Some Whales Might be Cashing Out as Stablecoins Redeemed Index Spiked to ATH (Analysis)

The redeemed supply across all stablecoins spiked to an all-time high of almost $5 billion a few days ago, and one analyst believes that this is an indication of some whales cashing out.

- According to data from popular cryptocurrency monitoring resource CryptoQuant, the number of redeemed stablecoins across the board hit an all-time high on December 10th.

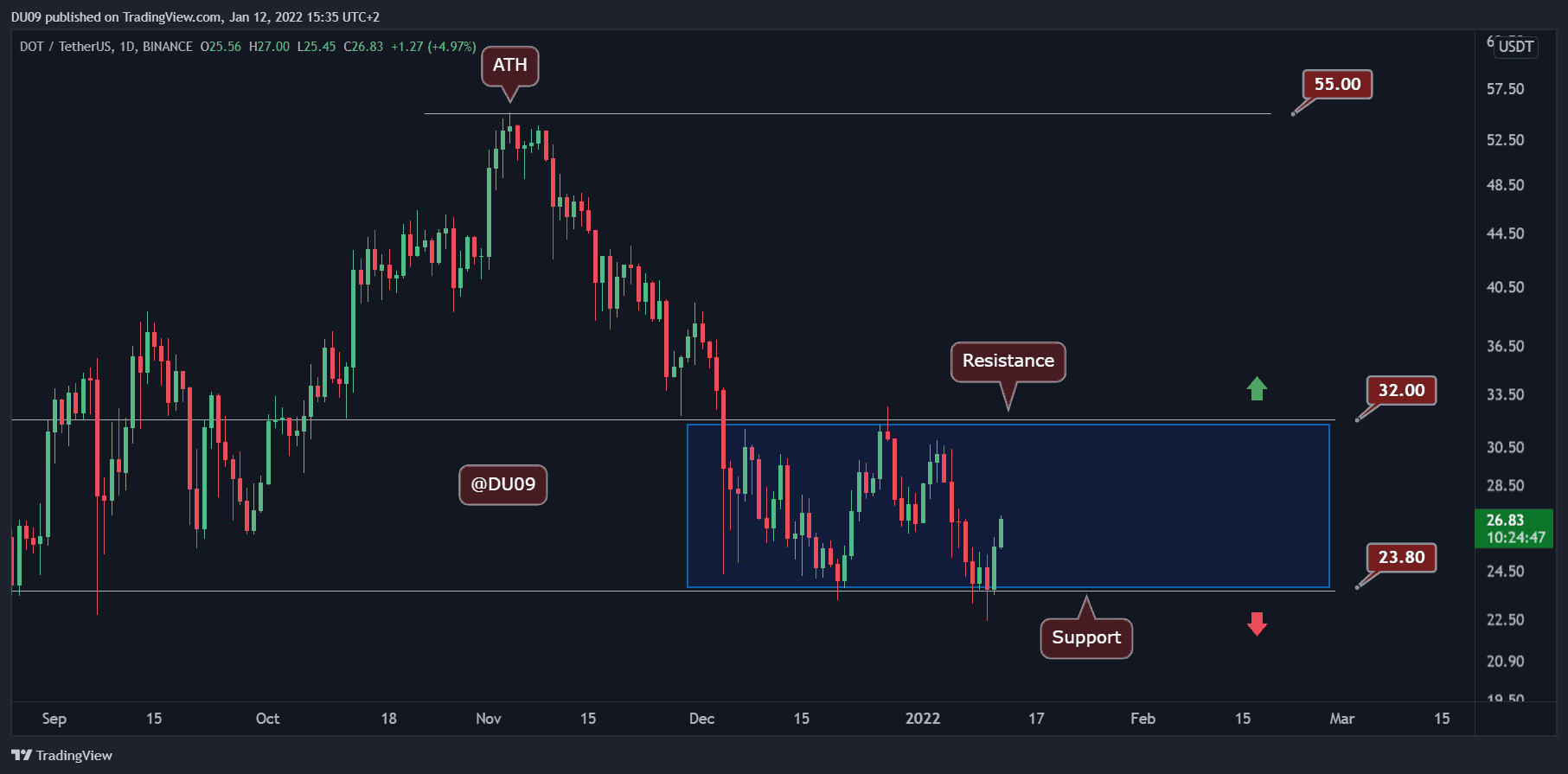

- As seen in the chart below, the number reached almost $5 billion on December 10th, when the BTC price was sitting at $47K.

- CryptoQuant’s Dan Lim believes that this might be an indication of some whales possibly cashing out.

- He also opined that this might be in response to the upcoming FOMC meeting that will take place on December 16th.

Not sure if the whales are chasing out ahead of the market’s volatility in response to the December 16th FOMC announcement, but that’s also one of the uncertainties.

So far, we still are careful until some uncertainties will be resolved. – He said.

- It’s worth noting, though, that this doesn’t necessarily mean that the whales in question have been selling BTC now.

- In fact, despite that this might be perceived as a negative indication, the price rallied in the days that followed.

- Yesterday, bitcoin’s price reached an intraday high of $50,800 before getting rejected and pulling back down to where it currently trades at $48.7K.