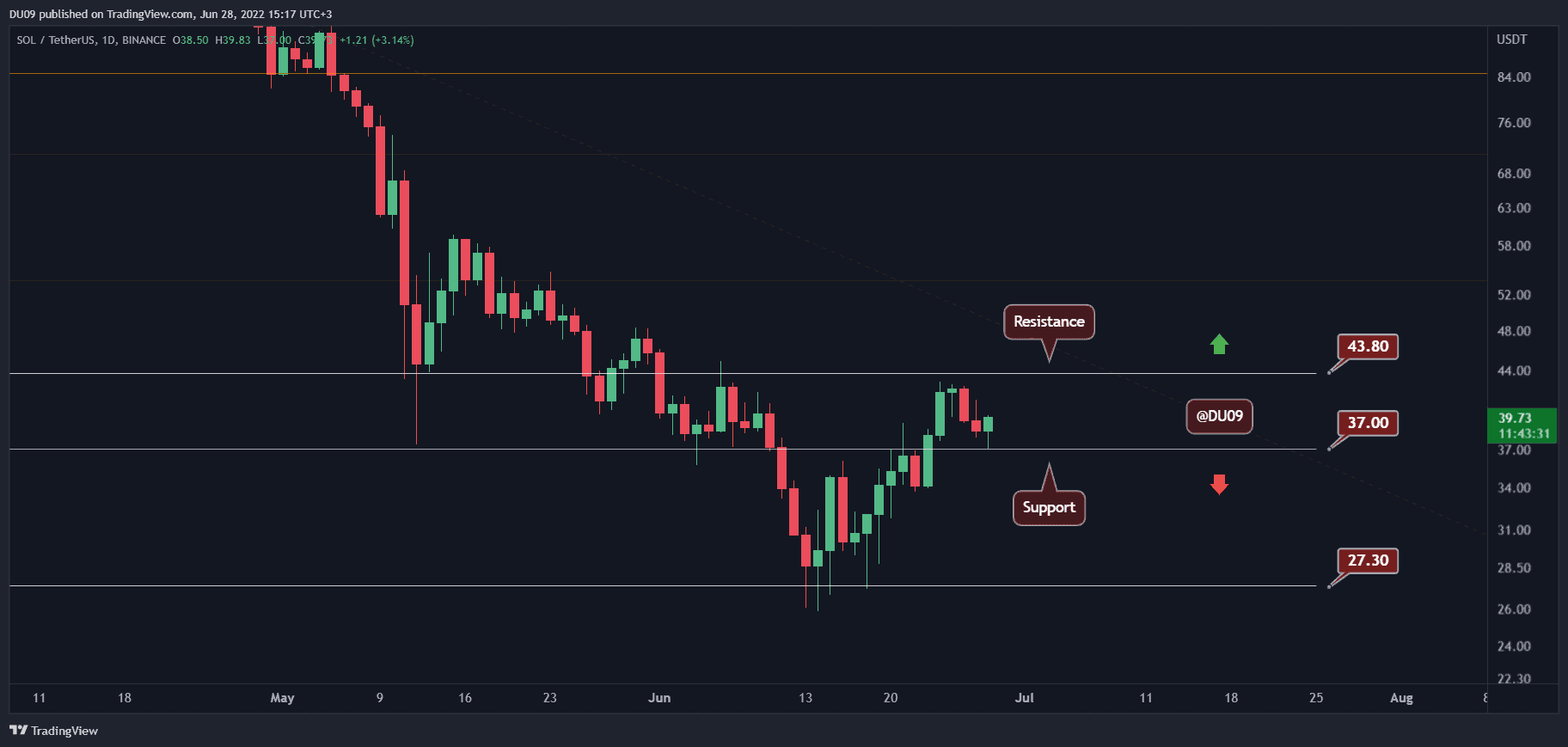

Solana Price Analysis: This is the Next Critical Resistance for SOL After a 10% Weekly Recovery

Solana has found good support at $37 and the price now appears in preparation to move higher.

Key Support levels: $37

Key Resistance levels: $44

After a successful test of the key support at $37, Solana’s price is ready to move higher and test the key resistance at $44. This pullback may be the pivot SOL needed to make a higher high. The only impediment appears to be a decreasing volume.

