Solving Fragmentation Is Next Blockchain Race as Layer 2s Multiply, ZKsync Developer Says

Starting with just a handful of pioneers a few years ago led by Arbitrum and Optimism, there’s been a rapid multiplication of layer-2 networks atop Ethereum, designed to provide an alternate venue for executing transactions, usually cheaper and faster. The tracking website L2Beat now lists 73 active layer-2 projects, 20 layer-3 projects, 81 upcoming projects and 12 already archived.

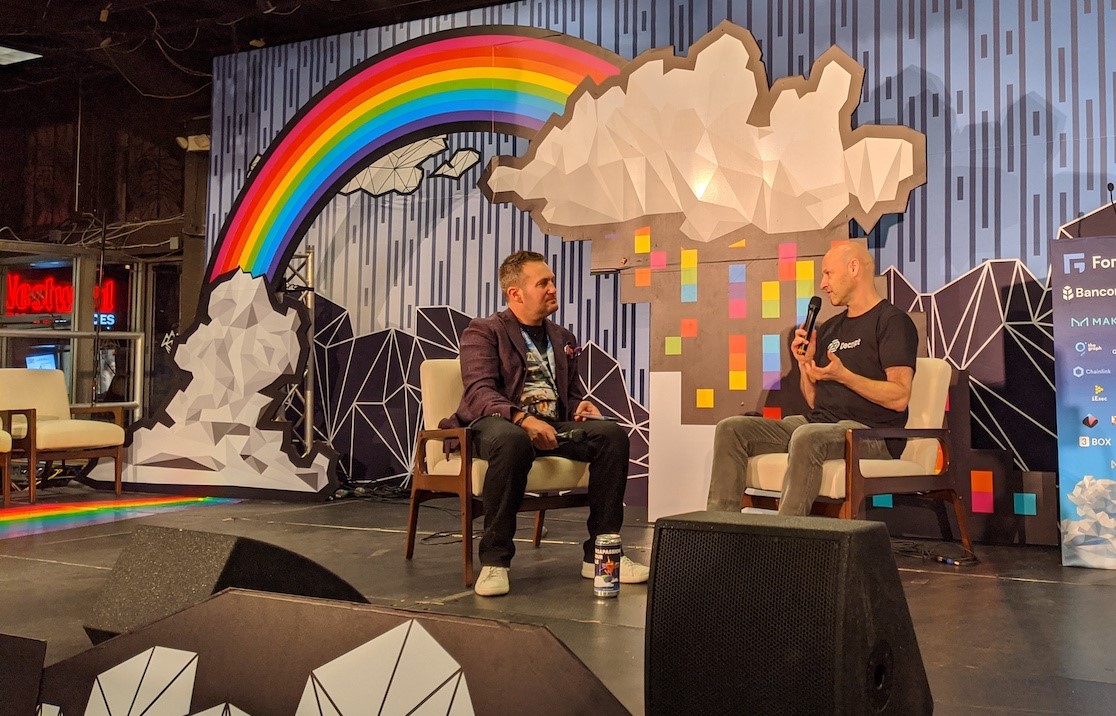

That’s the backdrop for why Alex Gluchowski, CEO of Matter Labs, the main developer firm behind the ZKsync layer-2 protocol, sees fragmentation as the next big challenge the blockchain space needs to tackle.

“Right now the race is to solve the fragmentation,” Gluchowski said Wednesday in an interview with CoinDesk in New York.

Superchain, Elastic Chain

Many of these layer-2 chains have issues communicating with each other. Interoperability solutions have been developed in hopes of solving this problem, including Matter Labs releasing its Elastic Chain in June.

Other layer-2 competitors like Polygon and Optimism have come out with their own versions of solving this, including Polygon’s AggLayer and Optimism’s Interoperability solution. They hope to solve fragmentation by having different chains in their ecosystem plug into their own interoperability layers.

But just as the race between layer-2s using zero-knowledge proofs heated up, the next will be between projects offering their interoperability solutions.

“More specifically, Optimism’s Superchain and Matter Labs’ Elastic Chain, because those are the only two live constellations in blockchains that actually implement the interoperability,” Gluchowski said. Gluchowski said he’s doubtful Optimism’s interoperability plans will be easy to pull off without upgrading its systems to incorporate zero-knowledge proofs. “Those are complex technologies.”

Part of the reason why so many chains have popped up over the last few years is because these companies have made it so easy for developers to clone their technology and build their own networks based on their tech.

Developer stacks like OP Stack and Matter Labs ZK stack let users build their own customizable layer-2 blockchains using Optimism and Matter Labs’ technology.

Some high-profile chains that have come out OP Stack for instance are Coinbase’s “Base” and Worldcoin’s “World Chain.” Layer-1 Cronos has also created their own layer-2 chain based off of ZKsync technology, called Cronos zkEVM.

Now, the goal is for all these chains to be more interconnected, so instead of feeling like users are transacting across many chains, it feels like one singular chain.

Gluchowski says the abundance of layer-2 chains need to be reframed and looked at as useful for specific use-cases. “The real question is, do we have L2s that matter? And I think that we will not need too many general purpose layer-2s, but we do need some application specific L2s or community specific L2s,” Gluchowski said.

“This could be regional, like one LatAm, Southeast Asia or Japan, because they have specific cultures, and they kind of have a separate approach there. Or it’s really application specific, like we have projects launching on the Elastic Chain that are just gaming chains, which does not really need to be sharing infrastructure block space with DeFi or financial applications,” Gluchowski said.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7dc71a1a-5122-47cc-9bbf-82501f65b060.png)

Margaux Nijkerk reports on the Ethereum protocol and L2s. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a small amount of ETH and other altcoins.

Follow @cryptauxmargaux on Twitter