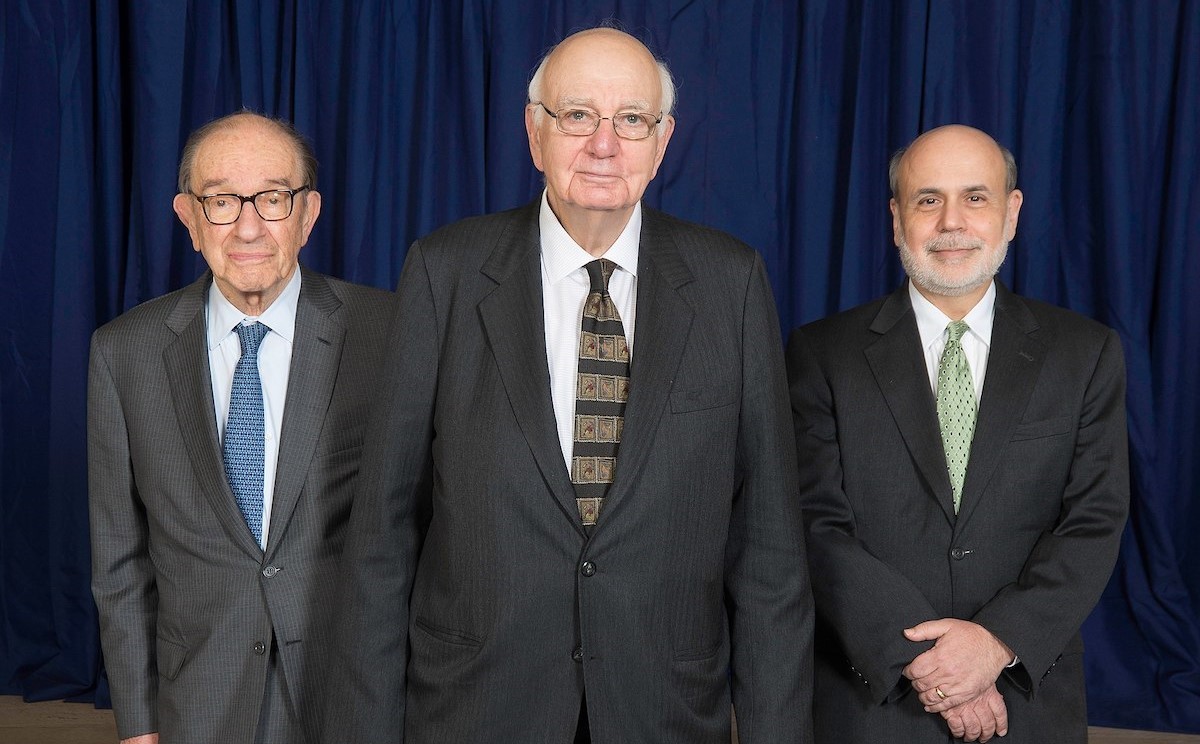

In the U.S., a digital dollar campaign has garnered support from a group of former regulatory chiefs, a treasury undersecretary and presidential advisor. The U.S. government itself has kept its cards closer to its chest, but Federal Reserve governor Lael Brainard revealed in February research is underway into whether a digital dollar could counter private initiatives like Facebook’s libra.

The BOK has previously expressed skepticism about CBDCs and even now, in its most recent move, officials say they have no plans to issue a digital currency, perhaps in an effort to curb over-enthusiasm. But one caveat buried deep within Monday’s five-page press release says that position could also change should there be a substantial shift in “domestic and external conditions.”

The findings of the research would be shared with other major central banks, the BOK said.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.