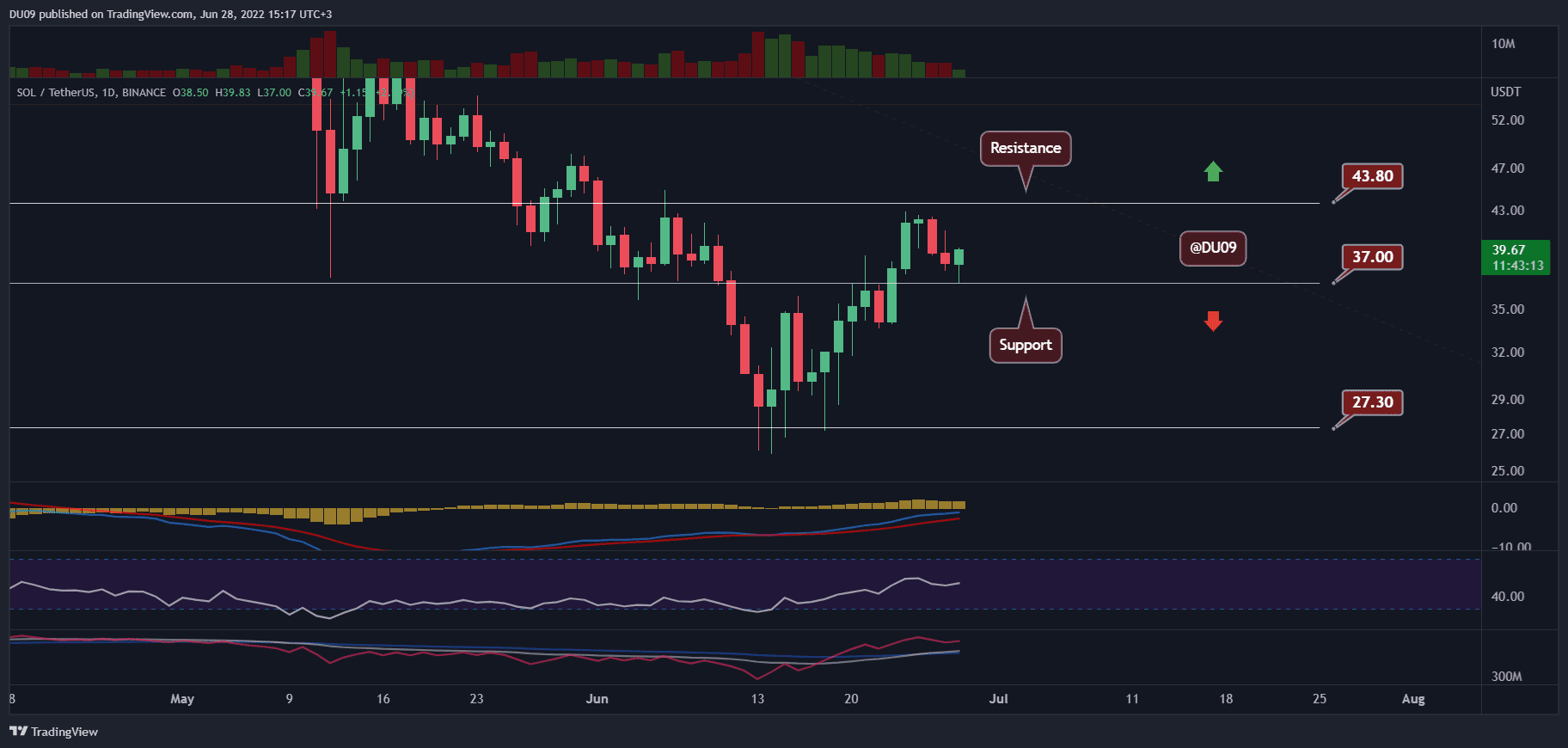

Technical Indicators

Trading Volume: Since the market crash in mid-June, Solana’s volume has been declining steadily. This puts any attempt at a major breakout in doubt. However, the low volume may also be indicative of a major move ahead.

RSI: The daily RSI is above 50 points and has made a higher low and higher high. This puts SOL in an uptrend, at least for the short term.

MACD: The daily MACD is bullish, but the histogram is making lower highs which would suggest some loss of momentum behind the current price action.

Bias

The short-term bias for SOL is bullish.

Short-Term Prediction for SOL Price

Solana had a steady recovery so far and managed to almost reach $44 before facing significant resistance. The price will have to break this key level if SOL is to move higher.