Solana (SOL), Cardano (ADA) Lead Crypto Market Lower as Traders Grapple With BTC Headwinds

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Prominent cryptocurrencies started the week in the red as fears of large bitcoin sales continue to confront investors, who are likely scaling back exposure in the broader market in anticipation of lower prices.

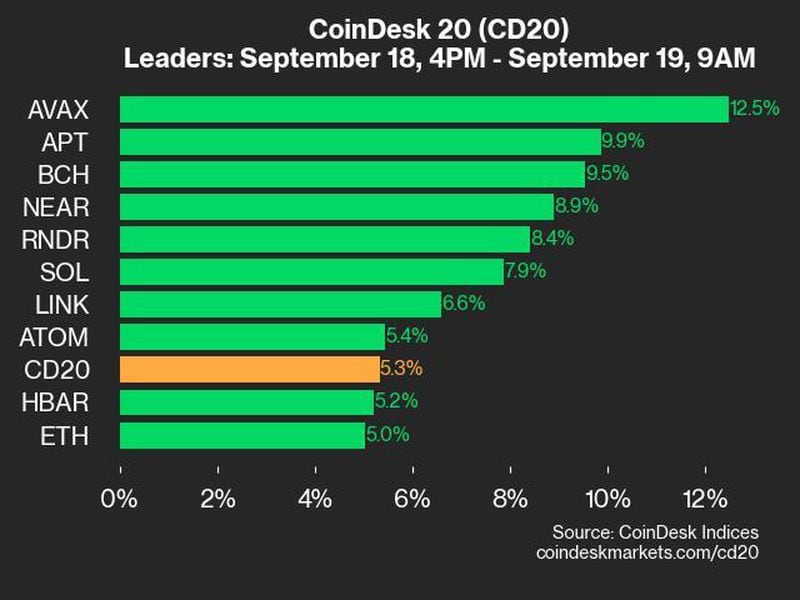

CoinDesk 20, a liquid index of the highest traded tokens, slumped 2.86% in the past 24 hours.

Solana’s SOL and Cardano’s ADA fell 5% in the past 24 hours, leading losses among majors. BNB Chain’s BNB was little changed amid demand for launchpads that require the token on the crypto exchange Binance. Dogecoin (DOGE) initially bucked the broader market weakness amid speculation of adoption in an upcoming feature on social application X but has retreated in the past 6 hours.

Bitcoin, the world’s biggest cryptocurrency by market value, lost the $41,000 support level early Monday. Traders expect prices to fall as low as $38,000 in the coming weeks, which could lead to more losses in other cryptocurrencies.

Recent downward pressure on bitcoin has been attributed to sales stemming from Grayscale’s GBTC bitcoin exchange-traded fund (ETF), as per some analysts, including Bloomberg’s Eric Balchunas.

Verified wallets belonging to Grayscale, tracked and labeled by analysis firm Arkham, show that the fund moved over $400 million worth of bitcoin to custodian Coinbase Prime on Thursday – potentially a step toward an eventual sale, as reported.

However, other newly approved bitcoin ETFs are seeing net inflows. BlackRock’s IBIT and Fidelity’s FBTC ETFs crossed $1 billion last week, data tracked by CoinGlass shows, indicative of buying pressure.