Slowest Block Production in BTC’s History as Miners’ Revenue Plummets 80% in a Month

The lower number of miners on the Bitcoin network has caused severe disruptions as the rate of newly-produced coins have dropped to just 58 new ones created in a day, says on-chain data. Furthermore, miners’ revenue has plummeted in the last month, while all eyes are on the upcoming difficulty adjustment.

The Disruptions on the BTC Network

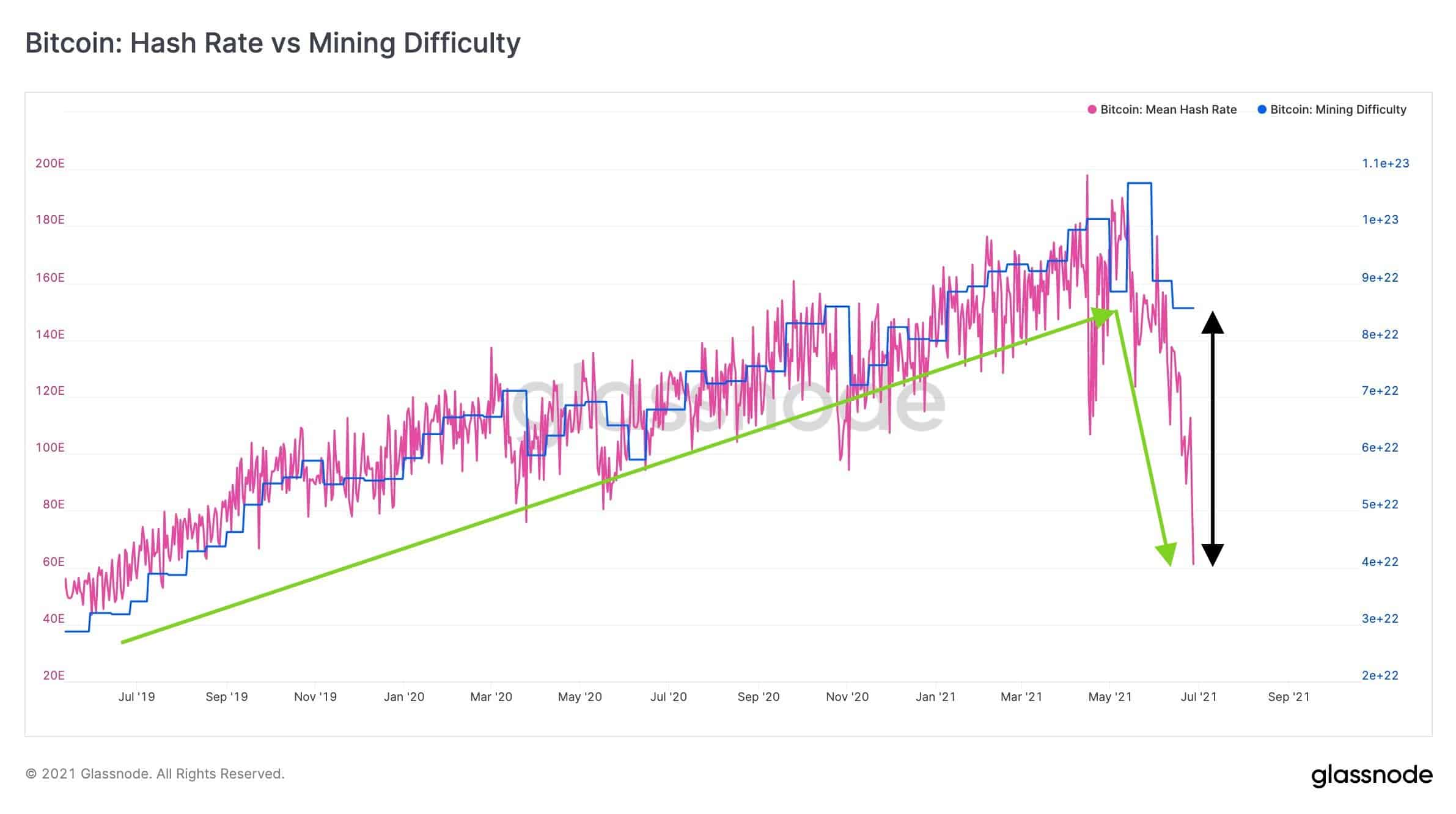

CryptoPotato reported yesterday that the Bitcoin hash rate – the metric displaying the amount of computational work miners put on the blockchain – has decreased by 40% in a month and 60% in six weeks. However, this is only one of the adverse effects after China intensified its crackdown and went after miners.

