Sora’s First Summit Brought Sam Bankman-Fried to Hong Kong. Now, They’ve Got Their Eyes on Taipei.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Hong Kong and Singapore are the usual destinations for crypto fund headquarters in Asia.

Jason Fang, managing partner and co-founder at Sora Ventures, disagrees, picking Taipei as the place to open a new office and run the fund from and host the next iteration of its Sora Summit conference, which takes place on Dec. 16 during the Taiwan Blockchain Week.

Fang says that the only crypto companies that really only need to be in these cities are exchanges, because of the legal clarity. It’s not the case for venture capital firms.

“A lot of these exchanges looked into areas like Hong Kong and Singapore, where regulation is a lot more black and white, which actually protects the exchange,” he said.

Taiwan doesn’t have the same sort of strict regulations and licensing.

“In Taiwan, we don’t have any restrictions in terms of any exchanges. So, you can have anything you want. There are no restrictions, and you don’t need a VPN to run anything,” he continued.

Fang says this is important because, as a VC, he is working on the bleeding edge of tech and exploring new segments that aren’t yet regulated. If he were licensed under Hong Kong or Singapore’s law there would be plenty of restrictions on what he can invest in, or say.

“Sora Ventures invests in forward-thinking, innovative areas often beyond current regulatory scope – ventures that are ahead of their time and not yet on regulators’ radar,” he said.

Fang has plenty of experience in Hong Kong.

Way back in 2018 – an eon ago in crypto years – Sora Ventures hosted its inaugural Sora Summit in Macau, a Chinese autonomous territory best known for its casinos.

A young Sam Bankman-Fried was in attendance, and the conference left such a positive impression on him he canceled his return ticket to the U.S. and stayed in nearby Hong Kong to plot how to bring Alameda Research (and later FTX) to Asia, eventually opening an office for this hedge fund in the city, so he recalled in his trial.

Crypto of the current year looks much different than in 2018. Beijing’s attitude towards it has changed, and running a digital assets fund in Shanghai isn’t the best idea from a compliance perspective.

Developing drugs on Bitcoin

Central to crypto’s thesis is revolutionizing finance through decentralization, taking out rent-seeking intermediaries. DeFi, or decentralized finance, with all its flaws and epic hacks, is the synthesis of this, linking up parties and counterparties with efficiency that only smart contracts can provide.

Decentralized Autonomous Organizations, or DAOs, are like the corporations of DeFi – a series of smart contracts that emulate an organization with roles, titles, and rewards.

But what if these DAOs could be used to do more than create the next pepecoin?

One incarnation might include DeSci – or decentralized science – hacking together answers to medical problems by building drugs via DAOs and not big pharma.

“Another category that we’re extremely bullish on, but again, a very, very early narrative, is decentralized science,” Fang said. “Science, in general, is a much larger industry that can be disrupted.”

Fang’s vision is to reduce the obstacles in drug development over time. Through DeSci he says the community can better reward scientists who make meaningful, real-world contributions, rather NFTs of frogs and monkeys.

The idea, he says, is over the course of the coming years, and the goal is to be able to shrink a bottleneck for drug development while compensating scientists well for their time.

Coinbase CEO Brian Armstrong is also a believer in DeSci and will be keynoting Sora Summit to promote ResearchHub, a platform he co-founded that rewards researchers with cryptocurrency for sharing their work and advancing science.

Everything is so damn centralized

Sora’s DeSci ambitions, like everything else it is investing in, are based on the Bitcoin blockchain.

There’s a whole DeSci universe out there, and Sora isn’t the first to make moves in this space.

But it’s the first to do it completely on Bitcoin.

Fang views centralization in the crypto industry as a significant risk, particularly in its potential to stifle innovation and create vulnerabilities in blockchain projects.

“Solana, for example, has a Solana Ventures or the Solana Foundation,” he said. “The majority of their development that’s going on is basically invested by these two companies, which is basically a centralized entity.”

“If one of those two things vanishes, they’re f—d,” he continued.

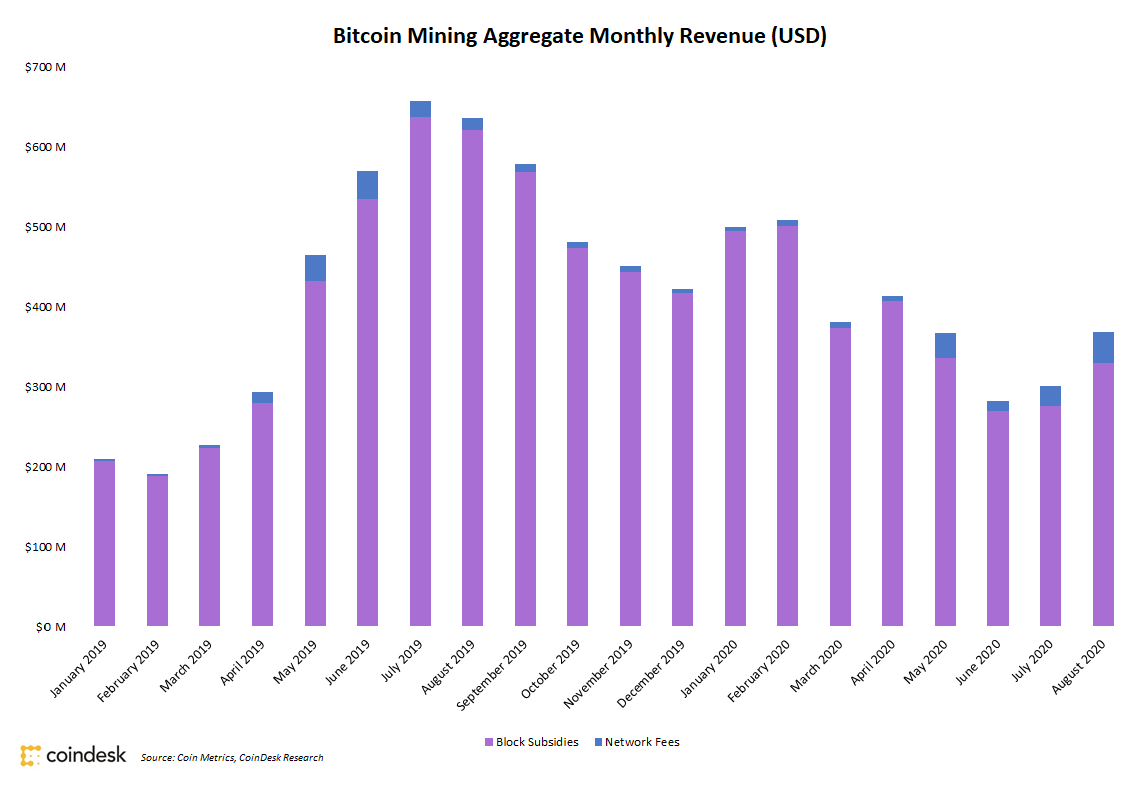

Bitcoin, he says, will walk a very different path because miners – as decentralized as you can get – are the ones benefiting from development in bitcoin utility thanks to the higher fees and are, in turn, funding it.

And a strong mining industry strengthens the decentralization and security of the network, like a sort of flywheel.

“Miners are way richer than Solana Foundation,” he says.