Solana-Focused Startup Accelerator Colosseum Raises $60M to Invest in Early-Stage Projects

-

Colosseum, a company that sets up hackathons for the Solana ecosystem, raised $60 million.

-

The company has already deployed $250,000 to 11 different companies.

00:46

Meme Coin Liquidity Hits Record High

16:42

How Ledger Stax Plans to Make Self-Custody More Mainstream

16:39

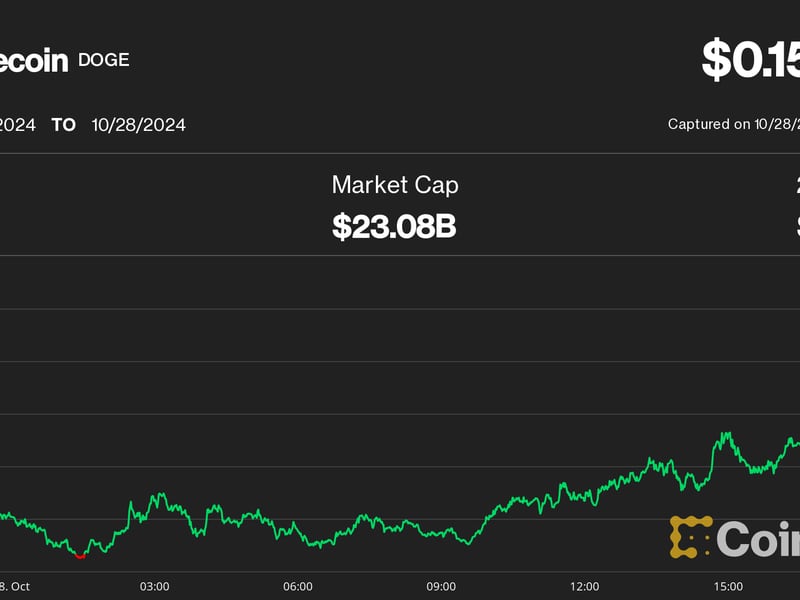

Why Dogecoin Is a ‘Weird’ Investment

00:47

AI Tokens Surge as Nvidia Becomes World’s Most Valuable Company

Colosseum, the recently launched startup accelerator that organizes hackathons for the Solana ecosystem, raised $60 million for a fund that will invest in early-stage projects, the company announced Tuesday.

The fund, which was oversubscribed, will focus on pre-seed investments in selected startups from the winners of Solana Hackathons. “It’s evident that there is a market demand for novel, specialized venture products in crypto, and we are excited to have a diverse group of investors, including ecosystem founders and hackathon alumni, alongside us to realize our vision for Colosseum,” said Clay Robbins, co-founder of Colosseum, in a statement.

When asked about what attracted investors to the fund, given the large sum of money that Colosseum raised, Robbins said, “many of Colosseum’s LPs are agnostic to ecosystem but believe in the team’s immediate thesis that the Solana ecosystem has the most potential. Institutional LPs invest with both the current focus on the future in mind for what the model can become – so not necessarily a fund focused on one ecosystem, but more so this model.”

The accelerator sees hackathons – events where developers and founders come together to innovate – as the “crucible” for crypto innovation and company formation. According to the statement, it hosted its first Solana hackathon earlier this year, which attracted over 8,000 participants.

“Our hackathons are designed to level the playing field for builders globally to experiment with crypto product development and launch onchain startups,” explained Matty Taylor, co-founder of Colosseum and former head of growth of Solana Foundation.

Colosseum has funded 11 companies and deployed $250,000 so far, Robbins added.

Among the investors, Bonk DAO – a 12-person council of Solana power brokers who manage $124 million worth of BONK token – said earlier this year that it plans to invest $500,000 in the fund.

Edited by Nikhilesh De.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/83b3bbdb-5508-48a9-a9d9-2d7dd460fd5b.png)