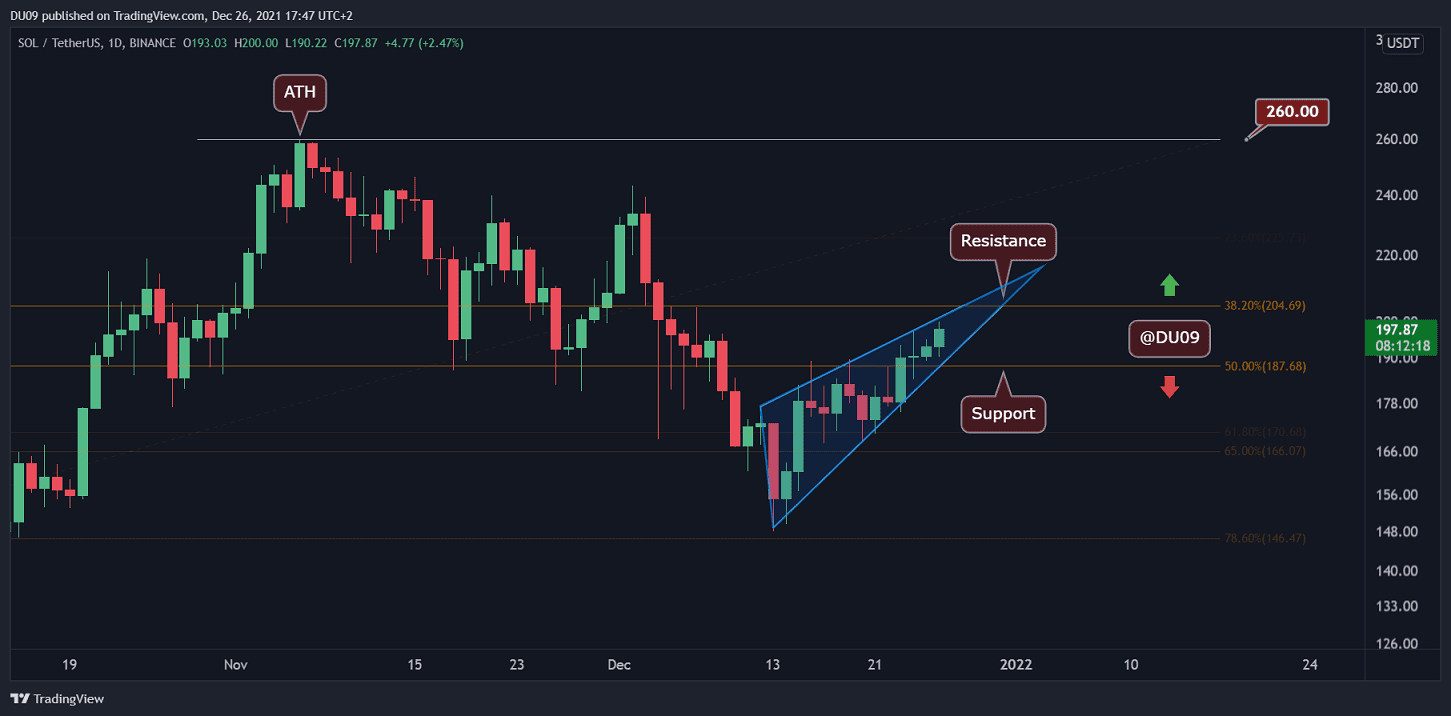

Solana Price Analysis: SOL’s Forming a Rising Wedge, Which Could Be Worrying for the Bulls

SOL is heading towards the $200 key resistance level. A successful breakout, and retest as support, might likely lead the Solana native cryptocurrency for another shot for its next major resistance level around the ATH.

Key Support levels: $187

Key Resistance level: $200, $205

SOL has found a solid horizontal support line amid the $187 level and is currently eyeing the $200 key resistance level.

On the other hand, the SOL price had formed an ascending wedge which is a textbook bearish formation, so best to be cautious around current price levels as a short pullback becomes possible upon breaking down the wedge pattern.

