Snore of Value: Bitcoin’s Sleepwalk Towards Stasis

You know how the dodo bird became extinct? It became too fat to fly.

In fact, the name ‘dodo’ likely originated from the Portuguese word, ‘simpleton’. The dodo bird lived very comfortably for much of its existence on an isolated island that lacked any natural predators. Over time the dodo bird grew bigger, and its wings grew smaller. Growing larger while having no predators emboldened the mighty dodo bird to become increasingly fearless.

And then humans showed up. And everything changed. Instantly.

The rapid and dramatic environmental changes left the dodo bird helpless. Because it was flightless, it couldn’t escape. It needed wings to survive but evolutionary processes don’t occur overnight, they take thousands of years. From happy, fat, and thriving to extinction. In the blink of an eye.

That’s the harsh reality of evolutionary biology – it only optimizes based on the past and present, never the future. Evolution is a reactive process. Environments can increase a species’ resiliency over time, or it can change so rapidly that it rids itself of them completely.

Bitcoin in its current state is a dodo bird.

The evolutionary checkpoints for money are universally understood as:

1) Store of Value: you can preserve purchasing power with it

2) Medium of Exchange: you can use it to buy and sell things

3) Unit of Account: you can use it to measure the value of other things

Bitcoin is firmly sitting on first base regardless of what its lazy critics claim. Price volatility does not negate the store of value property and there is no question that most current bitcoin adoption is related to saving. Bitcoin as a medium of exchange is a work in progress as the reality is very few users are engaging in any kind of commerce with it.

If bitcoin is only capable of serving as a store of value and nothing more, then it cannot become money. Aspiring to be the best store of value is aspiring to be a fat flightless bird. Bitcoin is on a lonely island of less than 2% global adoption, emboldened by price appreciation, with no concern of outside predators as glowing endorsements roll in from Wall Street – flourishing and unbothered like the dodo bird.

“Like you said, evolution takes time! Bitcoin will become a medium of exchange and later a unit of account. It’s just too early right now but it will happen eventually.”

Will it? Why is bitcoin as a medium of exchange a foregone conclusion?

Put down the orange pom poms and look around today. Bitcoin’s current landscape has it waddling down a path that leads to nothing more than becoming a captured amorphous digital property token. The lack of situational awareness and adversarial thinking amongst bitcoiners is at embarrassingly all-time lows and seemingly getting worse the further bitcoin sleepwalks towards stasis.

If it’s not clear to you, let me wake you from this slumber so you better see the signposts:

Signpost #1: Stablecoins

Remember the bitcoin rallying cry, ‘separate money from state’? If you’ve forgotten it, then it’s hard to blame you with the amount of self-described bitcoin maximalists head-scratchingly rallying behind stablecoins at worst and apologizing for them at best.

“Bitcoin is too volatile!”

“The global south!”

And my personal favorite, “Stablecoins are a gateway to bitcoin!”. Hard to say that with a straight face.

Here’s the wakeup call. Stablecoins are fiat money. They are a gateway to fiat money. They are an adaptation of everything bitcoin was designed to escape from. They are bitcoin’s biggest sheep in wolf’s clothing competitor. Full stop. They mostly run on Ethereum and Tron. If people want to use them that’s totally fine – but enough with pretending that stablecoins complement bitcoin in any constructive way.

Do you think the US Treasury is going to just idly sit by without sinking their talons into these stablecoins? The path of least resistance for the government to introduce a CBDC is to simply regulate stablecoin issuers with an iron fist. Their money, their rules.

What happens when we’ve sleepily conceded bitcoin’s medium-of-exchange evolution phase to heavily regulated stablecoins? Will people suddenly become enlightened and retreat to bitcoin overnight? It’s a warm and fuzzy thought until you consider that the government would unquestionably restrict stablecoins being exchanged for bitcoin. Their money, their rules.

And what’s to stop stablecoins from covering so much surface area as a medium of exchange that it never concedes any ground? Gresham’s Law posits that “bad money drives out good” which means people tend to spend the bad money and save the good money. However, in absence of legal tender laws, Thiers’ Law comes into play where “good money drives out bad” as the superior form of money is naturally preferred. If we abdicate bitcoin as a medium-of-exchange to stablecoins, then what incentives will there ever be to scale bitcoin as a medium-of-exchange? Gresham’s Law will take root and Thiers’ Law will be little more than an idealist fantasy relegated to underground markets and fringe circular economies.

“The market is signaling they prefer stablecoins for spending.”

This isn’t pearl clutching over the market being wrong. It’s an ominous warning that bitcoin’s destiny is not written in stone. If it is never optimized to be used as a medium of exchange, it will never be used as a medium of exchange. If we are not relentless in our pursuit to advance bitcoin’s monetary evolution, then it will not happen.