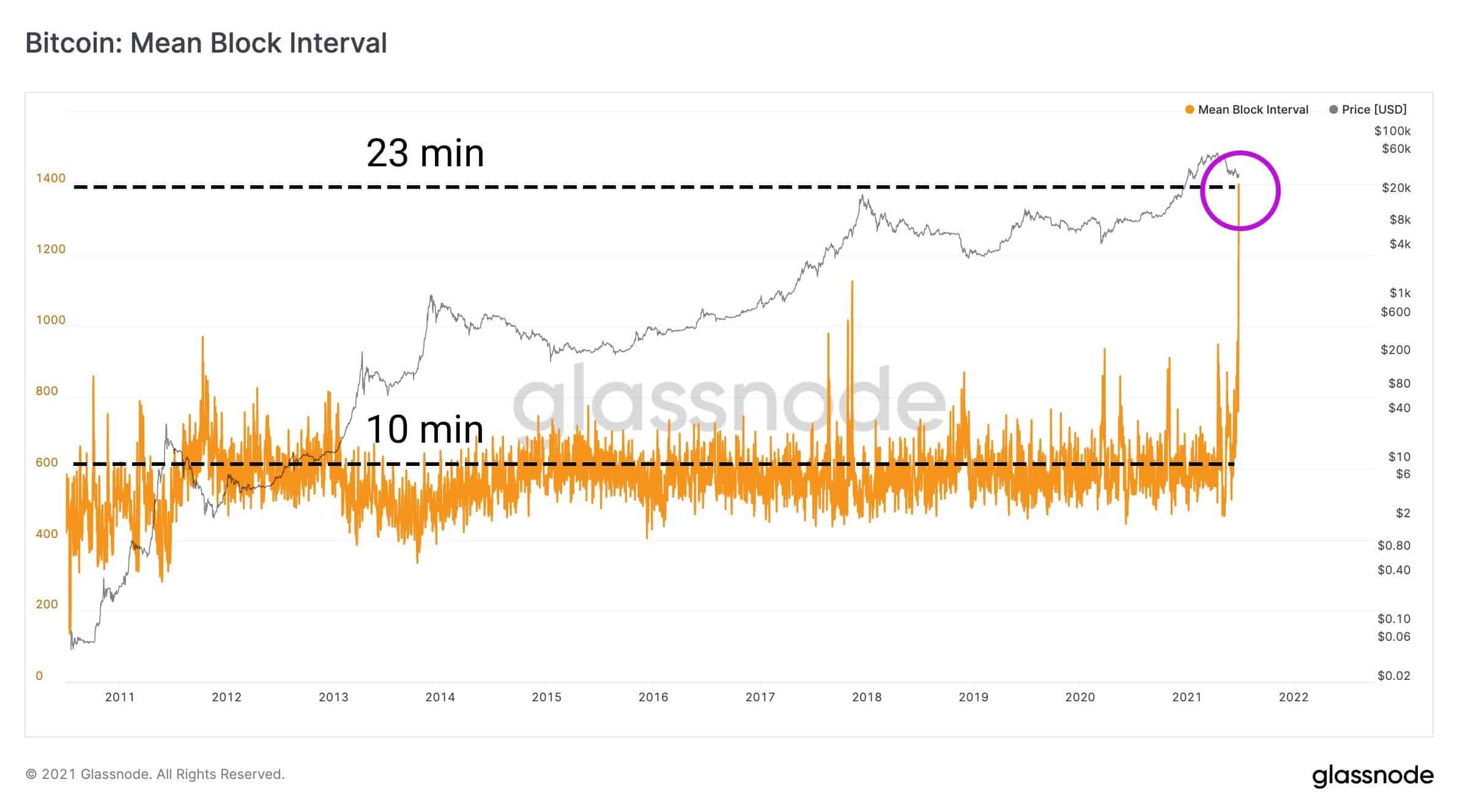

Data from Glassnode shows the rest of the story, starting with the block production. When it’s in a healthy state, a new bitcoin block is mined on average for ten minutes. Yesterday, though, the average number was over 23 minutes. This was the longest time needed for a new block to be mined in over ten years.

