Soteria To Launch Bitcoin-Backed, USD-Pegged Stablecoin

Soteria has announced the forthcoming launch of USDS, a USD-pegged stablecoin that is 100 percent backed by bitcoin, meaning that users can issue or redeem it in exchange for BTC. Testing of the product has concluded and Soteria expects to launch it in the near future.

Stablecoins are digital currencies built to retain stable value, usually be pegging them to a fiat currency, collatorizing them with other cryptocurrencies or algorithmically balancing their circulating supplies. Soteria envisions USDS as solving inherent problems with each of these approaches.

“Fiat-backed stablecoins suffer from censorship and audit problems,” per a Soteria release shared with Bitcoin Magazine. “Cryptocurrency-collateralized stablecoins can be unstable during extreme market volatility and are capital inefficient. Algorithm-based stablecoins are also unstable and do not hold their pegs. Soteria proposes to solve these problems by eliminating the need to convert to fiat currencies and to be stable under any market volatility.”

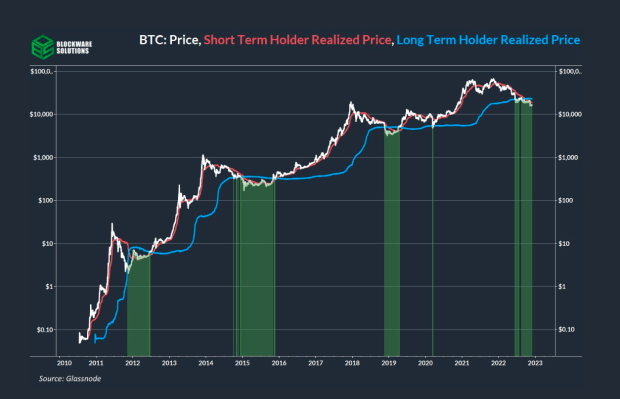

Soteria shorts bitcoin futures contracts to hedge the BTC/USD exchange rate risk and maintain an unchanging position in respect to the bitcoin price — this ensures the stability, or consistently pegged value, of USDS. The arbitrage between exchanges and Soteria will be used to keep the stablecoin’s value pegged to the value of USD.

But because USDS is cryptocurrency-backed, as opposed to fiat-backed, users don’t have to interact with the banking system or incur the censorship tradeoffs that come with it. And Soteria also promises that users can earn 10 percent annual percentage yield (APY) interest on USDS without staking or lending the tokens.

“Users of USDS earn interest automatically every day without lending cryptocurrency,” per the release. “This is possible because the interest generated by the futures basis on cryptocurrency derivatives exchanges goes to the users. We currently set the interest rate fixed at 10 percent APY but we will periodically review it since the futures basis fluctuates.”

Soteria’s website indicates that it will allow for instant conversion between BTC and USDS while maintaining a 0.1 percent issuance fee and a 0.2 percent redemption fee.

The post Soteria To Launch Bitcoin-Backed, USD-Pegged Stablecoin appeared first on Bitcoin Magazine.