Signpost #2: Bitcoin ETFs

Wall Street’s foray into bitcoin was an inevitability at some point in its life cycle. But what is striking is how quickly Wall Street arrived (less than 15 years of bitcoin’s existence) and the velocity of their entrance (daily trading volume in the billions of dollars). While today many bitcoiners applaud the new Bitcoin ETFs as a welcomed milestone for the ‘normalization’ of bitcoin, down the road this likely plays out differently from what they hope.

“Now that bitcoin is mainstream and in people’s retirement accounts, the government will never be able to ban it. It will be too politically untenable.”

A comment almost as ridiculous as thinking stablecoins are a gateway to bitcoin.

There’s not much debate that it is more convenient to purchase a Bitcoin ETF than it is to self-custody your own bitcoin. Market forces always compel people to seek the most convenient solution, especially when they have no consideration for the associated tradeoffs.

The hard pill to swallow is the fact that most people are not interested in self-sovereignty. They don’t want to become their own bank. And no, they don’t want to hear your long winded histrionic about fiat currency.

It boils down to:

1) Click a few buttons in my retirement account?

or

2) Go through a KYC/AML process on an unfamiliar bitcoin exchange, buy an unfamiliar hardware device, research how self-custody works, safeguard and manage private keys, etc.

If self-sovereignty disinterests you and all you want is bitcoin exposure – it’s a no brainer. You choose Option 1. And over time what this looks like is the next wave of adopters will seek exposure through ETFs – not taking direct custody of bitcoin themselves. Admittedly this concern doesn’t exist for the parts of the world that lack access to US financial markets – however allow me to point back to Signpost #1: stablecoins. The global south will seek refuge in stablecoins before pursuing bitcoin. The dollar isn’t hyperinflating any time soon and those who claim it will have been wrong on that call now for decades.

Now play this out. The next broad wave of adopters buying a financial product accelerating the amount of bitcoin held by the most regulated institutions on the planet.

The act of self-custodying bitcoin will be reduced to a suspicious and odd exercise.

“That’s weird. Nobody uses it as money. What’s the point of holding it yourself?”

And as the coffers of regulated custodians fill up with bitcoin supply, the surface attack density for those who self-custody will increase. And increase.

Financial institutions will not rally behind the self-sovereign bitcoiner. They do not care that the entire purpose of bitcoin was to disintermediate trusted third parties (i.e. literally them). In fact, their financial incentives are such that they have minimal interest in supporting self-custody as they make money on you giving your bitcoin to them. When the time is right, they are more likely to lobby against self-custody than to support it. And that time is when there are enough bitcoiners whose sole exposure is through these ETF’s and consequently wouldn’t care about defending the right to self-custody. Remember, you’re the weird one now doing it the wrong way.

This isn’t conjecture; self-custody is already under attack. The self-sovereign bitcoiner will become low hanging fruit. And saying you lost your bitcoin in a “boating accident” when you’ve purchased all your bitcoin on a KYC exchange is going to do you as much good as the dodo bird’s stubby wings.

Signpost #3: Ossification

The race for monetary supremacy is in full force. Where are we at? Stablecoins are dominating bitcoin as a medium of exchange and ETFs already hold close to 5% of total bitcoin supply in less than three months of trading.

Cool. So what are we doing about it? The price of bitcoin as a representation of purchasing power is paramount but it has become a sedative for adversarial thinking. Don’t get it twisted – the bitcoin price is a magnet, not a shield. As the price climbs so will the insatiable desire from governments to capture it. Do you think they will just let you opt out and ride into the sunset so easily? Oh, you sweet, summer child.

Sedated by paper gains, a non-insignificant amount of drawbridge bitcoiners are advocating for bitcoin’s ossification. Bitcoin, which *checks notes* is supposed to be money, is still not yet a medium of exchange, but is now somehow good enough as-is?

I’m willing to acknowledge that there are probably well-intentioned bitcoiners in the ossification camp who simply believe bitcoin can only be destroyed from within via protocol changes and that the battles to come can be won with bitcoin as it exists today. I’d respond to such line of reasoning with a quote from Sun Tzu,

“Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.”

Put simply – you do not win battles without preparation. Failing to plan is planning to fail. Bitcoin has not won. There’s less than 2% adoption globally and the wolves are at the door. Bitcoin hasn’t even surpassed the market cap of Amazon and you want to spike the football?

And for those in the pro-ossification camp purely out of selfish motivations because you got your bag and you’re just biding time to dump it later – are you certain it will be that easy? Wouldn’t your motivations be better served if bitcoin didn’t become low hanging fruit for government capture? Do you think in an increasingly adversarial environment, with no vibrant bitcoin circular economy, you will just be able to unload your stack on Coinbase sight unseen, no questions asked? Woof.

