Sino Global Files $67M Claim Against FTX-Alameda

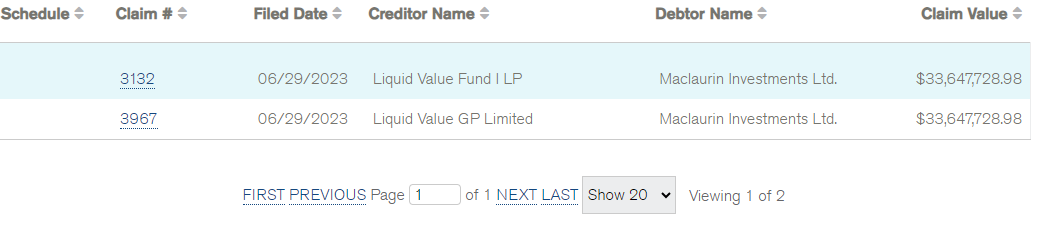

Matthew Graham’s Sino Global Capital has filed a $67.3 million claim against FTX Trading Ltd. on behalf of Sino’s Liquid Value fund, which it rolled out in conjunction with Sam Bankman-Fried in 2021.

The fund aimed to raise $200 million and primarily targeted high net worth individuals. This approach marked a departure for Sino, as it was the first time the firm sought outside capital through a formal fund vehicle.

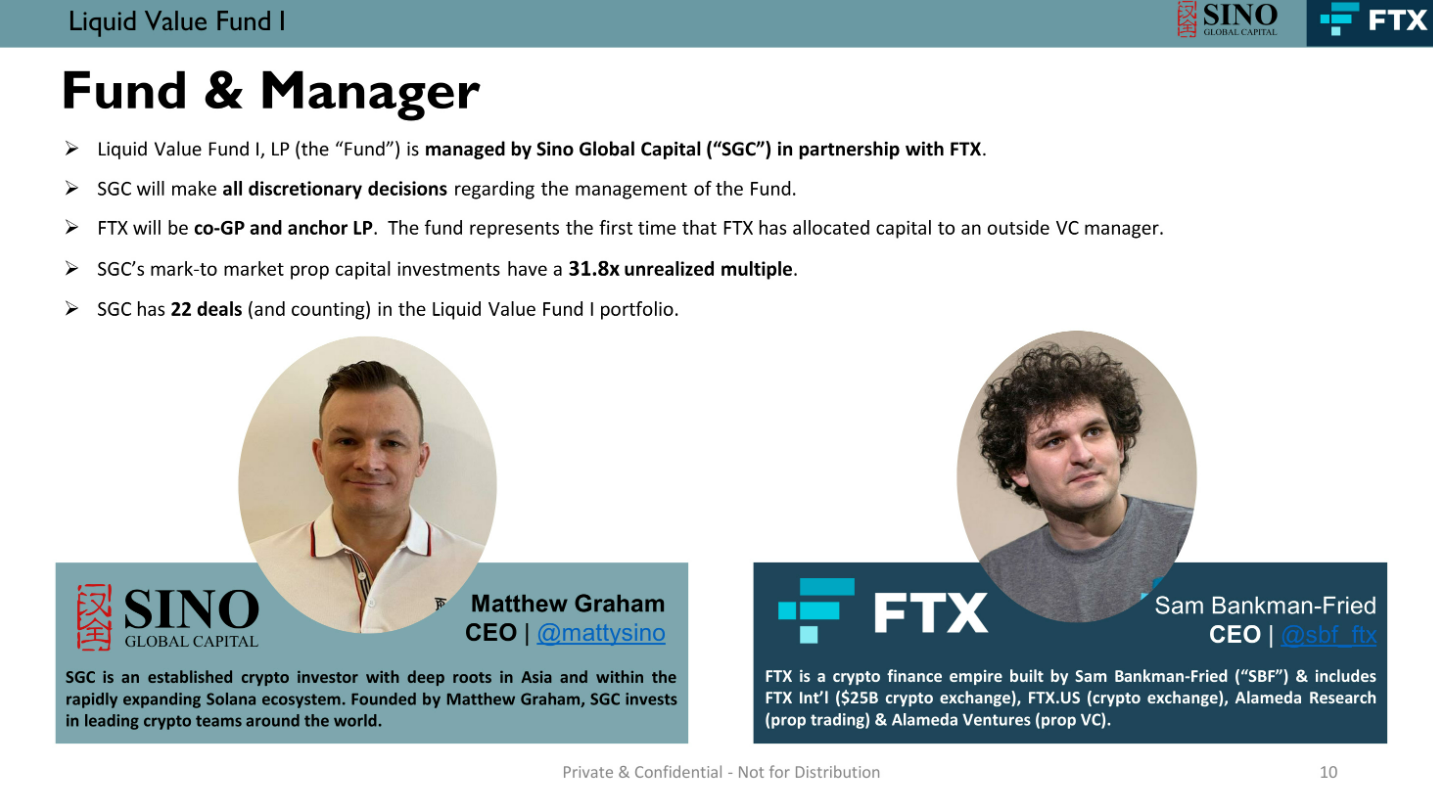

In marketing material promoting the fund, FTX was described in the slide deck as a “co-GP and anchor LP”, with the potential to unlock “significant strategic value” through exposure to Bankman-Fried’s universe of tokens. As of January 2022, the fund had already raised $90 million, with FTX as an anchor investor.

Initially, Sino Global said that its “direct exposure to FTX exchange was confined to mid-seven figures held in custody.”

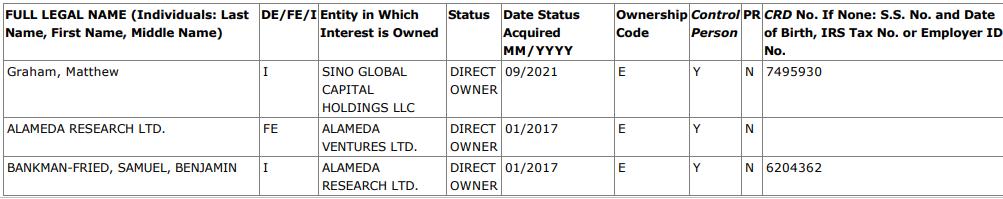

Bankman-Fried was listed as an indirect investor in the fund on SEC filings from 2022, alongside Alameda Research, subsidiary Alameda Ventures and Graham.

As of 2023, the fund is no longer registered with the SEC though it remains active with the Cayman Islands Monetary Authority.

A spokesperson for Sino Global previously told CoinDesk that a significant focus of the fund’s investing efforts has been on infrastructure and gaming.

Shortly after the collapse of FTX, Sino released a statement saying that it “trusted FTX to be a good actor committed to pushing the industry forward. “We deeply regret that misplaced trust.”

In mid-July, Sino Global announced that it had hired former FTX COO Constance Wang, once described as Bankman-Fried’s “right hand” in his fundraising drive, to be its head of gaming.

Edited by Stephen Alpher.