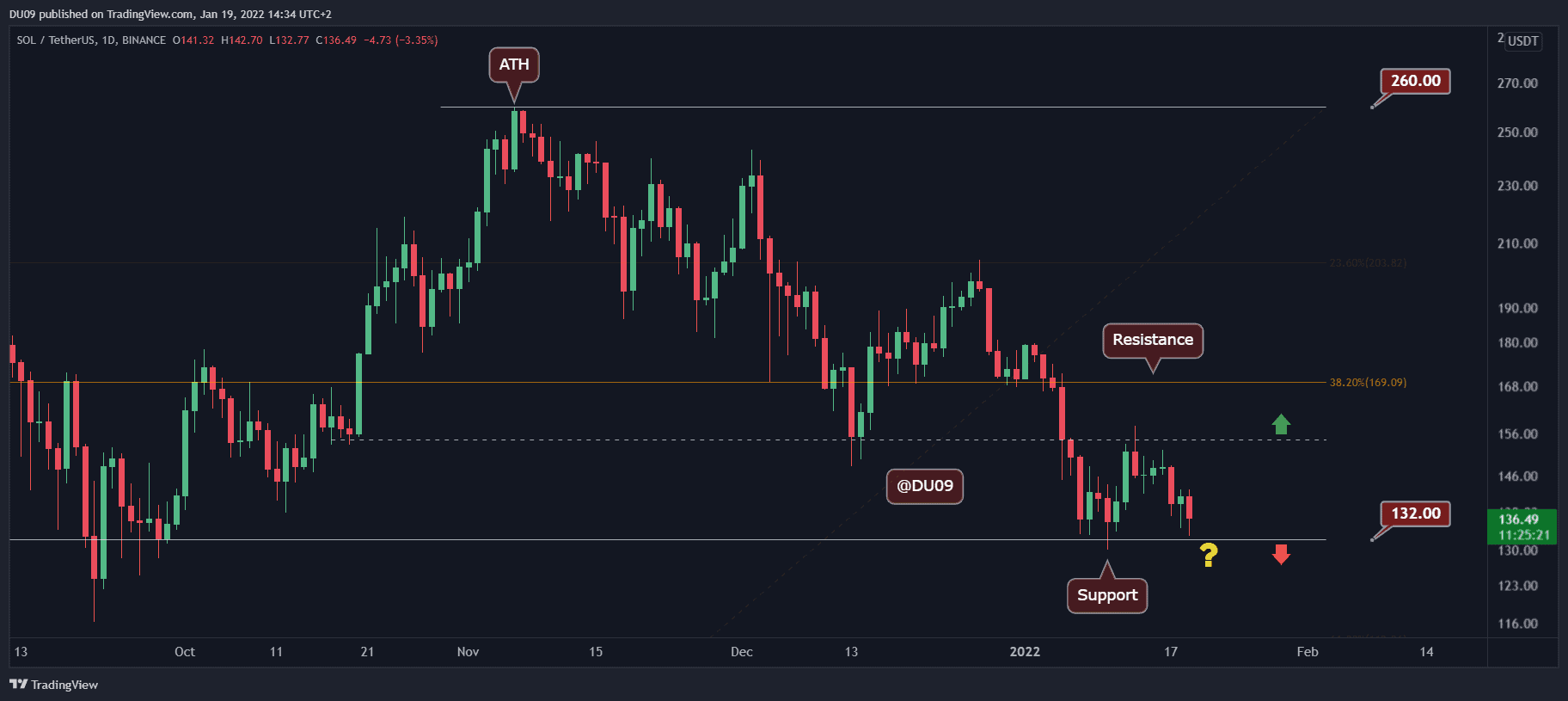

Solana Price Analysis: SOL Revisits $130, What’s Next?

Key Support levels: $130

Key Resistance level: $155, $170

SOL fell back to the critical support at $130 in the past few days, failing to maintain its rally from last week. Buyers might be interested at current price levels since the last time it visited this, key level bulls came in force and pushed SOL into a relief rally.

The resistance currently sits at $155. This level represents the biggest challenge for any possible rally.