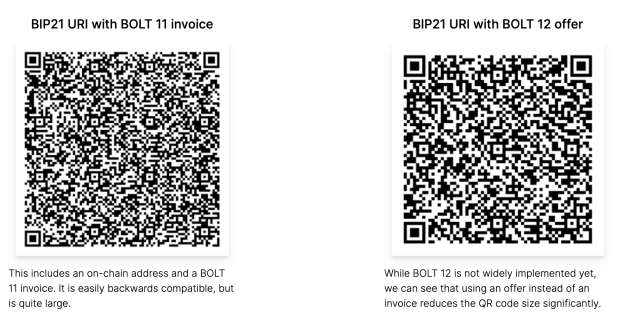

Scaling and enhancing bitcoin in a judicious manner so that it can mature into a medium of exchange should be paramount to bitcoiners. No, this is not a torn page from the big block, “buy a coffee with bitcoin” because “babies are dying”, playbook. The security and decentralization of the base layer is a non-negotiable primitive. You cannot have sturdy money on a wobbly base. However, we cannot be complacent with settling on bitcoin as just a store of value and then idly hope it becomes a medium of exchange when there is a dearth of layer two solutions beyond the Lightning Network which isn’t without its own limitations.

The introduction of ordinals has been a hotly contested cultural topic amongst different factions in bitcoin. The entire debate can be synthesized down to monetary maximalism (money only) vs platform maximalism (anything within consensus rules is okay). The debate is held at the margins and the overwhelmingly silent majority doesn’t really care for three main reasons:

1) they hardly know what ordinals are because it is such a niche subsection within bitcoin’s ecosystem

2) ordinals in their current format is just repackaged tech for people to gamble and engage in financial nihilism

3) bitcoin is still working just fine

The silent majority reaches the appropriate logical conclusion that expending mental bandwidth fretting over something that cannot be stopped and that doesn’t even hinder their ability to use bitcoin, is an utterly meaningless exercise in futility and virtue signaling.

The blind spot for the anti-ordinals crowd is the severe lack of introspection regarding the available block space due to a lack of ‘honest’ financial transactions. The pro-ordinals crowd doesn’t even dispute that all use cases other than bitcoin as money are unquestionably subordinate. People are inscribing nonsense because the barrier to entry is low enough to do so.

Every bitcoiner needs to eat this slice of humble pie: the apex use case for bitcoin is currently competing for block space with digital beanie babies.

Philosopher Epictetus said, “If you wish to be a writer, write.” The question we need to be asking is not “How do we stop the digital beanie babies?” it should be, “What are we doing to propagate more financial transactions?”

Unfortunately, the emotional response to ordinals comes with a call for ossification. Rather than harness the courage of a stoic competitor, some would rather take the ball and go home. For them, the specter of unforeseen consequences outweighs the benefits of bitcoin becoming money. The irony is that ossification kneecaps bitcoin such that it will become ensnared as only a store of value. No medium of exchange just means more available block space to incubate other arbitrary use cases.

Don’t like ordinals? Use bitcoin.

Sign Post #4: “Don’t spend your bitcoin”

There is a steadily repeating mantra amongst the bitcoin intelligentsia that you should not spend your bitcoin. “Savings technology”, “pristine asset”, “Buying land in Manhattan 100 years ago”, “store of value”, “Buy it and don’t touch it for 10 years”, etc. These are the prevailing bitcoinisms indoctrinating the latest waves of bitcoin adopters. The introductory value system individuals adopt when first arriving to bitcoin is demonstrably impermeable. Each cultural skirmish in bitcoin’s chronology is heavily influenced by whatever prevailing narrative surrounded bitcoin at the time they first became a user. It’s no coincidence that the existing ordinals squabble is a divide comprised mostly of longtime versus newer bitcoiners. People’s understanding of bitcoin is heavily influenced at the onset. If what they hear is “don’t spend your bitcoin” it reinforces the notion that bitcoin isn’t really money. Paring this with an explanation that bitcoin as a medium of exchange will happen at some point in the distant future, only perpetuates the falsehood that bitcoin is inevitable so there is no motivation for any change. Secure your bag and let some faceless future generation figure it out, eh?

Bitcoiners can agree to be disagreeable but can we at least agree to stop telling people what to do with their bitcoin? It’s supposed to be money. Do whatever you want with it. Don’t allow your actions to be enslaved by dogmatic rhetoric. Freedom money does not come with instructions.

Now what?

This isn’t a thesis to advocate for any specific BIP or scaling solution. It is a bucket of cold water to implore bitcoiners to have some self-awareness of the current path bitcoin is taking. Bitcoin is just software. What it eventually becomes is based on how users interact with the software. There is nothing inherent within the software that preordains bitcoin to become money. That outcome is completely dependent on the users – if they want it.

The dodo bird didn’t need wings – until it did. We can submit ourselves to the laws of evolutionary biology, do nothing, and see how this all plays out. Or we can do what the dodo bird couldn’t – adapt with foresight. Bitcoin does not win or reach escape velocity as solely a store of value. It is the foundation, not the destination. In the race for monetary supremacy, there is nothing the competition would want more than for bitcoin to stagnate as a store of value.

Because it’s at that point bitcoin will have become too fat to fly.