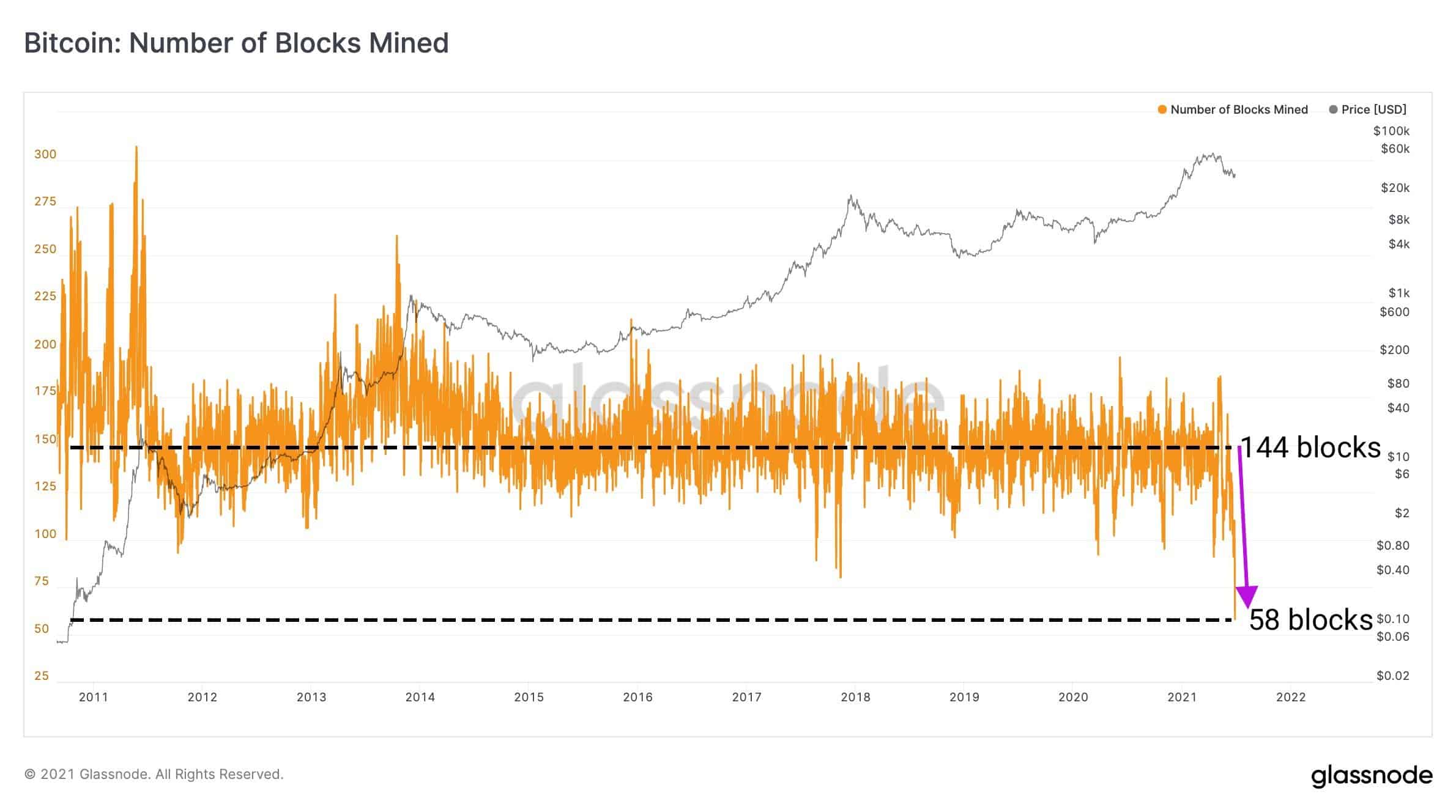

Somewhat expectedly, this delay reduced the total number of mined coins throughout the entire day. Instead of the baseline of 144 new bitcoins per day, yesterday saw only 58 new tokens, which represents a massive drop of 60%.

Miners’ Wallet Hurt; Network Activity Dumps

Glassnode further asserted that the average daily revenue that BTC miners receive had experienced a significant reduction as well. It was at all-time high levels in April and in May when the asset’s price had peaked above $60,000. At the time, the daily miner revenue was about $70 million.

Now, though, the declining BTC price and the delay of newly-created coins have brought it down to around $13 million.

According to the analytics resource, this “amounts to the same revenue miners were earning in early November when the price of BTC was at around $13,000 per bitcoin.”

The number of daily active addresses, which has been previously linked to the price, has also fallen sharply lately. In fact, it has declined to levels “not seen since early 2019,” after peaking when BTC topped $60,000 a few months back.

Largest Negative Difficulty Adjustment

With all of the adverse effects explained above, the BTC community looks at the next difficulty adjustment as the first line of defense. The feature, which makes it either easier or harder for miners to do their job, is expected to go through its largest negative adjustment in history.

According to on-chain data, the mining difficulty should decrease by over 23% this Friday. It will ease the pain for the network while the miners proceed with relocating from China, where they are no longer welcome, to other countries like the US and Kazahkstan.