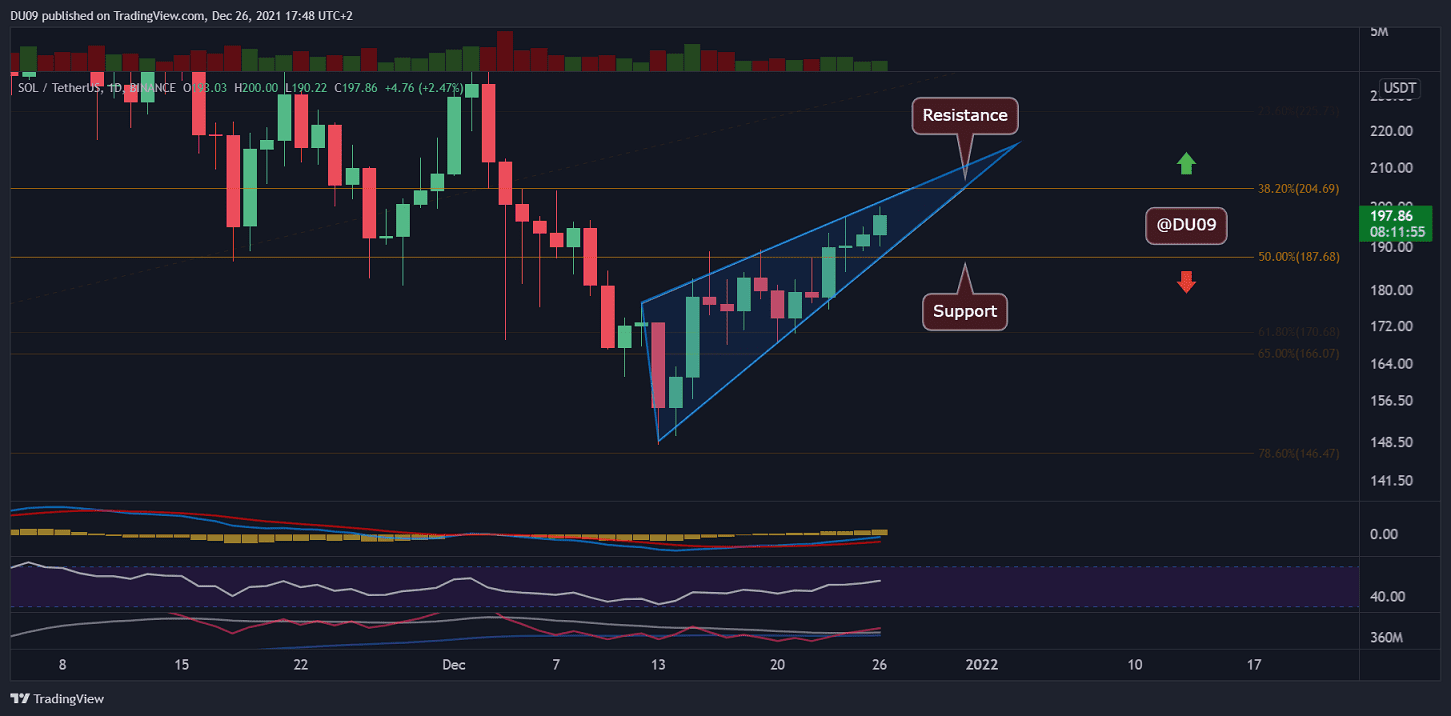

Technical Indicators

Trading Volume: Sustained volume has continued to push SOL higher and there is no weakness yet. This is good news for the bulls.

RSI: The RSI on the daily timeframe is marching upwards and recently crossed the 50 points mark. If it manages to reach over 58 points, this will signal a higher high which is is a clear bullish pattern.

MACD: The MACD on the daily timeframe is bullish with an expanding histogram and moving averages. This is exactly what one wants to witness in a bull trend.

Bias

The current bias is bullish but best to watch out for the current resistance level at $200 and the rising wedge bearish pattern.

Short-Term Prediction for SOL Price

SOL had seen great performance in the past week, moving across the resistance levels at a steady pace. The biggest challenge now is to break beyond $200 and create a solid base at this level. The bearish wedge requires caution as a pullback could take place before a further price increase.