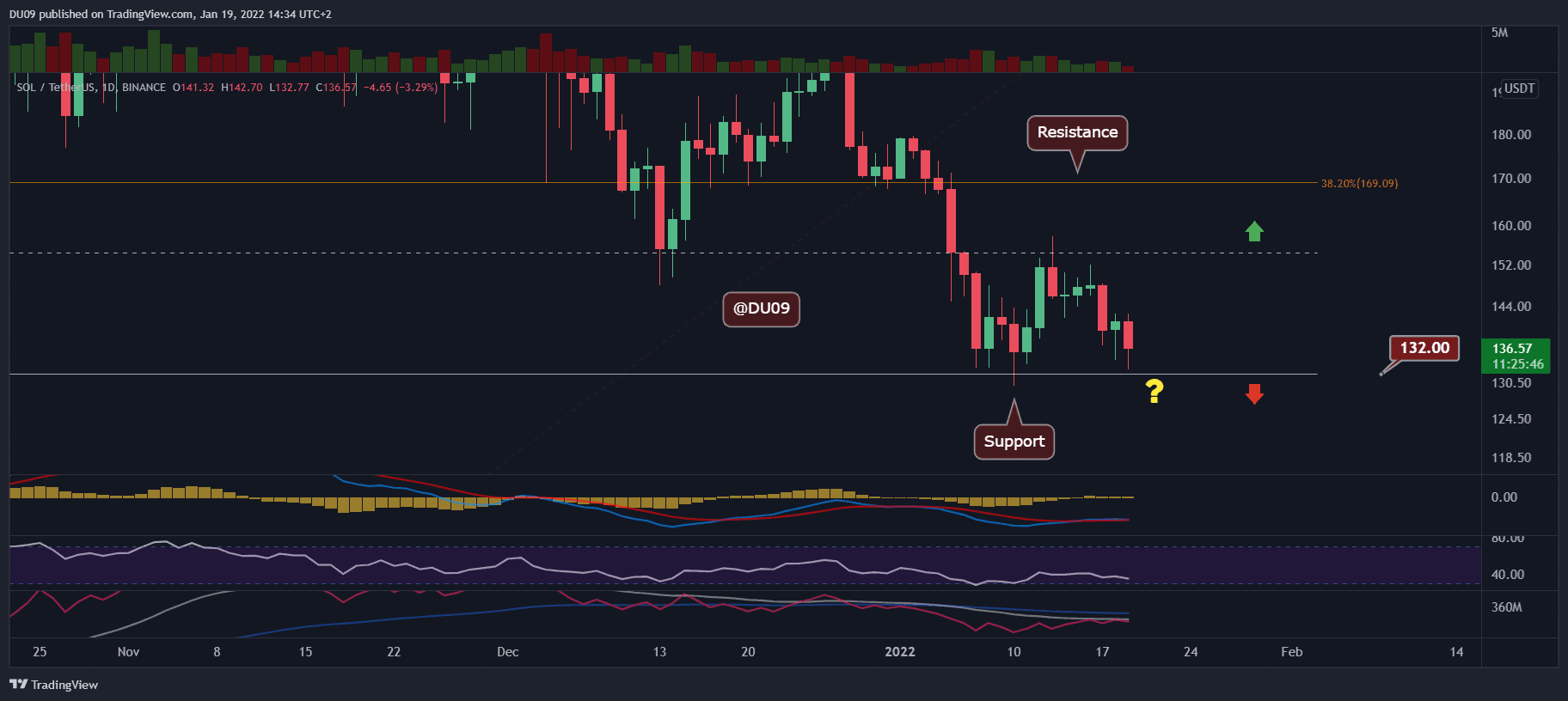

Technical Indicators

Trading Volume: The volume decreased as the price fell, which does not favor the bears. Therefore, buyers may have a great chance to reverse the current price action back into an uptrend.

RSI: The RSI on the daily timeframe remains bearish with lower highs and lower lows. There are no signs yet of a possible reversal.

MACD: While the daily MACD is on the positive side, there was barely any momentum to reflect this in terms of price, and now the moving averages are closing in for a bearish crossover. If the buyers fail to step in soon, then it is unlikely for the downtrend to stop.

Bias

The current bias is bearish. Nevertheless, the bulls have a good shot to push SOL higher from the key support level as sellers seem indecisive considering the volume profile.

Short-Term Prediction for SOL Price

SOL was unable to push above the key resistance at $155 last week, and the price suffered. Now, it is back on the key support at $130, and it’s possible for the bulls to step up once there. It is likely that SOL will be very much influenced by the market leaders in the face of BTC and ETH in its next move.