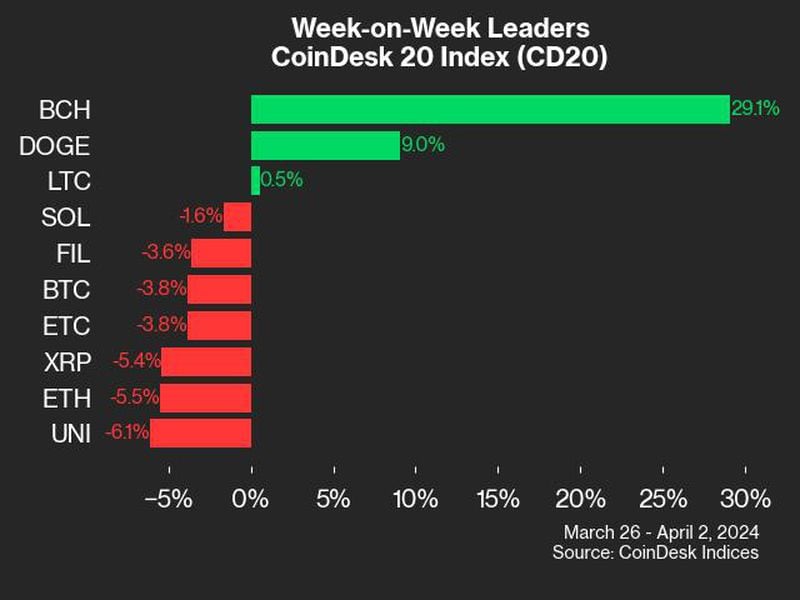

Sol, Memes, BTC: Digital Assets That Currently Outperform the Market

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

In the wake of FTX and other scandals, crypto has been suffering through a winter of legendary coldness. But many traders now say the worst is over and that a new period of upward momentum is upon us.

Where might traders think of putting their money at the moment?

This post is part of Consensus Magazine’s Trading Week, which is sponsored by CME.

For CoinDesk’s Trading Week, we asked our sister company, CoinDesk Indices, to do some analysis. Here are three areas that are currently seeing strong growth, compared to the CoinDesk Market Index (CMI), which measures performance across the entire market (or very close to it).

Solana Surges

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/65EOBPZ2TFBU3L7WDXJLP3FP7E.png)

Solana has experienced disproportionate gains compared to other major cryptocurrencies. Registering a 64% increase over the past month, SOL has outperformed Bitcoin’s 25% rise and Ethereum’s 8.4% gain. This latest rally brings SOL’s year-to-date gain to nearly 300%. However, Solana’s position in the market remains complicated by the fact that a substantial chunk of SOL supply is locked in the FTX bankruptcy estate.

Awesome Oracles

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ED6VNOZU2FFMRCSF6YLUNJ7G44.png)

Although the recent rally is felt across the asset class, with 156 of the 189 assets in the CoinDesk Market Index returning positively over the past month, some kinds of assets have outperformed others. The Computing Index, which contains protocols dedicated to decentralizing data sharing, storage, and transmission, stands out. This can be partially attributed to the outsized return of oracle networks, including ChainLink (up 47% month-on-month), Band Protocol (up 21% month-on-month), and Tellor (up more than 2x month-on-month). The surge in oracle platforms coincides with growing enthusiasm surrounding the tokenization of real-world assets.

Momentous Memes

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YQIFBJHWSBDAJI7PWYNOHKNJWA.png)

Meme coins, which have been on a general downtrend for the past several months, saw a resurgence. On October 23, as optimism around the launch of a spot Bitcoin ETF, Bitcoin saw its highest returning day in 2023. Over the same time period, ELON and PEPE were among the top performing assets overall, gaining 23% and 20% respectively. That by far surpasses BTC’s 10% gain.

Edited by Ben Schiller.